Study: Total U.S. TV Station Revenue To Decline in 2025

The S&P report also forecasts major downtick in pay TV subs, shift of ad dollars to streaming

A new analysis from S&P Global Market Intelligence calls 2025 “a pivotal year for the global media landscape” as the industry struggles with declining revenue for local broadcast TV, more ad dollars and sports rights shifting to streaming, profit margins for cable network slumping and cord-cutting hitting 9.5% this year.

Overall, the report said the U.S. broadcast TV and radio station industry will decline 9.3% to $32.83 billion in total advertising revenue in 2025 from $36.19 billion in 2024, primarily since it is a nonelection and non-Olympic year. In 2025, a nonpolitical year, S&P estimates total TV station revenue, including retrans, will decline 6.9% to $37.60 billion from $40.40 billion in 2024, although this is $517 million higher than the prior nonpolitical year 2023, with core national spot down 4% and local spot ad revenue ticking up 2%.

In the report, Seth Shafer, senior research analyst at S&P Global Market Intelligence, argues that “2025 could prove to be a pivotal year for the global media landscape as more sports programming and advertising dollars flow towards streaming services. Intense competition could see a rise in mergers and deal-making, especially in the U.S. where media firms are firmly focused on profitability and deregulation could be on the rise.”

Other key trends include:

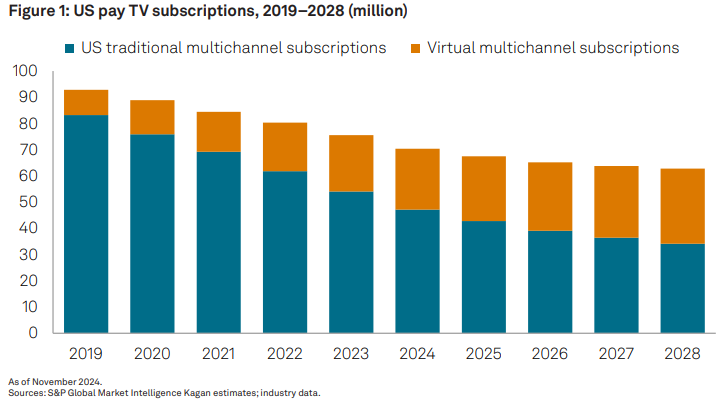

- Cord-cutting in the U.S. will persist and continue to pressure linear TV networks. Total traditional U.S. multichannel households will decline by 9.3% in 2025 as more consumers “cut the cord” in favor of digital video and streaming alternatives.

- Carriage disputes will result in more creative bundling options as operators push back on rate hikes from stations and networks. Subscriber declines will also continue to pressure traditional pay TV video margins, resulting in cost-cutting decisions to drop certain networks and push back on rising carriage fees. Even so, the report stressed that both network owners and pay TV operators remain incentivized to keep the traditional bundle alive, resulting in creative bundling strategies and mutual concessions to adapt to the market environment.

- Box office recovery will continue in the wake of the 2023 Hollywood strikes The domestic box office entered its fourth year of recovery in 2024. It had been steadily improving from 2021 and 2022 after the COVID-19 pandemic decimated the 2020 box-office year. Total box office grew 98.3% in 2021 to $4.33 billion and 69.2% in 2022 to $7.32 billion. Total 2023 box office ended up at $9.16 billion, growing 25.2%, but still down significantly from the totals of more than $11 billion from prior to the pandemic, the report said.

- In the current sports media-rights landscape, the expenses associated with broadcasting games have surged significantly, coinciding with an increasingly fragmented audience spread across various video platforms as more rights shift to streaming.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.