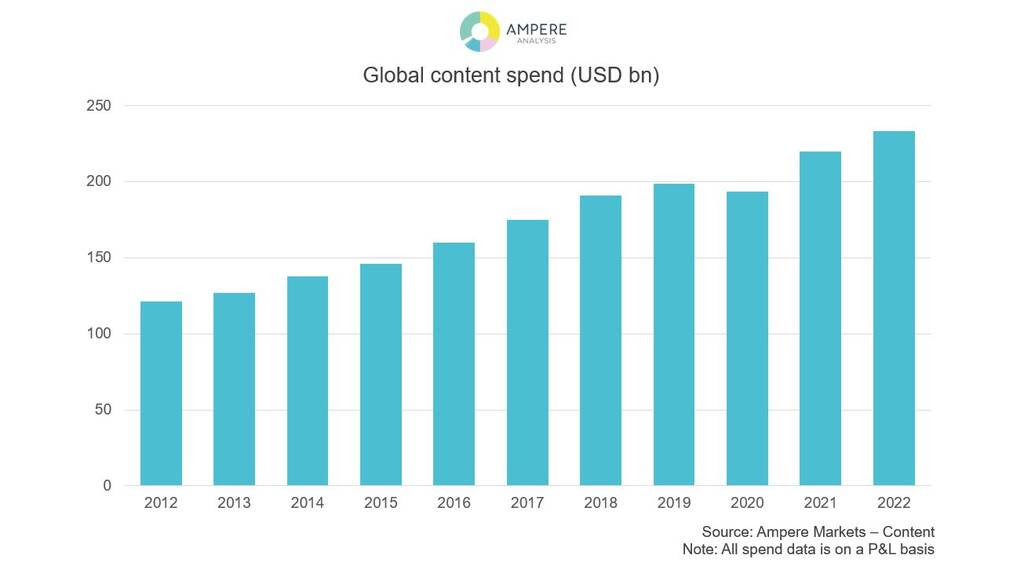

SVOD Players Boost Global 2021 Content Spend to $220B

Worldwide investment in new content was up 14% over 2020, driven by SVOD platforms commissioning original fare

LONDON—Spending on content around the world jumped by 14% in 2021 to more than $220 billion according to new forecasts and data from Ampere Analysis. They also predict that the trend will continue into 2022 when the global content spent will top $230 billion.

The increase was driven by increased spending on original programming by SVOD players, who spent nearly $50 billion on content in 2021, up by more than 50% from their spending in 2019, according to Ampere

Hannah Walsh, research manager at Ampere Analysis explained that in “2022, we expect content investment to exceed $230 billion, primarily driven by subscription streaming services, as the battle in the original content arena intensifies – both in the US, but also in the global markets which are increasingly key for growth.”

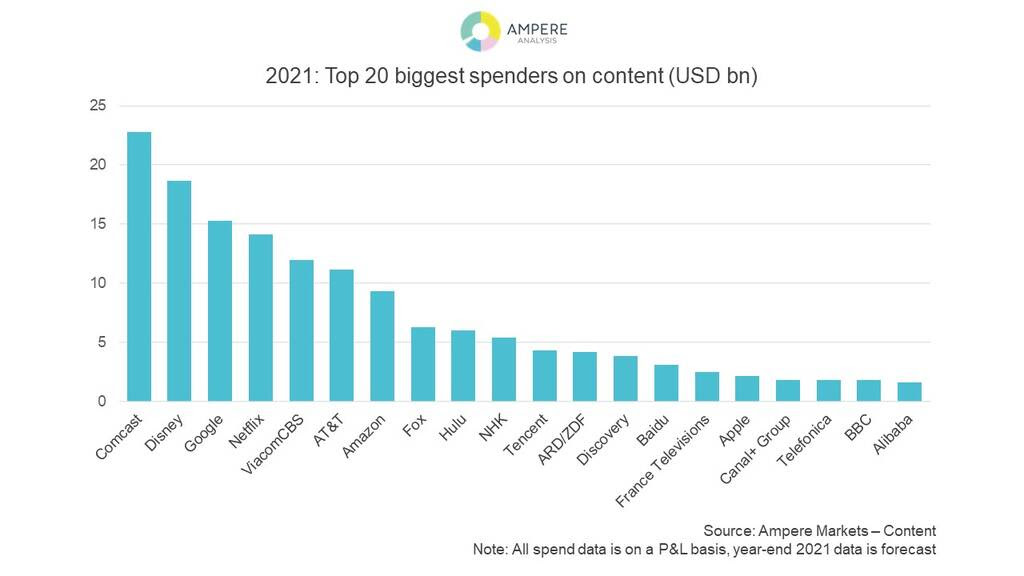

The research group found that Netflix continues to dominate SVOD content investment, contributing 30% of total SVOD content spend and 6% of total global content investment in 2021. Netflix is the third largest investor in professional video content at a group level ($14 billion), behind Comcast and its subsidiaries ($22.7 billion), and Disney ($18.6 billion).

“Comcast and Disney invest heavily in sports rights, which —alongside their hefty investments in original content — contributed to their leading positions in the table,” said Walsh. “Sports rights made up over a third of both Comcast and Disney’s spend in 2021.”

Content expenditure by commercial and public service broadcasters also bounded back in 2021, after being damaged in the prior year by ad spend cut-backs and production halts during the earlier phases of the COVID-19 pandemic, Ampere reported.

Despite this recovery, content spend from these groups still remains below 2019 levels, largely due to ongoing pressures on revenue (primarily TV advertising revenue)—a consequence of a mixture of viewing shifts to online video, and lingering economic effects influencing advertiser expenditure.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Ampere noted that all spend data is on a P&L basis and excludes theatrical production and exploitation costs. Disney+, Apple+, HBO Max, Peacock & Paramount+ content spend is for original content only and does not include the back catalogue of content acquired from their studio parent groups.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.