Thomson Scores Breach Waiver

PARIS: Thomson said its creditors have granted it a waiver, giving the company until June 16 to restructure its 2.9 billion euro ($3.8 billion) debt due April 30. The company warned in January that it would likely breach loan covenants, putting the Grass Valley and digital signage divisions up for sale as well.

“With regard to Grass Valley, the group has selected second-round bidders, which have now entered into the due diligence process,” Thomson said in the announcement of its 1Q results. The company said it maintains its goal of divesting Grass and Screenvision before the end of the year.

Thomson’s 1Q09 revenues increased 8.5 percent to 915 million euros ($1.2 billion) at actual exchange rates year-over-year, excluding Grass and Screenvision, which are being treated as discontinued operations. It ended the quarter with 586 million euros ($764 million) in cash and net debt of nearly 2.4 billion euros ($3.1 billion).

Thomson has been working on a restructure since February. Its senior creditors, owed “substantially all” of the $3.8 billion, agreed not to accelerate any of the debt nor require payment before June 16, the date of Thomson’s annual meeting. Beyond that, Thomson didn’t paint a particularly rosy image and said “it remains very cautious with regard to the evolution of its activity given the current low level of market visibility.”

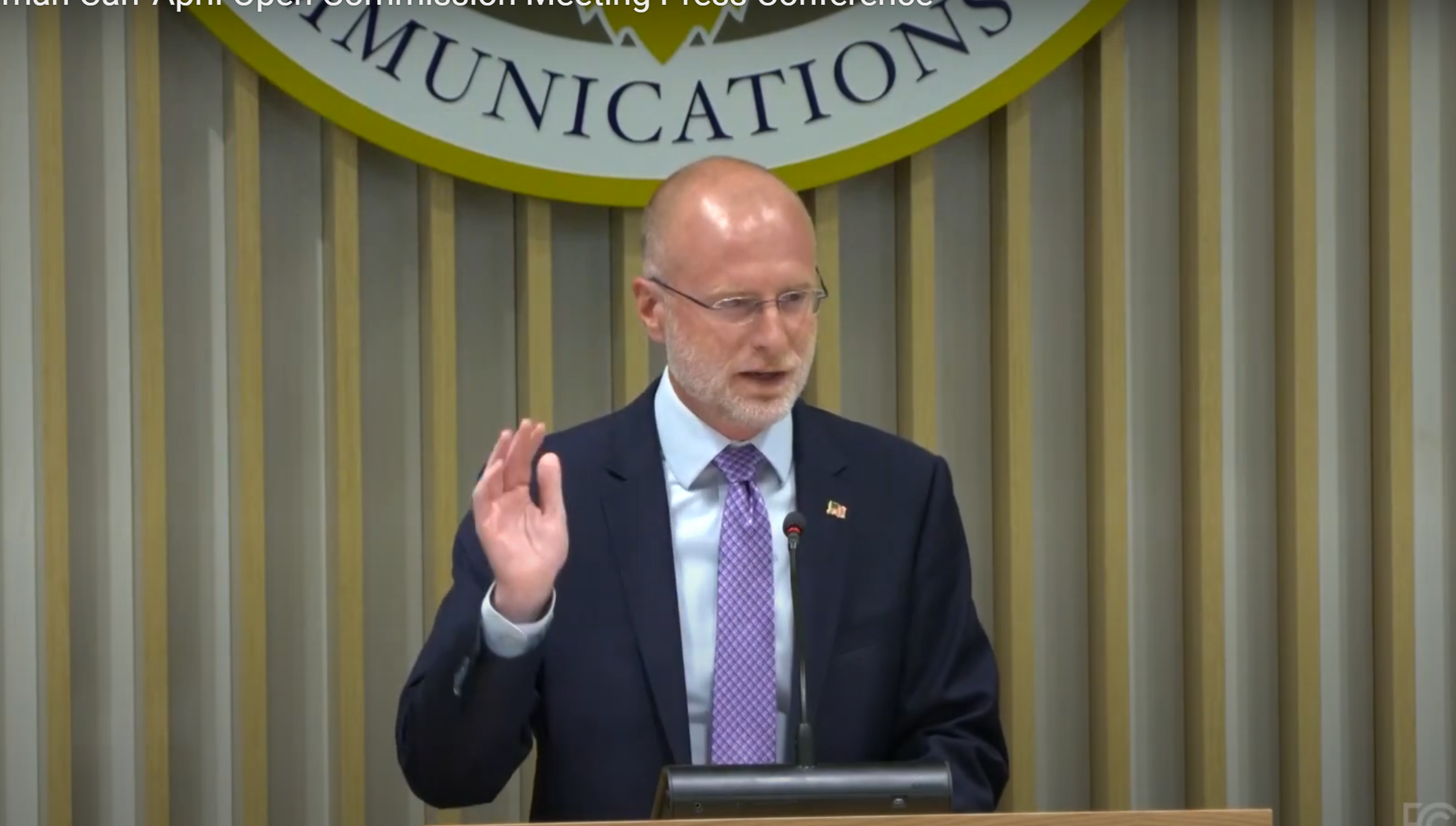

“While our first quarter revenue growth is encouraging under the present market conditions, the significant improvement in both profitability and operating cash flow trends is even more important,” Thomson CEO Frederic Rose stated. “This reflects the continued support of our customers and commitment of Thomson employees. In this context, the waiver agreement with our creditors is an important step to continue our discussions with the objective to find a balanced and sustainable solution for our balance sheet restructuring.”

Rose was appointed chairman of the board in addition to his CEO duties. François de Carbonnel remains a director and chairman of the Audit Committee. Remy Sautter, independent director and chairman of the Remuneration Committee, became vice chairman of the board.

Thomson’s (NYSE: TMS) American Deposit Receipts registered a slight uptick on the waiver news, closing Monday at $1.30 and topping out Tuesday at $1.45. ADRs leveled out at about $1.35 today. -- Deborah D. McAdams

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.