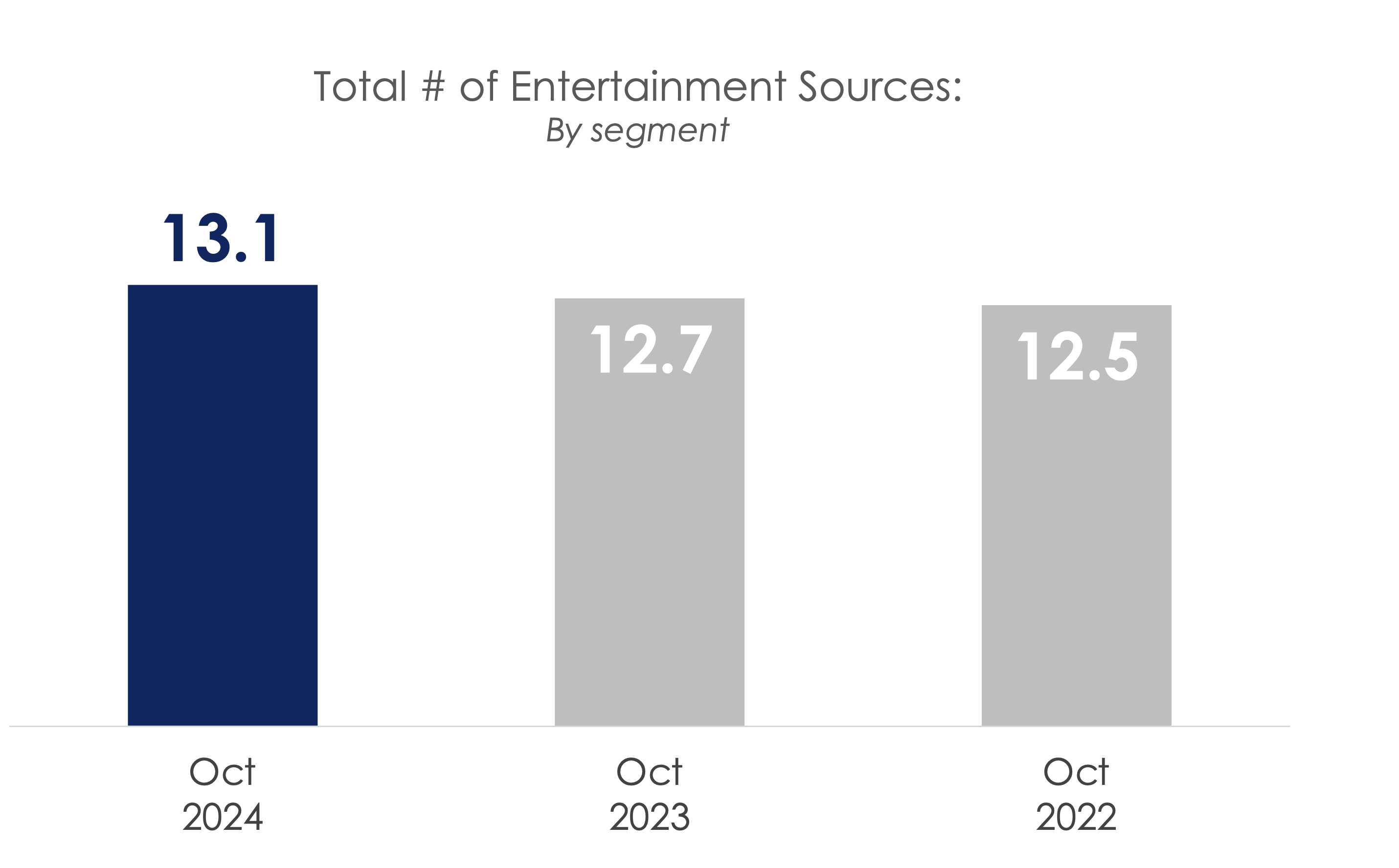

Survey: Viewers Access a Record 13 Different Sources for Entertainment

TV viewers face the most complex ecosystem ever, particularly among households with kids, who access 17 sources

PORTSMOUTH, N.H.—A new Hub Entertainment Research survey highlights the growing complexity of the average TV viewer’s entertainment ecosystem, finding people are using more entertainment sources than ever.

In 2024, the average household uses 13 different sources of entertainment—the highest total since the survey launched three years ago. Young people (respondents under age 35) use 16 different sources, and households with kids use almost 17 sources.

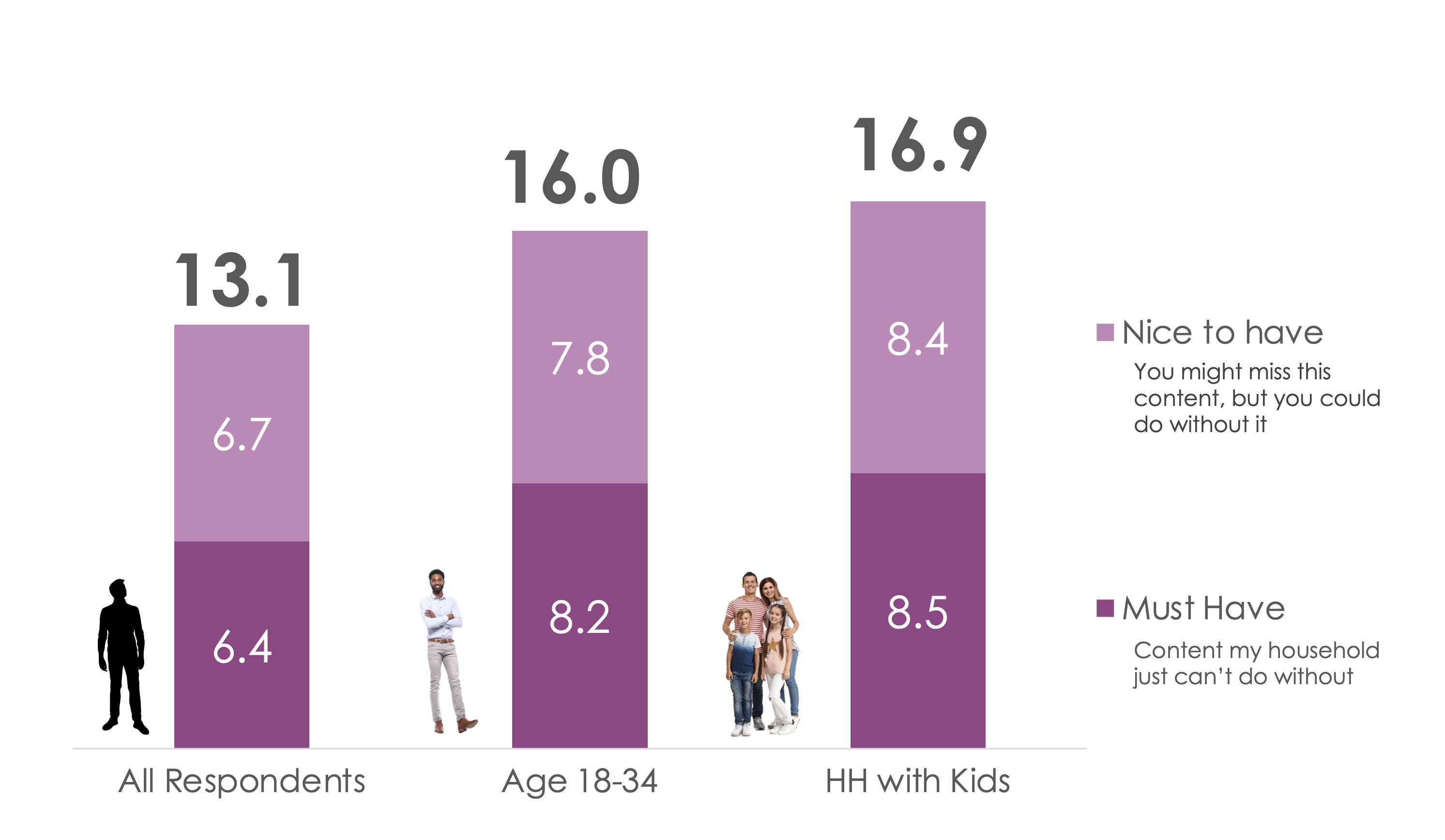

While the sixth wave of Hub’s “Battle Royale” survey underscores how crowded the entertainment ecosystem is and how much competition there is for share of mind, it also indicates consumers aren’t heavily attached to all these sources. Only about half of them are considered “must-haves.”

In the survey, consumers were asked to assign each platform into one of two categories: either “must-have” (“something my household can’t do without”) or “nice to have” (“I might miss it but could do without it”).

Respondents rated 6.4 of their sources as “must-haves” and 6.7 as “nice to have.”

While young people and families used more sources, their ratio of “must-have” to “nice-to-have” sources was the same. That 50-50 ratio has also been consistent across all 6 waves of this study since early 2022.

“These findings underscore how competitive the entertainment landscape has become,” Jon Giegengack, principal and founder at Hub and one of the study authors, said. “In particular, video games, YouTube and TikTok are rapidly gaining share of mind among young consumers, who have an entirely different idea of what ‘entertainment’ means and are forming habits unlikely to change as they grow older.”

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

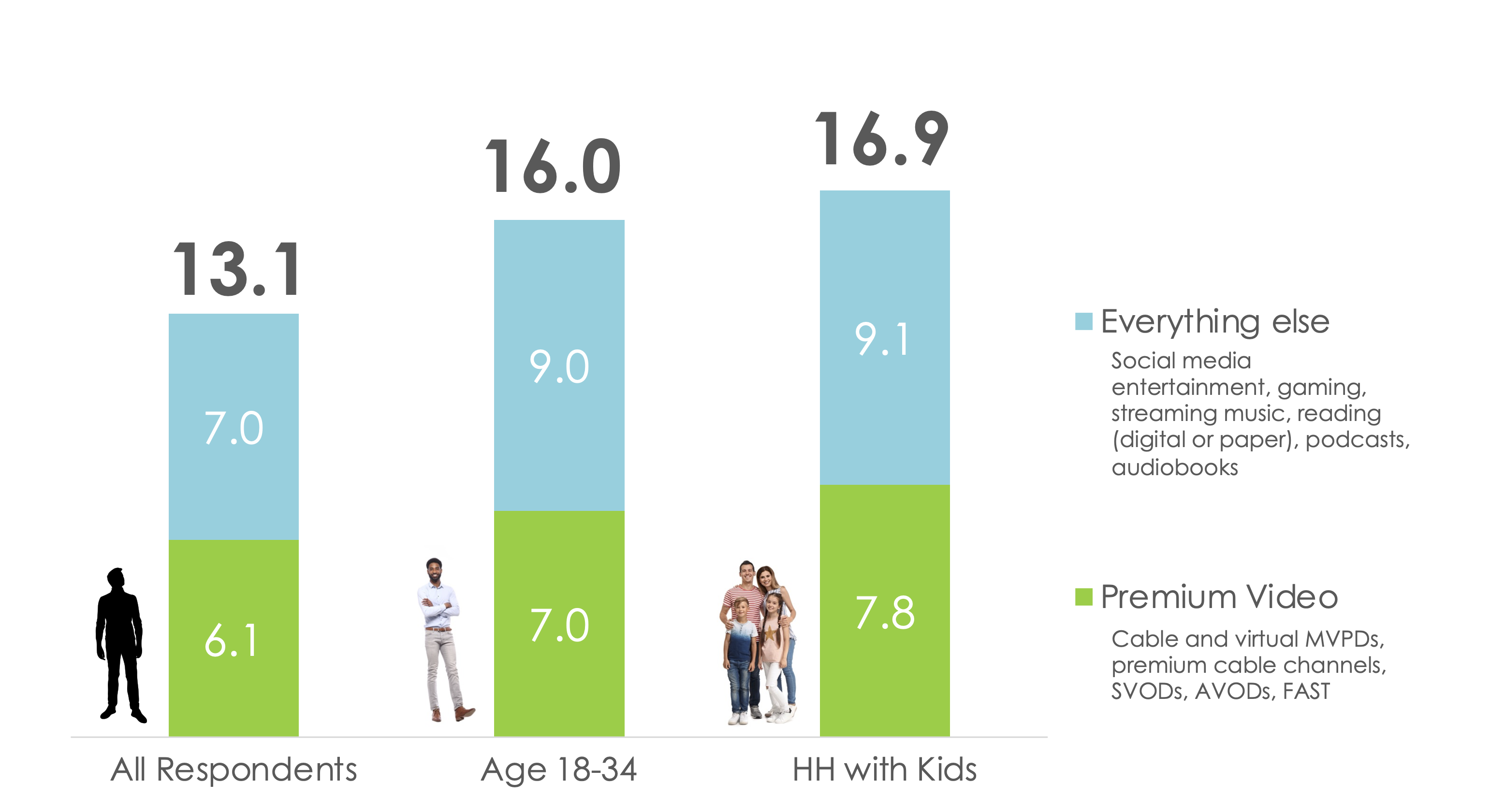

TV is getting competition from other types of content—especially among young people. What the industry calls “premium video” (cable, streaming, virtual MVPDs, etc.) has been considered the center of the entertainment universe for years. But this data shows the extent to which things like social video and gaming are consuming more disposable time, especially among young people.

In general, respondents use six premium video sources and seven other platforms (including social video like YouTube or TikTok, gaming platforms, streaming music subscriptions, etc.).

Among young people, premium TV sources are a minority of their entertainment ecosystem: only seven, compared to nine sources that provide other kinds of content. Most of this difference is driven by social or short-form video and gaming.

On average, entertainment consumers under 35 use: 2.4 gaming sources, compared to just one gaming source among those aged 35-plus. They also use 3.6 social or short-form video sources (compared to just 2.2 among those aged 35-plus.

These findings come from wave six of Hub’s semiannual “Battle Royale” report, based on a survey of 3,018 U.S. consumers age 18-74 who are entertainment decision-makers with broadband. The data was collected in October. A free excerpt of the findings is available on Hub’s website.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.