TiVo: Viewers Continue to Cut Back on Streaming Subscriptions

Good news for pay TV: cord-cutting has declined

SAN JOSE, Calif.—Cost-conscious TV viewers are cutting back spending on streaming services, preferring quality programming over a large number of choices, TiVo said in a report released today.

In its “Q4 2024 Video Trends Report,” Xperi-owned TiVo found consumers have begun to declutter their video libraries. This trend of streamlining video services underscores the critical role high-quality content plays in driving sustained engagement and connection with consumers, TiVo said.

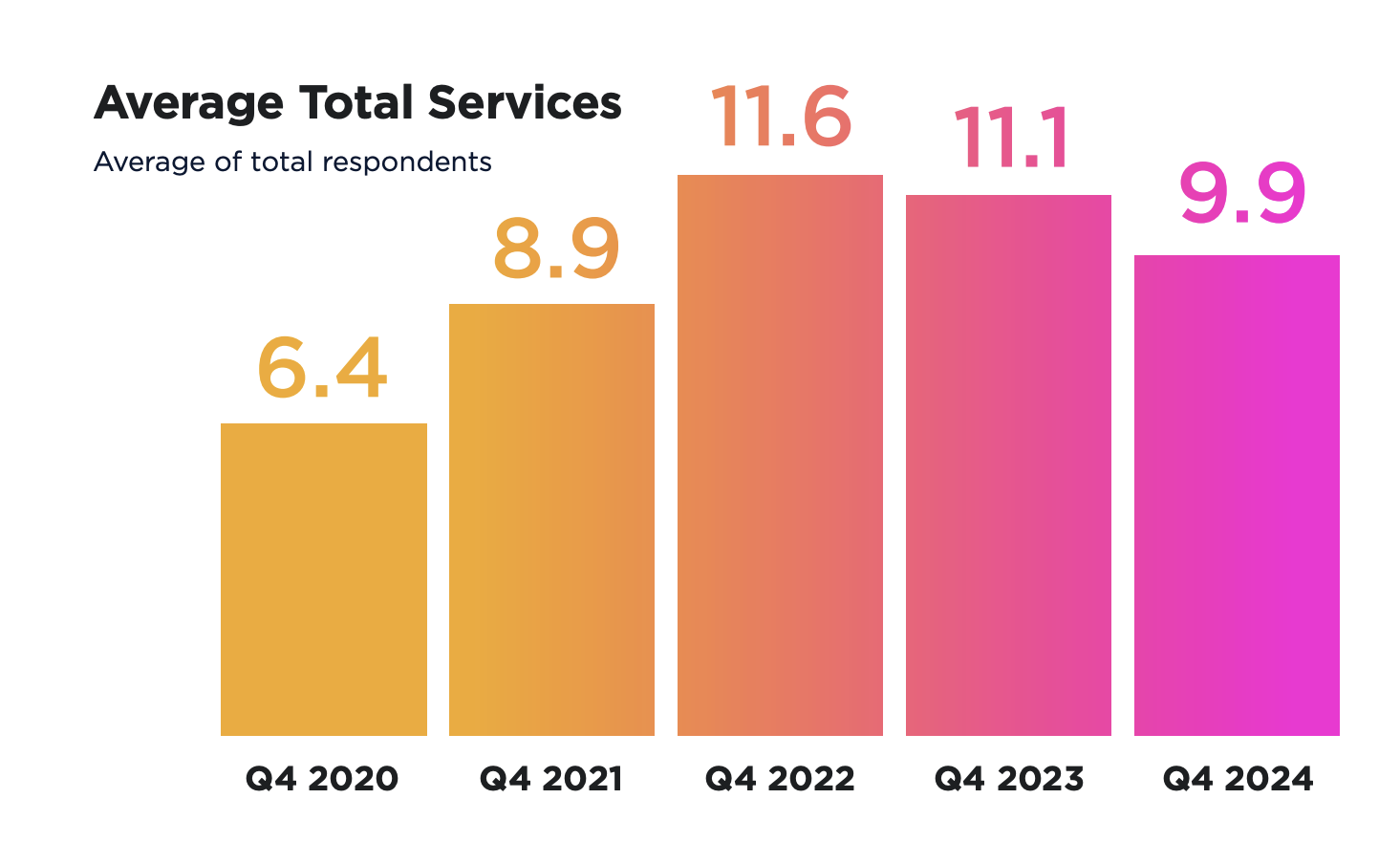

In fourth-quarter 2024, TiVo found that consumers decreased their entertainment spending by nearly $20 year-over-year, with the average number of services used declining from 11.1 to 9.9 in the same period. It marked the first time average monthly entertainment spend dropped below $160 since before 2021—it had peaked in 2022 with an average monthly spend of $189.38.

Among those who canceled a subscription video-on-demand service (SVOD) within the last 6 months, 17% said they did so because they “weren’t using it enough” and 16.9% said it was because the service raised its prices. This decrease, paired with a plateau of hours spent watching video, highlights that consumers are spending the same amount of time consuming content on linear and streaming TV, but on fewer services. This points to a reprioritization of how and what consumers chose to spend their time on, indicating a migration towards value.

Unlike in previous years, when consumers were willing to pay for ad-free SVOD services, TiVo says today’s consumers opt for richer content libraries, regardless of ad presence, as they seek a more simplified and value-driven entertainment experience. With this shift, consumer ad tolerance rose year-over-year from 75.3% to 76.2% and viewers chose more personalization. As the streaming landscape continues to evolve, the platforms that successfully win over consumers will be the ones that deliver both value and relevance.

“We are seeing a shift in consumer priorities as they look for ways to reduce the number of services they use without sacrificing access to quality content,” said Xperi’s chief product and services officer, Geir Skaaden. “As consumers face economic uncertainty, there will be increased pressure on the entertainment industry to deliver quality content and keep users engaged for long periods of time.

“There is a chance we will see a similar spend and entertainment consumption trend from that which we experienced during the pandemic, with consumers searching for cost-saving measures and spending more time at home, increasing the value in which consumers place on entertainment,“ Skaaden continued. “This new balancing act is and will continue to put more pressure on the entertainment ecosystem to deliver value with relevant and timely content.”

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

While consumers continue to trim down their streaming services, pay TV is seeing a revival. The number of users planning to cut the cord declined 2% year-over-year, indicating that consumers are staying with cable. This renewed interest has been fueled by unrestricted access to popular entertainment—especially sports—freeing consumers from the walled gardens of many streaming platforms.

In fact, sports emerged as a focus for consumers in Q4 2024. Amid an increasingly fragmented viewing landscape, 58.0% of respondents reported being unable to watch specific sporting events due to lack of access through their subscribed services, leading to frustration when games weren’t available (49.0%) and unveiling an opportunity for providers who can bring sports viewing together to win with consumers.

Additional TiVo Video Trend Report highlights:

- In-car viewing is on the up and up: In-car entertainment viewing increased by 6.0% year-over-year as respondents reported using video to pass the time while waiting in the car and to keep children entertained. Of those who watch video in the car, 75.1% reported doing so at least a few times a month.

- Sharing is caring: Password-sharing has been a hot topic for users and service providers alike, the TiVo report found that 34.6% of respondents shared a SVOD password for at least one service.

- All at once vs. one at a time: About half of respondents shared that they preferred when streaming services release an entire season at once, compared to 19.0% who prefer a slower release cadence of an episode a week; the remainder did not have a preference.

- Personalized ads at all costs: With 41.6% of respondents sharing that they prefer personalized ads no matter the platform, advertisers face greater pressure to provide relevant content that drives meaningful engagement through both linear and CTV options—especially as consumers prioritize quality content.

Find more information from the latest Q4 2024 Video Trends Report here.

Since 2012, TiVo has surveyed consumers to uncover key trends relevant to TV providers, digital publishers, advertisers and consumer electronics manufacturers. The latest TiVo Video Trends Report surveyed 4,490 adults 18 and older living in the U.S. and Canada during the fourth quarter of 2024 (3,485 in the U.S. and 1,005 in Canada).

In addition to identifying and analyzing key trends in viewing habits, the TiVo Video Trends Report provides insight to consumer opinions regarding subscription video on demand (SVOD), transactional video on demand (TVOD) and advertising-based video on demand (AVOD) providers, emerging technologies, connected devices, over-the-top (OTT) apps and content discovery features, including personalized recommendations and search.