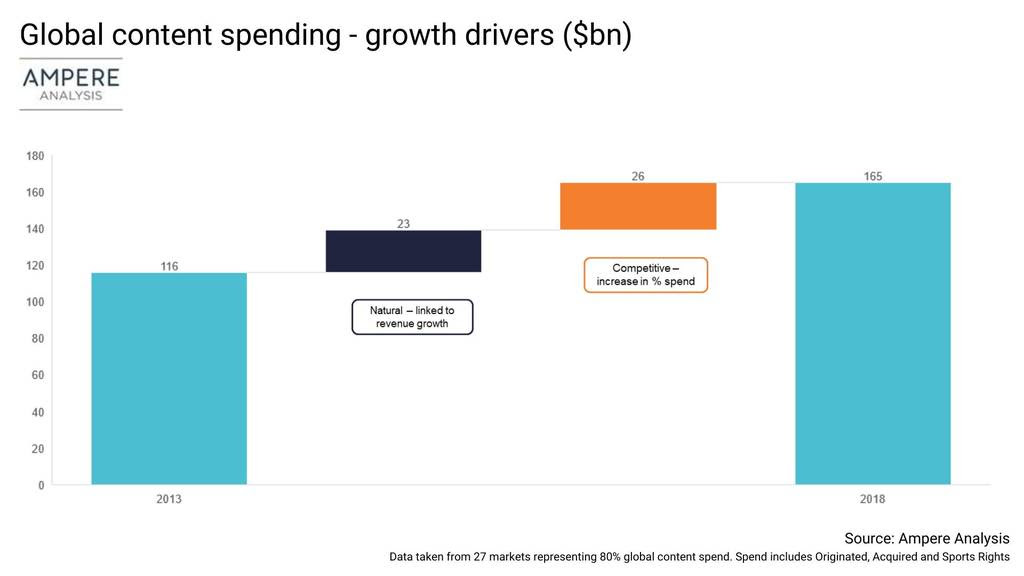

TV Content Spending Increased $50B Over Last Five Years

LONDON—We are in the middle of a content explosion not only in what is available to consumers, but how much industry players are spending to stay competitive. According to a recent study from Ampere Analysis, spending on TV, film and sports content has increased from $100 billion in 2008 to $165 billion in 2018, with nearly $50 billion in growth occurring in the last five years.

While most new players in the TV market are SVoD players, Ampere found that they are not where much of this growth is coming from. Rather its traditional TV companies that are increasing their spending on content to ensure they stay competitive against the likes of streamers. Broadcasters have increased their proportion of revenue they devote to content and rights expenditure from an average of 41% in 2013 to 50% by the end of 2019. Had broadcasters remained at their 2013 strategy of spending, the total spending would have increased $23 billion rather than $49 billion.

While streamers have also increased their spending budgets from 2013 ($2 billion) to 2018 ($19 billion), $111 billion of the $165 billion spent were from broadcast groups.

Most of streamers spending in the past was based on content acquisition—Netflix, Hulu and Amazon spent more than $13 billion on content acquisition in 2018—but original programming is becoming a bigger part of their strategies. Netflix, which spent $1.5 billion on original content in 2018, has ordered 300 brand new series.

Contributing to this need for original content is that studios are deciding to retain the rights to their original content rather than license it out to independent streaming services in the past.

“Where SVoD has led in content spend, others have followed and this has resulted in a positive feedback loop, stoking the fires of competition for content and driving up spending,” said Daniel Gadher, research manager at Ampere. “But the nature of competition is soon set to change as the big studio groups pursue their own services. This will create opportunities for local and global indie producers as Netflix and other streaming services seek to replace content retracted by existing content partners.”

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.