Sports Gambling on TV: Is It a Sure Bet?

NEW YORK—A year after the United States Supreme Court struck down a 26-year-old federal law that prohibited sports betting, many broadcasters are still hedging their bets on where television fits into the picture. However, Sinclair Broadcast Group has gone all in.

The nation’s largest station group—which owns professional wrestling’s Ring of Honor as well as the Tennis Channel—is now betting big on new opportunities in the world of sports gambling on TV. In May it announced a partnership with the owner of The Weather Channel to buy 21 regional sports networks and Fox College Sports from The Walt Disney Co. for $10.6 billion. The company already owns Stadium, a joint channel available over the air and on demand, focused on broadcasting college sports and professional highlights and it is launching a regional sports network with the Chicago Cubs.

MOVING QUICKLY

Sinclair isn’t the only player at the table. ESPN has already partnered with Caesars Entertainment, and has its Daily Wager program, while Fox has announced plans to launch its own betting service, Fox Bet, via a deal with The Stars Group, a Canadian developer of online and mobile gaming technology. Fox Sports is already in discussions with the NFL, Major League Baseball and NASCAR, and Fox Sports 1 has launched “Lock It In,” the first daily program devoted to sports betting.

Not to be left on the sidelines, Turner Sports and Bleacher Report, an online destination for sports news and sports culture, announced a deal in February that would include the building of a branded Bleacher Report studio inside the Caesars Palace Sports Book in Las Vegas. That studio will be the hub for the creation of a variety of gaming-related programming and editorial content that will be distributed via Bleacher Report properties including the B/R mobile app.

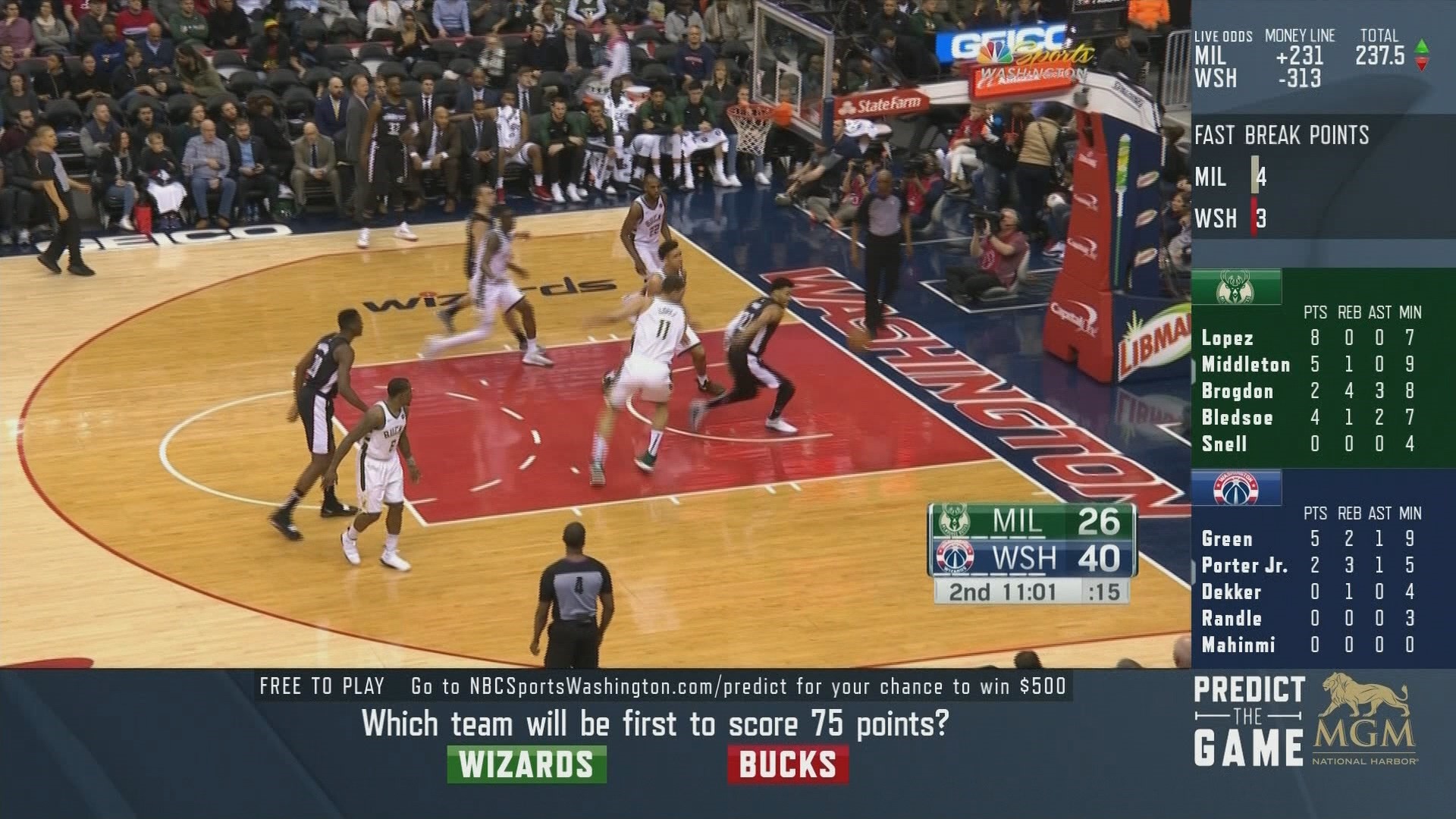

In May, NBC Sports offered what was essentially off-track betting when it launched its first betting program to coincide with its annual broadcast of the Kentucky Derby. It appeared on the NBCSports website as well as the mobile app, while NBC Sports added a 30-minute presentation, NBC Sports Bet: Derby Special that aired just prior to the race coverage. NBC, which launched Pick ‘Em games for its Premier League and golf coverage, has taken a lead in regional alternative broadcasts for the Washington Wizards and Philadelphia 76ers.

“Things have been moving very quickly and we haven’t seen something [like this] having an impact on sports broadcasting in a very long time,” said Dan Pozner, director of sports betting content at NBC Sports.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

STATE BY STATE

The key to describing the progress of legalized sports betting one year hence is “regional.” The SCOTUS decision wiped out the federal law that barred sports betting in any state other than Nevada and allowed the individual states to set their own laws. So far, five states—New Jersey, Delaware, West Virginia, New Mexico and Mississippi—were quick to legalize sports wagering; while four more states—Pennsylvania, Rhode Island, New York and Arkansas—could soon open the door for sports betting as well.

An additional 19 states, along with the District of Columbia, are now moving toward legalization in 2019. However, 21 states have laws that prohibit full-blown sports betting and those laws would need to be repealed or amended to enable any form of sports wagering. To date those states don’t have publicly announced bills, while one state, Utah, has anti-gambling measures written into the state's constitution and is unlikely it would change that stance.

“The overturning of those laws has given rise to a lot of conversation about how to deal with gambling,” said Jed Corenthal, CMO of real-time, peer-to-peer video streaming platform Phenix. “We’re now looking at 50 different laws, with some states legalizing sports betting while others have not.”

All this presents both challenges and opportunities for content providers.

“It is absolutely uncharted waters,” said Wayne Kimmel, managing partner at sports tech venture capital company SeventySix Capital. “It is an unbelievable opportunity for media companies and broadcasters, and for the whole sports world. This is a way to engage with viewers and fans that wasn’t possible in the past.”

At the same time content providers will have to make sure content doesn’t become irrelevant to the non-gambling viewers.

“You have to make sure the casual fans understand what is being said, and this can include the content on the broadcast or website, and could include a half sentence parenthetical to explain it,” said NBC Sports’ Pozner. “We don’t want those not into sports betting to feel like they’re not part of the conversation.”

The SCOTUS ruling has been seen as a major boost to the value of live, televised sports. According to the National Research Group, 79% of current and potential gamblers said they would likely watch more sports live. Potential gamblers said they were also more likely to bet on professional football and basketball, and that Fox Sports and ESPN would be the networks that have the best fit with sports gambling programming. The survey also noted that while the vast majority of potential sports gamblers would place their wagers via online or mobile apps, seven out of 10 were interested in viewing gambling odds onscreen during live broadcasts.

This could open the door for not only gamblers but also advertisers, but how that will be handled is still very much a work in progress.

This means there won’t be any national ad buys anytime soon, according to Brad Seitter, executive vice president for business development at the Television Bureau of Advertising (TVB).

“Half the states haven’t legalized and you have 20 to 25 states that won’t be legalizing anytime soon,” Sietter said. “Those states where it is legal will present new opportunities. In local markets this could be a new way for casinos to advertise sports gaming.”

OUT IN THE OPEN

Sports gaming content isn’t exactly new to the world of television, but instead of being sidestepped—as it had been for years notably with the likes of Jimmy “the Greek” Snyder Jr., the sports commentator and Las Vegas bookmaker—it will become far more open.

“The thing about sports betting is that this is something new, but people have been betting on sports for years, just in an illegal market,” said Casey Clark, vice president of strategic communications at the American Gaming Association (AGA). “This is now creating a legal market with the protections that come with it. There has also been hinting of gambling, but a lot of the new content will be around formalizing legal sports betting. We envision how this could include ‘CNBC-type’ tickers around betting."

Launched in 2017, national gambling news network Vegas Stats & Information Network (VSiN) is one of the early pioneers in the genre with Hall of Fame broadcaster Brent Musburger as its lead on-air personality, while its newly launched Follow the Money show now airs daily on the New England Sports Network (NESN). Its launch anticipated the legalization of sports betting and its emergence from the underground.

“In the past, the gambling aspect of sports broadcasting was danced around,” said Kimmel. “Most audiences have known what it was about. This is only going to bring more interest to the games, but people have already cheered when a team won by a lot more points or people groaned when a meaningless basket went in. Gambling may get more people to tune in and stay with a game—even a blowout—longer. That is what could make sports on TV a lot more exciting.”

In fact, betting on sports could ensure that audiences don’t tune out even in a runaway game—simply because there are so many aspects of the play to bet on even if the bettor’s team doesn’t win. “This could drive more people to stay with the game,” said Pete Giorgio, principal at Deloitte Consulting LLP, and lead on Deloitte’s U.S. sports practice. “This is something that could help broadcasters maintain an audience.”

With this new openness comes new responsibility; and legal sports gaming on TV has already resulted in the industry adopting a code of content. The AGA, which represents the U.S. casino industry, has published a “Responsible Marketing Code for Sports Wagering,” which AGA’s Clark said was done “to ensure that this engaging entertainment is done in the right way. We want to see that this is self-regulated and our hope is that others will take up this mantle. It isn’t enough for a broadcaster to have a gambling show if they don't have a hotline that viewers can call when someone has a problem. We’re focused on responsibility and our hope is that the broadcast partners will be too.”

MULTIPLE PRESENTATIONS

Broadcasters and content providers such as Turner—now owned by AT&T—are unlikely to become a sports book, but there are still opportunities for these companies to generate revenue. In addition to the potential increase of gambling-related ads, there could be complementary feeds that cater to the gambler.

While linear broadcasts on a national level are unlikely to change, content delivered over IP/OTT could include customized presentations—perhaps one aimed at the pure fan who always roots for his/her team, and another that is more catered towards those with money on the line. Even ATSC 3.0, which allows for such customization via its IP-enabled architecture, could play a part.

“[ATSC 3.0] is an IP pipe. It’s interactive, so it allows for you to add overlays with more information,” Anne Schelle, managing director of Pearl TV recently told Fierce Video. “Think about sports gambling. It really makes the content become much more of an interactive environment for consumers, and that’s a great thing for sports.”

However, it’s still a ways off before broadcasters embrace it on a national level, according to Corenthal. “We’d have to have 50 states that allow sports betting, so it won’t be likely with the NFL games as none of those are truly local.”

Prior to its Derby sports betting programming efforts, NBC Sports had already been testing the waters with the NBA’s Washington Wizards earlier this year.

“We offered a regular game channel, but fans could flip over to a betting channel,” said Pozner. “Those are the initial steps, but this could be more of the norm. I do envision a day when this is possible even on a national level, but it could be two years or five years down the line.”

The future of the genre is heavily dependent on local laws, and as noted, the NFL is unique as every game is delivered on a national level.

“Local is where you can do things that could be more ‘adventurous,’” added Corenthal. “It will be interesting to see how broadcasters deal with this, and we could see a different take on the content over time.”

Offering a different feed for the gambler, perhaps one that includes that CNBC ticker for all things in the sports book, wouldn’t be that difficult—or costly—to produce.

“It would be as simple as adding a Spanish-language feed to English-language presentation,” said Giorgio. “This could include alternative commentary, but also statistics and perhaps it could be accompanied by a Twitter feed.

“This won’t be limited to a single device, so mobile smartphones will be likely among included in the experience,” Giorgio added. “It could be dependent on a second and third device as well as another channel or feed. This is certainly something that 5G could handle.”

Even in markets (hello Utah) where sports betting is unlikely to be legalized, the industry could just do another dance around it.

“We only have about 14 states where sports betting is legal or will be legal, so we understand that the majority of the country cannot legally place a sports bet,” added Pozner.

This could be where the ever popular fantasy sports could come into play.

“CBS Sports already has a fantasy element, and this is a way to create a product that doesn’t have to break existing bettor laws,” said Corenthal.

“It is likely we’ll see broadcasters more involved with fantasy sports on the programming side,” added Seitter.

“This is where the NBC Sports Predictor could come into play," said Pozner, referring to a recently launched app that awards cash prizes to fantasy sports winners. "Fans can be engaged without making a financial bet.”

Even with nearly half the country not on board, the easy money is on a future with some sort of gambling component in sports broadcasting.

“Right now I’d say we’re in the third chapter of a 15-chapter book," said Giorgio. “Chapter one was simply repealing the national law; chapter two was taking this local; and three-four-five is figuring out how broadcasters can take advantage on a national level. We still have a long way to go to the end.”