Survey: Tubi Sees 59% Bump in Viewing

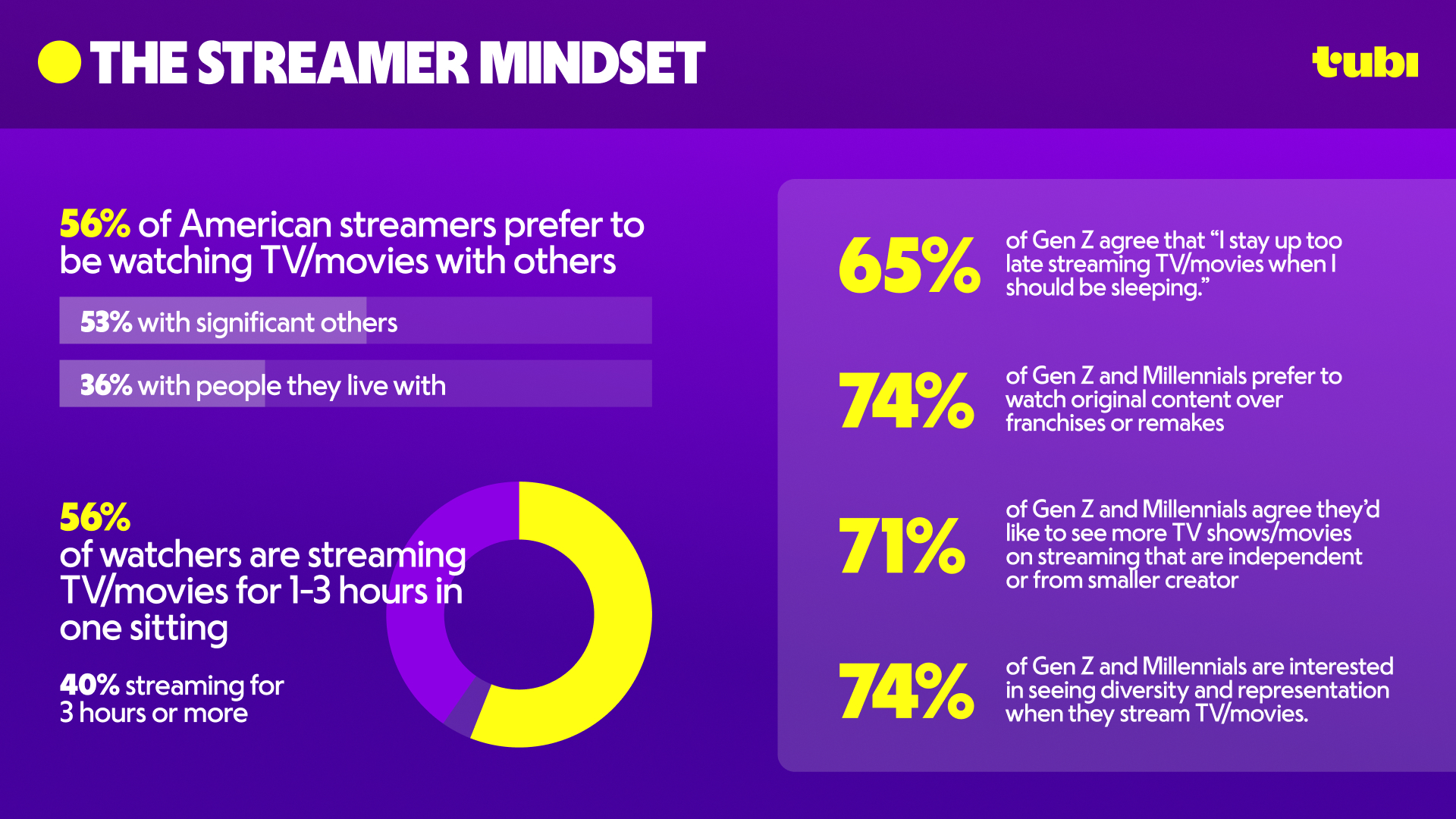

56% of viewers are streaming one to three hours of programming in one sitting, while 40% are streaming three or more hours at a time, according to Tubi

SAN FRANCISCO—Fox Corp.’s free ad supported streaming platform Tubi has released a new survey that shows Tubi saw a 59% growth in total viewing time and reached over 8.5 billion streaming hours in 2023.

Tubi’s “The Stream 2024: Streaming Insights for Marketers” done in conjunction with The Harris Poll also takes a deep dive into the behaviors and preferences of today’s streamers with data showing that 56% of viewers are streaming one to three hours of programming in one sitting, while 40% are streaming three or more hours at a time.

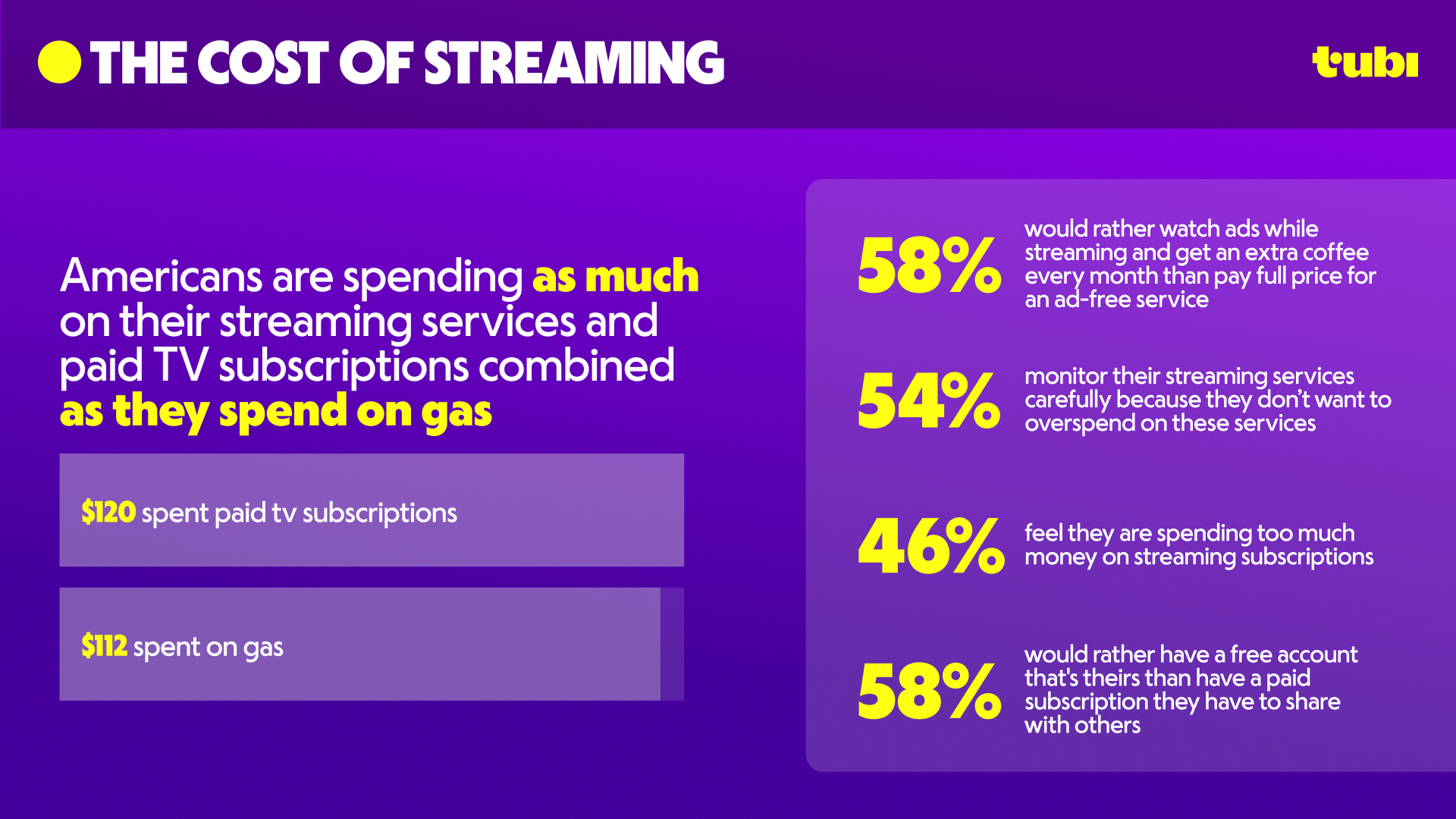

Overall Americans are spending about $120 a month on streaming services and TV packages, the study found.

“Viewers love Tubi because we provide frictionless access to a massive library of content where they can experience the thrill of discovering entertainment they can’t find anywhere else,” said Cynthia Clevenger, senior vice president of B2B Marketing at Tubi. “Tubi’s growth reflects a broader consumer shift towards ad-supported streaming and understanding next gen audiences is critical for us to create a differentiated streaming experience. We’re proud to extend these insights to marketers, sharing how to best connect with Gen Z and Millennials.”

The survey found that Tubi, which saw 78 million monthly active users and 59% growth year-over-year in total viewing time, surpassing 8.5 billion streaming hours in 2023.

The ad-supported service also continues to see momentum with incremental young, diverse audiences who are not typically watching traditional TV. Sixty-three percent of Tubi streamers are cord-cutters and cord-nevers, and 30% are unreachable on other major ad-supported streamers, according to MRI-Simmons’ November 2023 Cord Evolution Study. Also according to MRI, Tubi has seen 60% growth in the 18-34 demographic, 58%+ growth in Multicultural demos including Latine (67%), African American (58%) and LGBT (85%) audiences and 64% growth in female audiences, year over year.

In general the survey found that consumers estimate using about four different streaming services (3.8 average), with heavy streamers (defined as those who stream 15+ hours/week) using about five (4.7 average).

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

In terms of motivation to spend time streaming, viewers told the researchers that they wanted a vast selection of shows and movies (69%), new or original content (61%), and different genres or categories (50%).

The survey also highlighted the cost of streaming services, finding that Americans spend an average of $120 every month on streaming services and TV packages – more than what they spend on gas ($112).

With this high price tag, over half (53%) of Gen Z and millennials believe they’re overspending on streaming, with 71% canceling due to tiered memberships that force them to pay more to access certain content.

Other key highlights include:

- Viewers aren’t opposed to ads – and free streaming is in favor: 58% of viewers would rather watch ads while streaming and get an extra coffee every month than pay full price for an ad-free service – with 62% preferring free, ad-supported streaming over paid. Additionally, 58% of viewers would rather have a free account to themselves than a paid subscription they have to share.

- Viewers expect the ad experience to be seamless and contextually relevant: The most preferred ad format among viewers is the standard ad break, similar to those on traditional TV, strategically placed at convenient plot point breaks in an episode or film (35%). Additionally, two-thirds (67%) of all viewers would rather watch an ad that’s related to the content they’re streaming.

- Gen Z and millennials want original, diverse content from independent creators: Three-quarters (74%) of Gen Z and millennials prefer originals to remakes and three quarters (74%) are interested in seeing diversity and representation when they stream TV and movies. Additionally, 71% agree they’d like to see more TV shows and movies on streaming that are independent or from smaller creators.

- Viewers are tuning into nostalgic content – especially younger audiences: Nearly all (96%) of Americans are interested in nostalgia watching, streaming shows that are 10+ years old. Classic hits also continue to find new audiences among younger viewers who may be discovering them for the first time – 67% of Gen Z and millennials turn to content that’s 10+ years old because “the style and quality is good.”

- Gen Z is rewriting the playbook for sports streaming: Two-thirds (68%) are keen on watching live sports or sports programming, such as NFL weekly game previews (45%) or the NBA G League (31%), and 42% dedicate three or more hours each week to live sports streaming, eclipsing those watching on traditional cable and satellite TV (24%).

- Viewers turn to streaming for connection and self care: 71% of viewers stream content with members of their household as a form of quality time. However, many viewers also view streaming as self-care, with 68% streaming TV or movies as an opportunity to carve out alone time. Sixty-eight percent also agree: “when I’m really invested in a show, I’d rather stay home and binge it than go out to see friends.”

The full survey is available here.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.