S&P: TV-Station Advertising To Grow 14% to $24.95 Billion in 2024

Political ads are driving a 9.3% increase in TV, radio station ad revenue to $36.2 billion

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The newly released S&P Global Market Intelligence Radio & TV Annual Outlook from Kagan finds some good news in this year's ad-revenue outlook and some not-so-good news for the next five years, as core advertising categories continue to slump.

The study forecasts that U.S. TV and radio stations will reach $36.19 billion in total advertising revenue in 2024, up 9.3% from $33.10 billion in 2023, primarily from the influx of record political ad spending in a presidential election year.

S&P Global Market Intelligence Kagan's 2024 projection also shows $24.95 billion from TV stations — including core national and local spot, political and digital/online — and $11.24 billion from radio stations, which includes national and local spot and digital, excluding network and off-air.

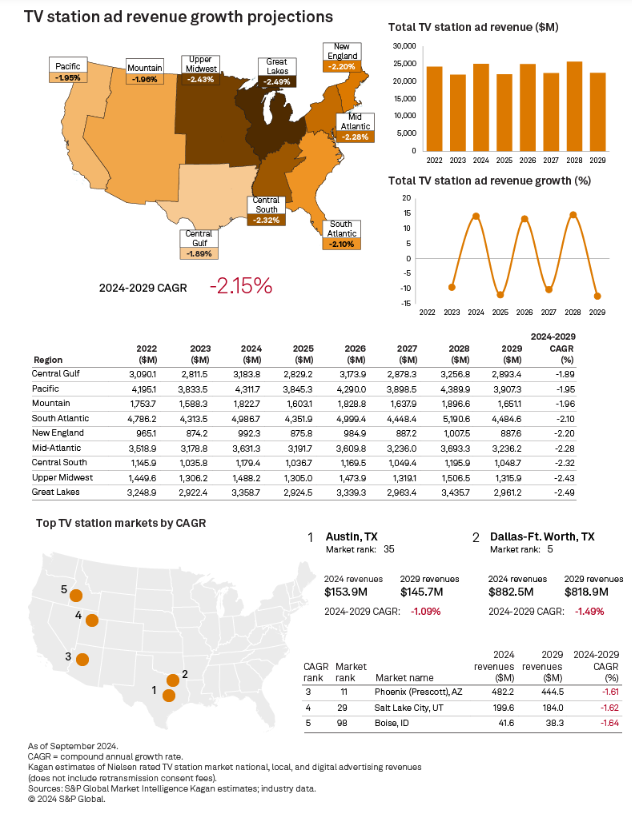

Article continues belowHowever, the report predicts negative growth for TV advertising over the next five years as traditional media continues to lose advertising share.

Amid those declines, the report finds that the local ad market continues to be stronger than the national side of the spot ad business, thanks to broadcast stations’ close ties with the local community.

That will help stations as ad agencies and major brands continue to shift budgets to digital-native platforms as more content moves from linear to streaming.

Even so, core ad categories, including automotive, retail and travel, have continued to see softness due to high interest rates and inflationary pressures dampening consumer spending on big-ticket items. Pharmaceuticals, telecom and professional services continue to outperform other ad categories.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Key highlights from the report include:

- TV stations’ core local and national ad revenue is expected to decline slightly this year by 0.3% to $17.58 billion, with local spot up 1.5% and national spot down 4.5%, while digital could climb 3.0%.

- With the influx of $4.09 billion in political ads in a presidential election year, total TV-station ad revenues are expected to grow 14.1% to $24.95 billion.

- TV-station ad revenue over the next five years is projected at a negative 2.1% compound annual growth rate (CAGR), hitting a high of $25.57 billion in 2028, and then dipping 12.5% to $22.39 billion in the 2029 nonelection year. This five-year CAGR is lower than the 2023 outlook, given that it starts in a presidential election and Summer Olympics year in 2024 and ends in 2029, a nonelection year.

- Over the 2024–2029 projection period, the core national spot ad market for TV stations is expected to decline by a CAGR of 5%, with local spot up 1.5% CAGR, while the ebbs and flows of political ad spending in election years are reflected in the peaks and valleys of total TV station ad revenue.

- The radio station industry’s five-year ad outlook, driven more by the local market and less by political ad uptick, is expected to decline 3.7% in 2024 to $11.24 billion, excluding network and off-air revenue.

- As radio advertising continues to shift to streaming audio and podcasting alternatives, S&P expects a 5% CAGR decline in national spot and a 3.6% CAGR in local spot, as digital ad growth of 5.9% CAGR offsets larger declines with total radio ad revenue contracting to $10.08 billion by the end of the projection period in 2029.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.