Survey: Global Investors See Big Opportunities in Sports Tech

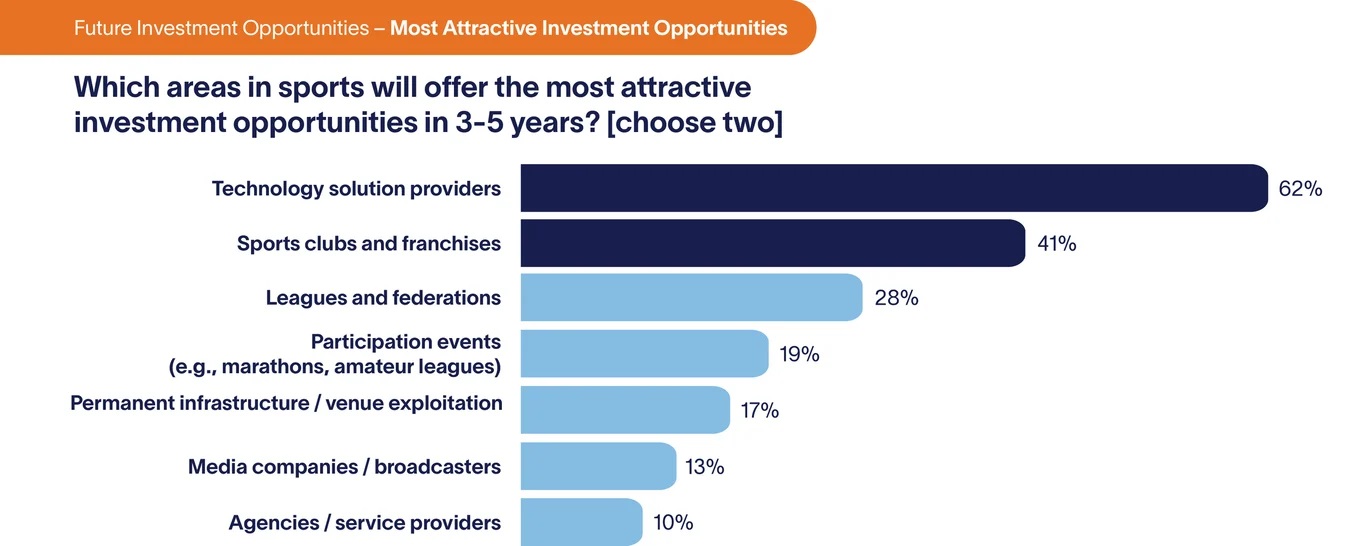

Sports executives said that technology solution providers offered the most attractive investment opportunity

ZURICH, Switzerland—While buying and selling sports franchises often gets the most media attention, a new survey from Altman Solon finds that global sports executives see technology as the most promising investment opportunity in the next three to five years.

Newly released data from Altman Solon’s Global Sports Survey found that sixty-two percent of the more than 250 global sports executives surveyed see technology solution providers as the most attractive investment opportunity. Sports clubs and franchises came in second at 41%.

Investments in technology could also help sports rights holders broaden their audiences and attract younger viewers with new experiences, the researchers found.

“Premier sports franchises will never lose their attractiveness, given the power and longevity of their IP. Yet, private equity and other investors are turning to new technologies providers, particularly those that are revolutionizing media workflows and fan experiences,” Altman Solon partner David Dellea said. “To boost returns, sports investors can build a spectrum of strategic assets and capabilities across their portfolios.”

Other key findings of the Investor Perspectives report include:

- Sixteen out of 22 segments in sports media production, transport and distribution are expected to grow.

- Based on recent deals, major U.S. franchises can have enterprise value more than 10 times revenues, which continue to grow.

- European football clubs have about 5 times multiples value, signaling growth potential, especially considering supply constraints.

The report also highlighted the value of sports rights, finding that it offers recurring and predictable audience performances.

While consolidation has decreased competition for sports rights, a growing cohort of nontraditional media buyers are acquiring sports properties and encouraging rights owners to rethink their content monetization strategies, the researchers wrote.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

These buyers include streaming services, technology groups, gaming companies, betting companies and e-commerce marketplaces. This can be seen in Prime Video and Netflix expanding their sports offerings to include exclusive live broadcasts of NFL games.

The researchers also argued that broadcasters need to go beyond monetizing live games with legacy broadcasters and offer new content use cases to expand audiences. “This makes sense in a world where younger fans are becoming less interested in watching live games than their elders,” the report noted. “Diversifying into adjacent, non-live content can increase fan engagement and offer new, untapped revenue opportunities for media rights holders.”

The report also stressed that “to get the most out of rights distribution, executives must adapt their IP to meet the needs of a new crop of content buyers and an evolving, fractured global fan base. This requires moving away from a wholly B2B distribution strategy focusing on licensing raw content and towards hybrid distribution models that explore adjacent licensing verticals and O&O platforms. These platforms (which include league social media accounts, league websites, and official fan communities) are of great interest to sports industry executives: over 80% of them think O&O channels will be increasingly relevant for fan engagement.”

The full report is available here.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.