Sports Piracy Costs $28.3B Per Year, Report Shows

Nearly three-fourths of illegal streamers willing to switch to legal source if available

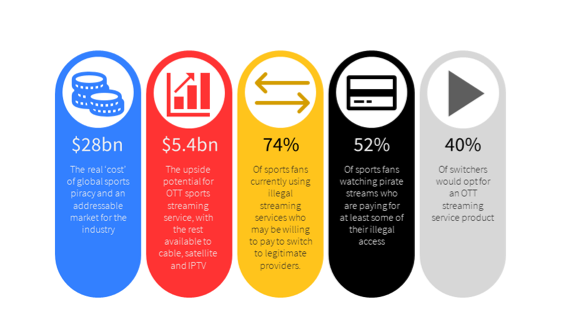

LONDON—The cost of sports piracy has been revealed via a new report from Synamedia and Ampere Analysis, with as much as $28.3 billion in new revenue being available to service providers and rights holders each year if they are able to reduce sports piracy.

The report, “Pricing Piracy: The Value of Action,” uses a model that evaluates how different illegal viewers respond to anti-piracy measures and identifies the demographics and characteristics of those illegal users who are most likely to convert to legal services.

By understanding the motivations of those who access pirated streams, the report says that service providers can target those most likely to switch—aka “the converter cohort”—by implementing disrupting streams as well as providing them with incentives. Of more than 6,000 sports fans in 10 markets, Ampere found that 74% are willing to switch from illegal streams if a legitimate alternative is available and illegal streams become unreliable.

This converter cohort tends to be younger and is often families with young children, the report finds, with them watching as many as 10 or more different sports on connected devices. As many as 40% of the converter cohort would subscribe to OTT streaming sports services, while the remaining balance would opt for traditional pay-TV, particularly those offering exclusive sports rights. More than half of the converter cohort actually already pay for legitimate services (57%), while 52% pay for pirate services.

To convert pirate customers to legitimate services requires service providers to address the reasons that they sought illegal services out to begin with. Per the report, these include flexible access without complex installations or long contracts; ease of use; availability on every device in any location; and, for OTT services, a price point that is lower than traditional pay-TV services with premium sports tiers included.

If able to access this new revenue, Synamedia and Ampere estimate that of the $28.3 billion, about $22.9 billion would be split among pay-TV providers and $5.4 billion would be for OTT sports streaming services.

For more information, the full report can be downloaded here.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.