The Many Moving Parts of the Transition to NextGen TV

Broadcasters await the results of the ‘Future of TV’ task force and a 1.0 sunset

Fifteen years ago this month, U.S. broadcasters “cut the cord” on NTSC, shutting down analog TV and putting the finishing touches on a transition to digital that lasted more than a decade.

Viewer response was fairly muted, but that’s because broadcasters, regulators and consumer electronics companies rightly anticipated an outcry if too many viewers lost access to a free over-the-air signal. Navigating the deadline to shut down analog was a frustrating process as all parties involved attempted to assemble the variety of moving parts that made up the transition.

In the summer of 2024, the industry is looking at the next shutdown—the end of ATSC 1.0. Despite the arduous task that faced broadcasters in the 2000s during the first transition, this next transition could be even harder to achieve.

Comparing the two transitions is apples to oranges. The first transition was mainly based on regulatory guidelines that in essence, forced industries to cooperate toward a common goal. The cable, broadcast and consumer electronics industries were also facing a far less complex media ecosystem where there was less competition for eyeballs. And perhaps the biggest factor was the decrease in prices for large screen 16:9 flat screens that aligned with broadcasters’ move to HDTV, a very noticeable and welcome advance for home viewers.

What Do You Get With NextGen TV?

The transition to ATSC 3.0 (aka NextGen TV) is touted as “market-driven” with a lighter regulatory touch than the move to 1.0. There are no specific deadlines for stations to deploy the standard nor are there any mandates to provide tuners in any receiving devices. There aren’t any mandates for broadcasters to provide anything more than simulcasting ATSC 1.0.

And, in contrast to the first transition, broadcasters face a much more complex media landscape and Silicon Valley competitors with far deeper pockets and much less to lose if a particular experimental service failed (remember Quibi?). It’s also harder to get viewers who are now used to getting their programs in 4K and HDR to get excited about 4K HDR broadcasts.

Mark Aitken, senior vice president of advanced technology for Sinclair Broadcast Group would beg to differ on that front.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“HDR is very significant, and one of the promises of the ATSC 3.0 standard is better television for America’s living rooms,” Aitken said at this year’s NAB Show. “It was the focus of the ATSC at this year’s CES. CBS’s delivery of the February Super Bowl LVIII in HDR should spur others to add this enhancement to their ATSC 3.0 transmissions and I expect to see announcements from other networks,” said Aitken, who added that some 40 Sinclair stations are on the air with Advanced HDR by Technicolor.

Aitken’s sentiments are echoed by Anne Schelle, managing director of Pearl TV, the consortium of broadcasters and manufacturers promoting NextGen TV, who discussed how local Louisville, Ky. TV stations promoted HDR, 4K and Atmos immersive audio in their local 3.0 broadcasts during the week leading up to the 2024 Kentucky Derby. Local stations partnered with a local retailer to give away NextGen TV sets and promotions on their websites attracted “a significant increase in traffic.”

“I think that is a good indicator of the interest in HDR,” she said. Schelle also noted Pearl’s recent announcement that several large station groups, including Gray Television, Sinclair Broadcast Group, Hearst Television, Tegna and The E.W. Scripps Co. will accelerate funding of the ATSC 3.0 Framework Authority (A3FA), the driving force behind the RUN3TV platform. Pearl TV says it expects additional broadcast groups to become involved in the future.

“RUN3TV is built by broadcasters for broadcasters and it allows companies who built on the platform to easily build applications and try out unique features and have them be able to work across the multitudes of operating systems that are currently out there and more to come,” she said.

A new partnership with ROXi to launch interactive music channels, as well as NBC’s announcement that affiliates in top markets are launching ancillary services via NextGen TV were among the other 3.0 highlights announced at the NAB Show in April.

Beyond consumer applications, broadcasters are also using a portion of their spectrum to deploy new datacasting services. Also at the NAB Show, Sinclair launched its “Broadspan” datacast service in partnership with Edgio. The new service will enable data distribution in all the current markets where Sinclair stations are offering ATSC 3.0 broadcasts. Sinclair CEO Chris Ripley invited other station groups to join the service.

Bandwidth Constraints

While all of these new capabilities are brought to us via the ingenious capability of ATSC 3.0’s combination of broadcast with IP, there’s only so much bandwidth available and that bandwidth is further constrained by the 1.0 simulcasting requirement.

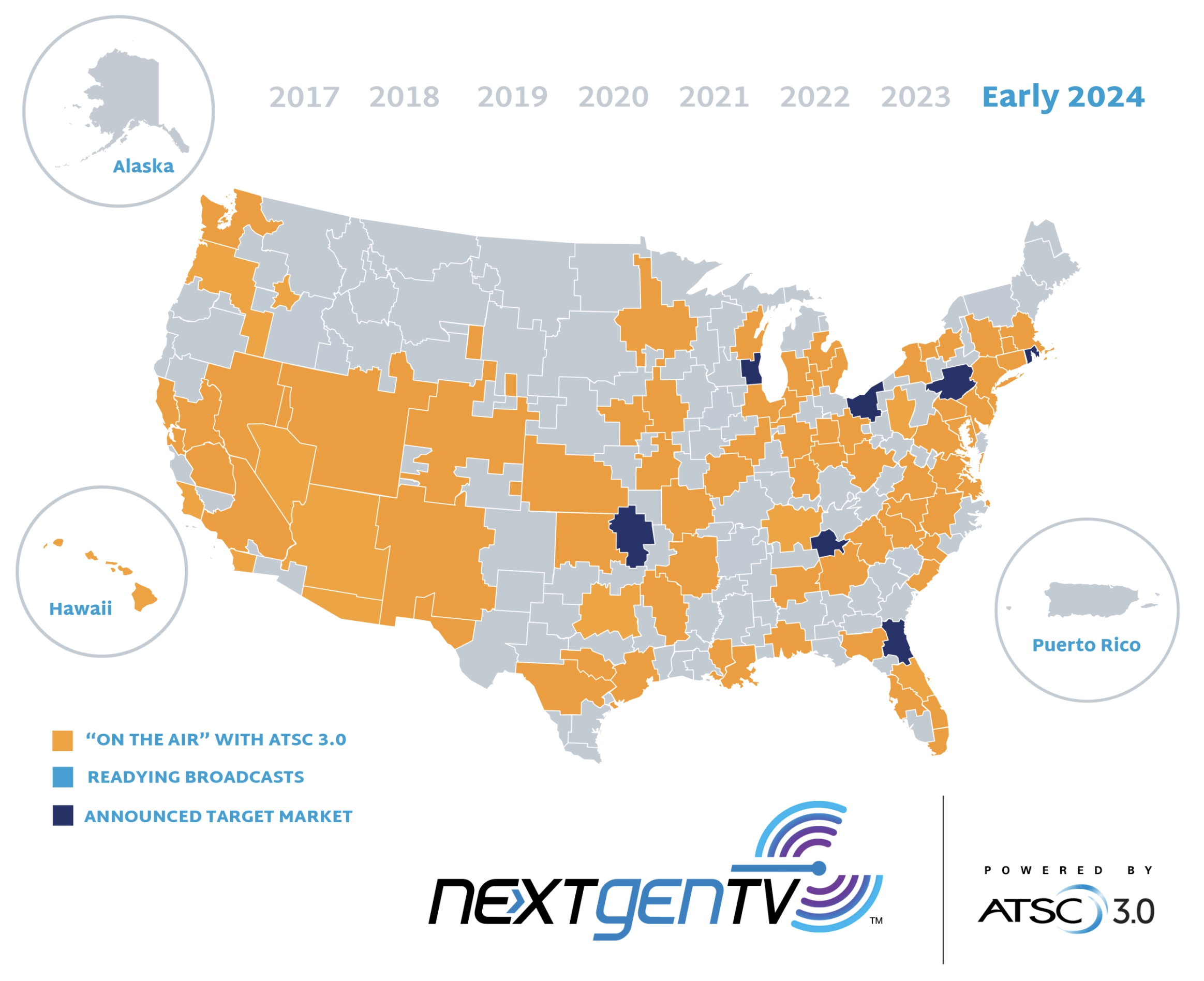

At presstime, ATSC 3.0 has been launched by more than 91 stations in 40 markets, bringing the advanced broadcast standard to within reach of more than 75% of U.S. households. Pearl TV says it expects that number to grow to more than 200 stations in 53 markets by the end of 2024.

Most of those stations are simulcasting 3.0 with 1.0 over “lighthouse” transmission partnerships in which one local station offers up its transmission facilities to “host” the other 3.0 stations in particular markets. This requirement is in place during the transition to ATSC 3.0. Originally, the FCC imposed a 2025 deadline to end 1.0 simulcasting but in 2023, moved the date to July 17, 2027. The decision was in part predicated by the industry’s exhortations to the commission earlier in the year about a “stalled” transition.

In response, FCC Chairman Jessica Rosenworcel announced the formation of the “Future of TV” task force at the 2023 NAB Show, inviting all industry players to work together towards a successful conclusion of the transition to 3.0.

“This Future of Television initiative will gather industry, government, and public interest stakeholders to establish a roadmap for a transition to ATSC 3.0 that serves the public interest” Rosenworcel said at the time. “A successful transition will provide for an orderly shift from ATSC 1.0 to ATSC 3.0 and will allow broadcasters to innovate while protecting consumers, especially those most vulnerable.”

‘Frank’ and ‘Candid’

The FCC asked the NAB to take the lead by hosting the meetings, and while the industry has been tight-lipped about characterizing the tone, the best the press has been able to get out of sources is that they are “frank” and “candid,” which, in Inside the Beltway-speak, can have a wide variety of meanings.

But given the cable industry’s long-held viewpoint that certain guardrails must be in place before it replaces 1.0 with 3.0 and the consumer electronics industry’s vehement opposition to any Congressional tuner mandates, it’s understandable that the task force may not arrive at a definitive deadline that will please everyone.

The NAB, for its part, is staying on message. “The Future of TV initiative has made great progress, and we are looking forward to releasing the report later this year,” they told TV Tech. “We appreciate the participation of everyone involved in this effort to help ensure a smooth transition.”

ATSC President Madeleine Noland agrees that ending the transition is top of mind for broadcasters, noting that until a deadline is established, broadcasters are finding ways to add more capabilities despite the bandwidth constraints.

“As exciting as datacasting is, until the transition is farther along—and I don’t mean getting from 75% to 100%—but I mean within a given market, it’s important to have more transmitters available with 3.0. I think about the Boston market and we have one transmitter up, which is carrying five or six high-definition signals and at least two standard-definition search services. There’s not a lot of room to do anything else.”

Noland mentioned the recent addition of five more 3.0 stations in the San Antonio market as one of the ways around such constraints. “I gotta tip my hat to San Antonio for being able to get that second stick up.“ Noland said, adding that the current focus will not be in trying to finish the other 25%, but in expanding coverage in existing markets. “Let’s try to get depth in the markets that we already have because we’ve got all the big markets; let’s build it out and be able to do more with 3.0 in those markets.”

Consumer Devices

According to the CTA, the cumulative U.S. installed base of NextGen TV receivers topped 10.3 million in 2023 and consumer sales of NextGen TV products are expected to increase by 45% in 2024. ATSC says more than 100 consumer products that support NextGen TV are expected to be available by the end of 2024, with the vast majority being TV sets from Sony, Hisense, TCL and Samsung. LG, which announced a suspension of the manufacturing of NextGen TV sets in 2023 due to a patent dispute, currently sits on the sidelines.

Unlike the transition from analog to digital when the federal government subsidized the purchase of low-cost digital tuners for consumers who have yet to go digital, NextGen TV’s market-based approach provides no such incentives.

One person, however, believes that a pure market driven approach is unrealistic and notes that public-private partnerships between industry and the government have an historic precedent that should also play a part in the transition to NextGen TV.

John Lawson, executive director of AWARN, a consortium of business and government entities promoting advanced emergency alerting technologies on 3.0, thinks low-cost converter boxes subsidized by the federal government would help accelerate the move to sunset 1.0.

In an op-ed on TV Newscheck in March, Lawson wrote:

“Congress would establish a new voucher program for 3.0 set-top boxes and dongles. This time, however, the subsidy program would be established in the name of public safety, for both resilient alerting in the face of climate change and national security to provide a back-up for GPS. Broadcasters would agree to carry Advanced Emergency Information, perhaps with sunset provisions for EAS, and receivers would be enabled to display AEI messages.”

Lawson said he arrived at his position after a meeting with the FCC as well as with broadcasters in Michigan.

“Senior staff at the FCC told me that the broadcast industry had made it clear from the beginning in their opinion that the 3.0 transition was unlike the transition from analog to digital, and that it would be a purely market driven approach,” he said. “And then I went out on the road so to speak to the Michigan Broadcast Engineering Conference I really got a dose of reality,” adding that nobody raised their hand when he asked attendees if the 3.0 transition was “on the right track.”

Lawson adds that his proposal follows a traditional path and promotes, “in effect, a partnership between government and industry.”

“American capitalism is dependent upon R&D and other investments by the federal government and it allows companies like Apple and Meta and many others to make a lot of money. [But] there's a general healthy weariness among the broadcast industry about getting government involved but there are many, many examples of where the two actually support each other.”

Will it Survive as a Purely Market-Driven Transition?

The transition to ATSC 3.0 contains an insane number of moving parts as well as a variety of approaches and while no one is suggesting Congressional mandates of any kind, in its current state, there remains some question as to whether it will survive its status as a completely market-based transition.

But don’t tell that to Rob Folliard, senior vice president of government relations and distribution with Gray TV and chairman of Pearl TV who says the transition to 3.0 is moving at a faster pace than the move to 1.0.

“[The transition] has worked better than the government-mandated transition 20 years ago, we are moving ahead faster,” Folliard said. “And I think the reason the market-based approaches work is because the broadcasters see a huge opportunity, a huge ROI, and we’re making it work. We’re finding creative ways to cooperate, channel share, in order to make the transition happen.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.