Spectrum repacking

In the December 2012 issue of Broadcast Engineering, I presented an article focused on the eventual television band repack and how stations should prepare for this event. At the time the article was written, the FCC had just released its Notice of Proposed Rule Making (NPRM) (Docket No. 12-268). My plan is to present periodic updates on the process that will look at the FCC’s actions, industry reactions and the thoughts of some industry leaders.

We now have many comments and reply comments that have been filed in response to the FCC’s NPRM. The FCC has also released several proposals and actions, such as the revision to OET-69 and comments on possible ways that initial valuations might be made on television spectrum. At least one group has surfaced, announcing it has properties that it plans to put into the reverse auction process.

The NAB and others have reacted to the OET-69 revision. Spectrum issues were a hot topic at the recent NAB convention; the FCC recently conducted a workshop on issues surrounding the proposed 600MHz band plan; and the FCC implemented a freeze on television facility changes. It has been a busy six months.

If this wasn’t enough, the FCC also announced that it is beginning proceedings on the T-band segment (TV Channels 14–20), where the television service has shared, in some markets, this spectrum with public safety users.

NPRM responses

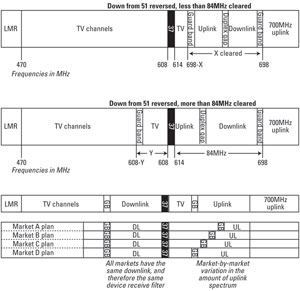

Figure 1. Shown here is the FCC’s proposed repack plan of the 600MHz band.

Hundreds of companies and organizations filed comments on the TV Spectrum NPRM. Both the broadcast and wireless communities were aligned on one major point: No one liked the FCC’s proposal for a split-band plan. (See Figure 1.) Most support the idea that the reclaimed spectrum should come off of the top of the TV band. Another issue that had less cross-industry support, but was unanimous among broadcasters, was that the band plan must be uniform across the nation. The FCC has pushed the idea that the lower limits of the reclaimed spectrum can vary on a market-by-market basis, while broadcasters reminded the commission that co-channel interference will result from such a plan.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

A joint letter submitted to the FCC by NAB, Verizon, AT&T, T-Mobile, Qualcomm and Intel rejected the FCC’s proposed split-band plan and advocated for the following principles:

- Adopt a contiguous “down from TV 51” approach with uplink at the top.

- Maximize the amount of paired spectrum above TV 37. (Rely on supplemental downlink configurations where spectrum is cleared but pairing options are not viable.)

- Rely upon 5MHz spectrum blocks as building blocks for the wireless band plan.

- Incorporate a “duplex gap” or spacing between uplink (mobile transmit) and downlink (base transmit) of a minimum of 10MHz, but no larger than technically necessary.

- Avoid broadcast television stations in the duplex gap.

- Preclude any operations in the duplex gap or guard bands that would result in harmful interference to adjacent licensed services.

Many broadcasters supported loosening the proposed reverse auction eligibility requirements to allow more licensees and permittees to participate. They argued that one or more of the following should be eligible to participate in the auction: full-power or Class A licensees appealing the expired, cancelled or revoked status of their license; permittees of new, unconstructed full-power stations with construction permit applications granted as of Feb. 22, 2012; licensees with applications to convert stations from low power to Class A status pending as of Feb. 22, 2012; low-power stations able to demonstrate compliance with Class A eligibility requirements; and entities faced with “exceptional and unique circumstances” that prevented them from licensing their facilities by Feb. 22, 2012.

Most broadcast commenters supported expanded bid options for licensees, such as moving from a UHF channel to a VHF channel, agreeing to accept additional interference, and agreeing to accept a smaller service area or reduced population coverage.

Many broadcast commenters, including NAB, argued that the Spectrum Act requires international coordination with Canada and Mexico as a prerequisite to conducting the incentive auction. Various state broadcaster associations noted that border coordination affects about one-third of broadcast television stations. Putting off international coordination, therefore, would complicate the repacking process and delay reimbursement beyond statutory time limits. Wireless carriers, including CTIA, also urged prompt attention to international coordination measures, but not at the expense of an auction delay.

An unreasonably short deadline

Many broadcasters criticized the proposed 18-month deadline for construction of new broadcast facilities as unreasonably short. Harris Broadcast argued that the engineering infrastructure could not handle the expedited 18-month timeline and suggested a phased, geographic-based transition that would account for unforeseen circumstances like bad weather and tower damage. Other commenters stated that the DTV transition and BAS relocation demonstrated that three years is the bare minimum needed to complete construction and transition to new channel assignments.

Wireless commenters supported the FCC’s position that three years is too long for the transition to repacked facilities. U.S. Cellular supported the 18-month deadline, while Sprint argued that the final 25 percent of a broadcaster’s relocation payment should be conditioned upon relocating within six months of a timeline adopted by the Commission.

In the previous article, I reminded readers that a maximum of 434 stations could undergo antenna changes within a three-year period, with the limitation being the number of qualified tower crews.

NAB, supported by other broadcasters, argued that the $1.75 billion allocated by Congress for the relocation fund should be enough to cover the reasonable relocation costs of between 400 to 500 stations. NAB’s comments stressed that the FCC should consider $1.75 billion as a cap on its repacking model.

NAB also advocated for broadly defining what would constitute eligible broadcaster costs, while Harris Broadcast stated that the FCC should adopt and release a detailed list of covered expenses prior to the auction. One major broadcast owner also noted that the FCC should anticipate higher costs than during the DTV transition because of the short time frame.

NAB rejected both NPRM proposals for repacking relocation payments and instead proposed a two-stage approach. In Stage 1, eligible entities would file a request for advanced payment based on a schedule of values, and all entities would receive the same percentage of estimated expenses that would be no higher than 80 percent of those estimates.

In Stage 2, 30 months after competition of the forward auction, eligible entities would file documentation of their actual expenses. The FCC would then determine the “true up” amount or be paid back unused funds from the advance payment.

In addition, stations facing delays beyond 30 months would file additional documentation of expenses yet to be incurred. To reduce abuse to the relocation fund process, NAB proposed appointing a third-party administrator to the fund that would conduct spot audits of stations’ documentation.

Will broadcasters volunteer?

A frequently asked question is: Will broadcasters actually volunteer to participate in the reverse auction? Recent news articles indicate that more than $345 million has been spent by several speculators to acquire television properties for the purpose of selling them in the reverse auction.

One well-known former broadcaster, Preston Padden, is the Executive Director of Expanding Opportunities for Broadcasters Coalition. This is a group of more than 70 stations interested in participating in the reverse auction process. Padden indicates that of those stations involved, there is about an even split between full-power and Class A station groups.

Proper planning missing

Last December, I stressed that three years was insufficient for repacking implementation, given that we do not know how many stations will be required to move. I also pointed out that no repacking spectrum plan has been presented and reviewed by the engineering experts.

At the 2013 NAB Show, both repacking and the auction process were covered during the Broadcast Engineering and Management Conferences. Bill Meintel, of Meintel, Sgrignoli & Wallace, gave an excellent presentation on some of the issues, such as the changes to OET-69 and the spectrum planning that will have to go into the repack process.

When asked about the planning process, Meintel reminded the audience that each station affected by the spectrum changes would have to be modeled individually. There is no single answer on what channels will work. His estimate was that planning could take up to a year.

Keep in mind that we will not know how many stations will relinquish their licenses and where they are located until after the reverse auction is completed. The spectrum repacking planning can’t begin with any credibility until we know the above information. If that takes a year, then we only have two years remaining in the allocated time to actually do the repack. That is certainly insufficient time if there are more than about 288 stations forced to relocate.

Both the Commission and the wireless industry seem to be in a rush to do all of the steps nearly simultaneously without proper time to plan as information become available. At a recent FCC LEARN Workshop on the 600MHz band plan, it became obvious that the 120MHz recovery of TV spectrum was wishful thinking at best. Most talk was around 84MHz, and some comments even indicated that less spectrum might be recovered.

Remember, this whole process is not just about adding spectrum for wireless services; it is also about putting funds into the U.S. Treasury. Original estimates were in the neighborhood of generating up to $28 billion from the spectrum auctions. Congress took a subset of that number and spent the money well before it was ever generated. Remember, too, every station that relinquishes spectrum is going to be compensated in the auction at some price that is at least equal to the value of the business in a sale, and every station that must move to a new channel will be reimbursed from a $1.75 billion fund set up by Congress. It is only after those expenses that the auction returns money to the treasury.

At the recent FCC LEARN Workshop, Harold Feld, Legal Director for Public Knowledge (an FCC watchdog group), reminded the Commission that unless sufficient stations participate and unless wireless entities are willing to pay prices for spectrum that are premium to past auctions, this whole process could end up costing the Treasury rather than adding funds to it.

—Jay C. Adrick is technology advisor, Harris Broadcast.