Survey: Amazon’s Push into Ad-Supported Streaming Is Working

85% of Amazon’s Prime Video subs are now in the ad-supported tier, more than any other streaming service according to Hub’s quarterly TV Churn Tracker

PORTSMOUTH, N.H.—New findings from Hub Entertainment Research provides extensive data showing that the majority of consumers will opt for lower cost ad-supported video services over higher priced premium ad-free offerings and that Amazon’s push to move consumers into ad-supported tier seems to be working.

The findings also indicate that the launch of advertising as the default Amazon Prime Video service has had an immediate and dramatic impact on the ad-supported ecosystem.

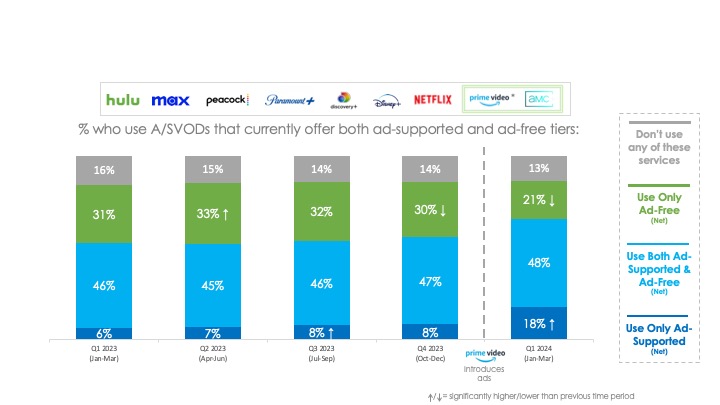

With the launch of ads on Amazon Prime Video at the end of January 2024, a significant number of all TV viewers shifted from watching ad-free only to watching ad-supported video. The proportion of consumers using only ad-supported increased ten percentage points since 4th quarter 2023, while the group who watch only ad-free was down nine.

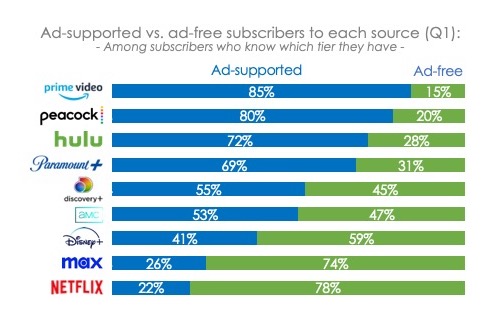

The study also found that by defaulting viewers to the ad-supported service, Amazon Prime Video has hurdled into the lead in share of ad-supported subscriptions.

Historically, streaming services that launched with an ad-supported tier have had the highest level of subscribers accepting ads, and services that either introduced a new ad-supported subscription or defaulted consumers to the ad-free option had the lowest level of accepting subscribers. By opting existing subscribers into the ad tier, Amazon has immediately become the leader with more than eight in ten subscribers using the ad-supported service, the study found.

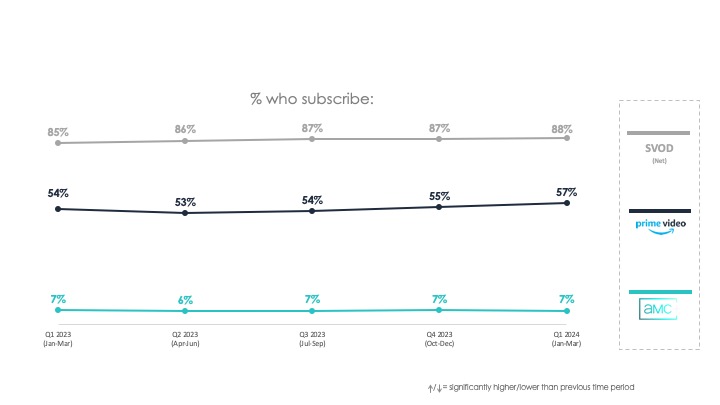

Very importantly, the researchers said that there is no evidence that putting subscribers on an ad-supported tier has resulted in a backlash.

As Amazon Prime Video defaulted tens of millions of their subscribers into the ad-supported service, there was no measurable effect on either Amazon’s subscription levels or the overall rate of SVOD subscription, Hub reported.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Similarly, AMC+, the other most recent entry into ad-supported streaming, saw no effect on their overall subscription rates.

Viewers are clearly accepting of advertising in streaming video, and Amazon has capitalized, the study concluded.

Over the past several years, consumer research conducted by Hub and others has demonstrated that the majority of viewers choose watching ads over paying higher subscription fees, and Amazon has taken advantage in launching their ad-supported service. By placing all subscribers on an ad tier, and requiring them to opt out and pay a higher monthly fee, Amazon Prime Video prodded the vast majority of subscribers onto their ad-supported service. It now has the highest proportion of any streaming service of viewers watching ads.

“Virtually overnight, Amazon Prime Video dramatically transformed the video advertising ecosystem,” said Mark Loughney, senior consultant to Hub. “Suddenly advertisers have the ability to reach tens of millions of viewers on one platform, with robust targeting capabilities and a vast retail capability. Amazon has immediately launched themselves into ‘must buy’ territory for advertisers and media agencies.”

These findings are from Hub’s Q1 report on the continuously fielded “TV Churn Tracker” survey, based on 6,338 US consumers age 16-74, who watch at least one hour of TV per week. Interviews were conducted from January through March 2024 and explored which video services and platforms viewers are adding or dropping, and why. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated report series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.