Survey: Viewers Confused About Streaming Brands

Despite massive marketing campaigns viewers don’t know what makes one streaming brand different from another, the Hub reports

PORTSMOUTH, N.H.—As the streaming wars have heated up, streaming services have spent increasingly large amounts of money trying to establish their brands with consumers, going so far as to make some big media buys at this year’s Super Bowl.

Yet despite all the marketing, the Hub’s annual “Evolution of Video Branding” survey reveals viewers often have a hard time differentiating the brands of streaming services, and turn to their knowledge of specific series and creative brands to help make viewing decisions.

“Viewers have not lacked in choice of services and content over the past few years. But this can be a two-edged sword for content providers, as the immense volume just makes it hard for viewers to remember what is different about each service,” said David Tice, senior consultant to Hub and co-author of the study. “But at the end of the day, content is king, and unique content will drive viewers even if the service itself isn’t unique to consumers.”

The confusion about individual streaming brands actually stand for is particularly problematic in an increasingly crowded streaming landscape where services have to stand out from the pack to attract viewers and subscribers.

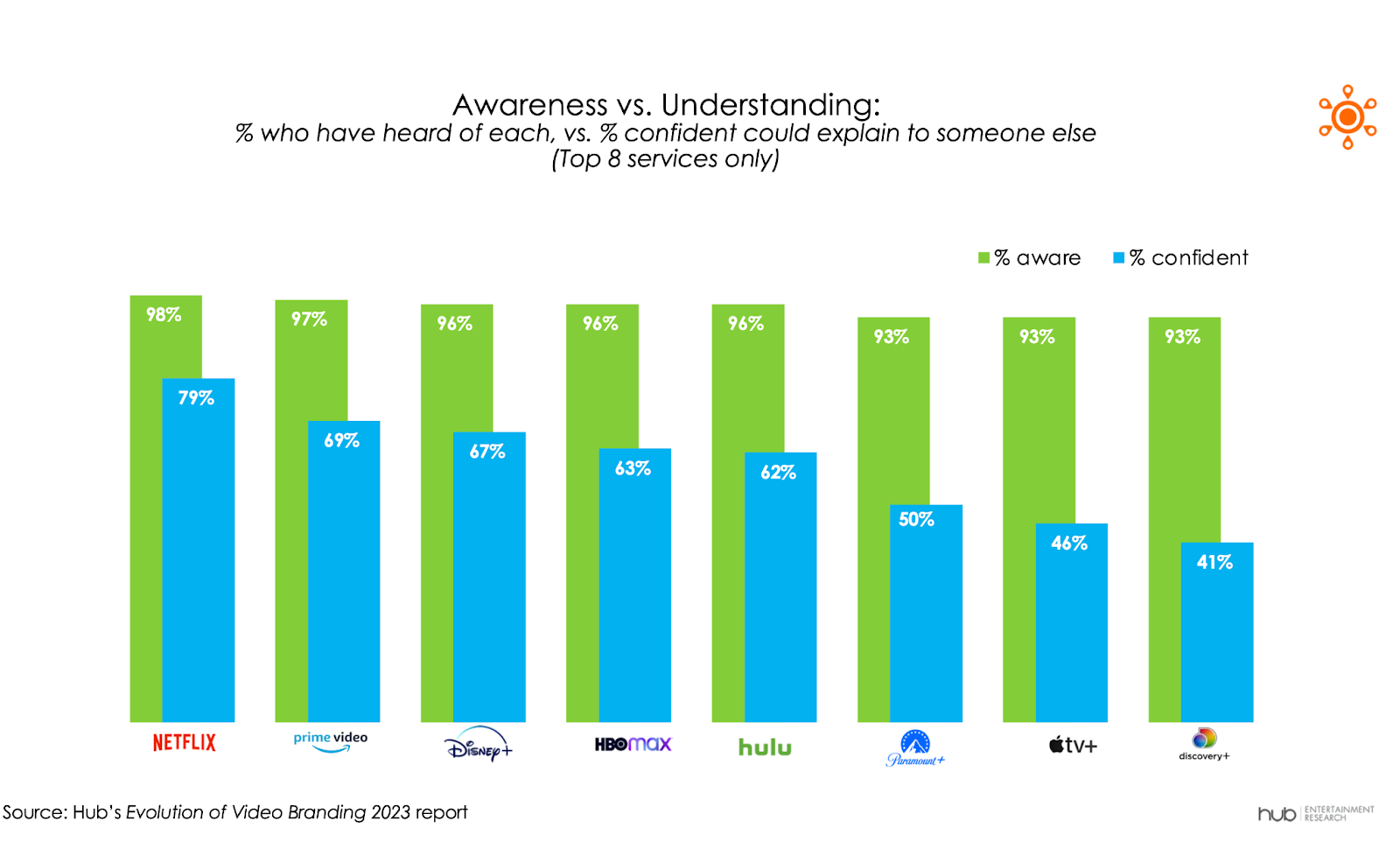

The Hub researchers noted that brand awareness and brand familiarity are two very different things. Viewed from the lens of brand awareness, the vast sums expended on marketing during the streaming wars have been effective: all the major platforms have brand awareness above 90 percent.

But brand understanding is another matter: far fewer consumers feel confident that they could explain to someone else what each platform does best, or how it’s different from the others.

This is the case even for companies that are masters at branding, like Apple: almost all respondents are aware of Apple TV+, but fewer than half feel they understand the value proposition.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

That means consumers are choosing between a well-known set of brands, without a clear understanding of what differentiates them, the researchers said.

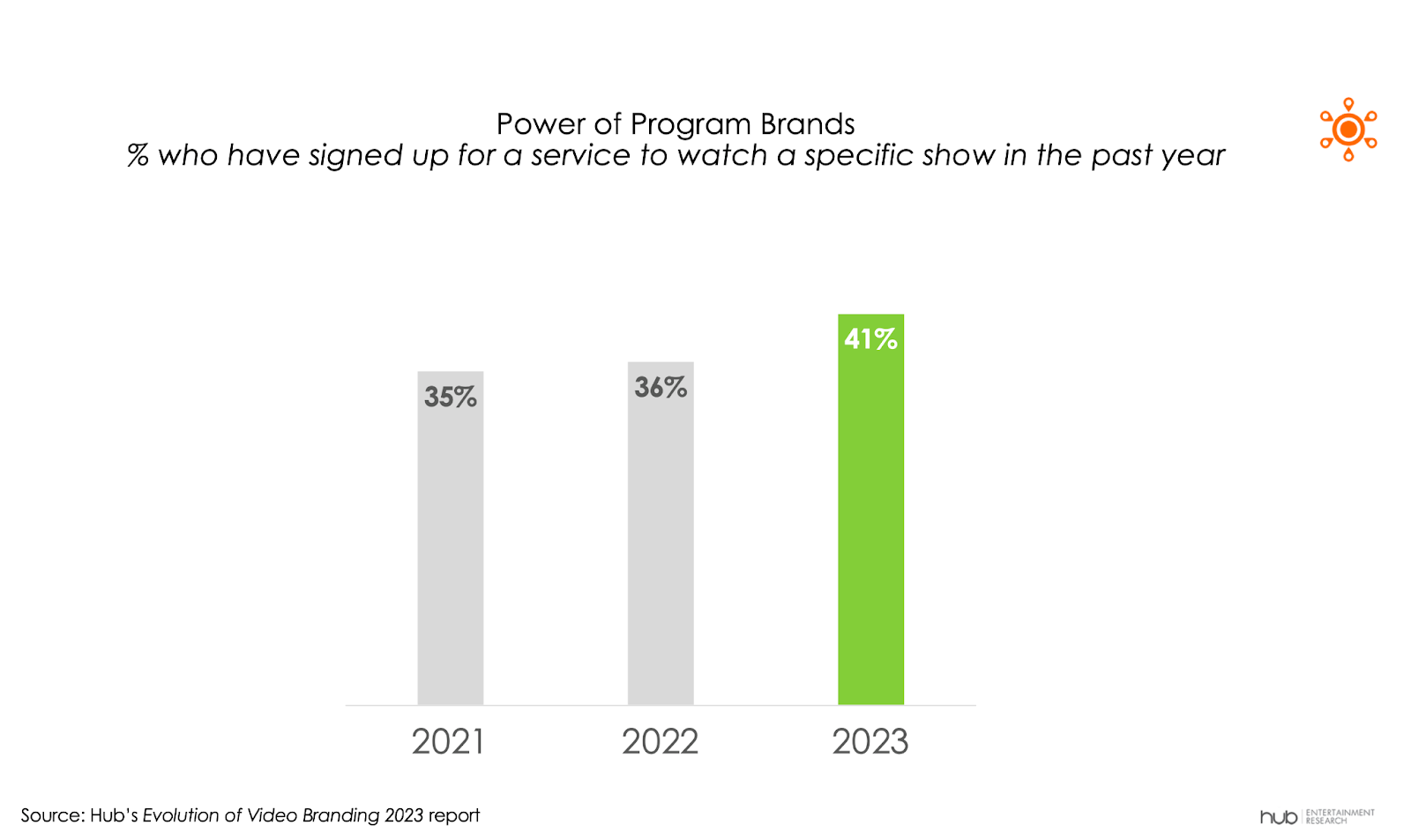

Lacking a clear understanding of the difference between platforms, consumers turn to other guideposts, such as program brands, the researchers noted. The survey found that 41% of viewers say they have signed up for a platform just to watch one specific show (up from 35% to years ago). This is even more pronounced among desirable audiences like young people: 57% of those aged 16 to 34 have signed up to watch one particular show.

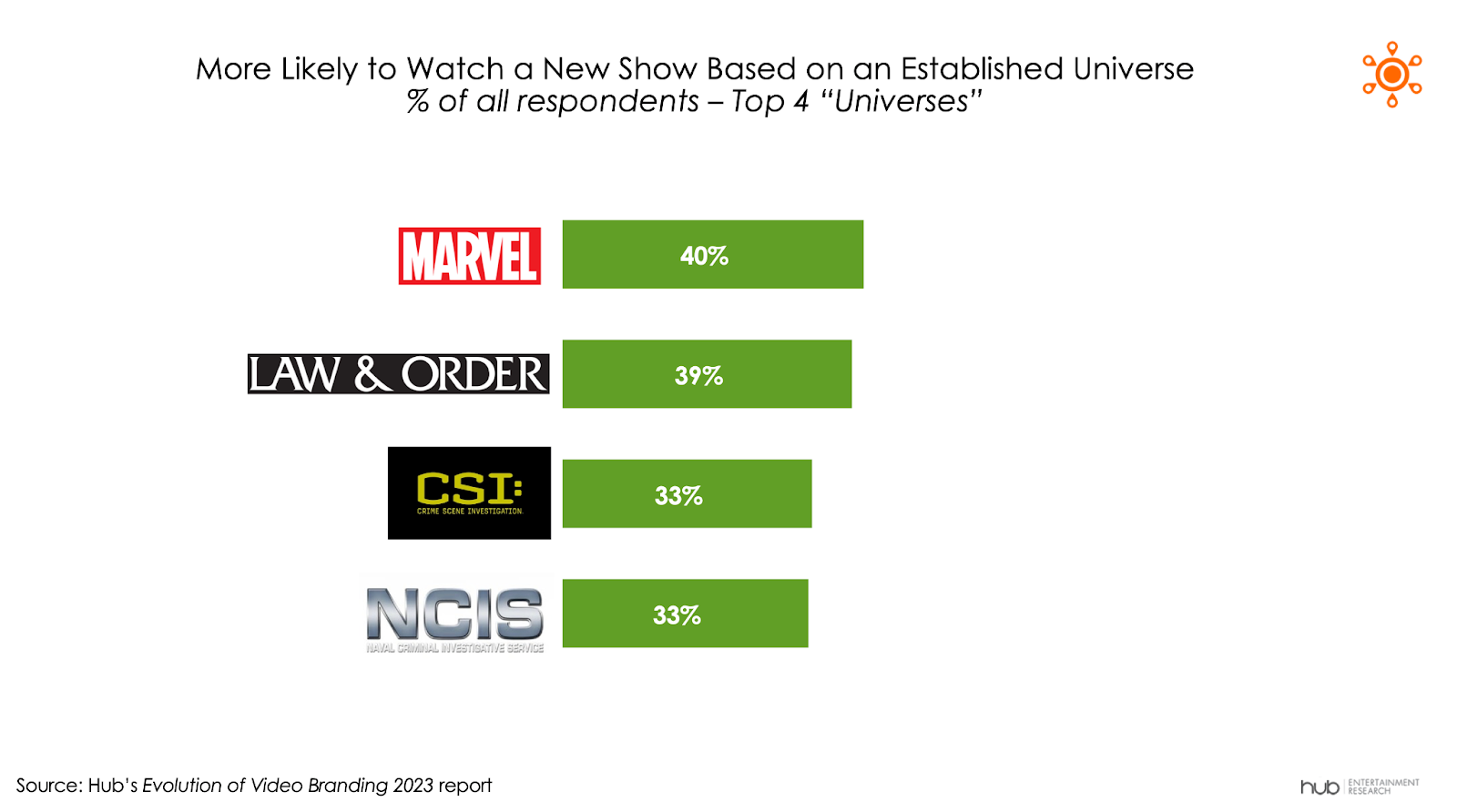

When lost in a sea of content, viewers look for what’s familiar: New shows based on familiar characters or histories have a leg up in the discovery process, the researchers said, nothing that 40% of all respondents said they would be more likely to watch a new show based on the Marvel universe (the highest of the 10 brands we tested.)

But the next three highest were broadcast TV procedurals that have already had successful spinoffs.

Another example is the Yellowstone franchise (shows set in the world of “Yellowstone” or marketed as coming from the same creator), the study explained.

Among the respondents who had ever watched Yellowstone, 70% also watched at least one of Sheridan’s other shows (1883, 1923, Tulsa King, or Mayor of Kingstown).

Perhaps most notably, viewers had to put in some effort to watch these: Yellowstone is only on Paramount cable network and on Peacock, while the other shows are only available on Paramount+.

These findings are from Hub’s 2023 “Evolution of Video Branding” report, based on a survey conducted among 2,400 US consumers with broadband, age 16-74, who watch at least 1 hour of TV per week. Interviews were conducted in February 2023 and explored attitudes towards brands associated with traditional TV service as well as those providing streaming TV service. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated report series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.