U.S. FAST Channels See 20% Growth in Ad Impressions

Hours of viewing rose by 12% between Q2, 2022 and Q2 2023 according to Amagi

NEW YORK—The U.S. remains the largest FAST channel market in the world according to a new report from Amagi but its growth has become relatively sluggish by global standards.

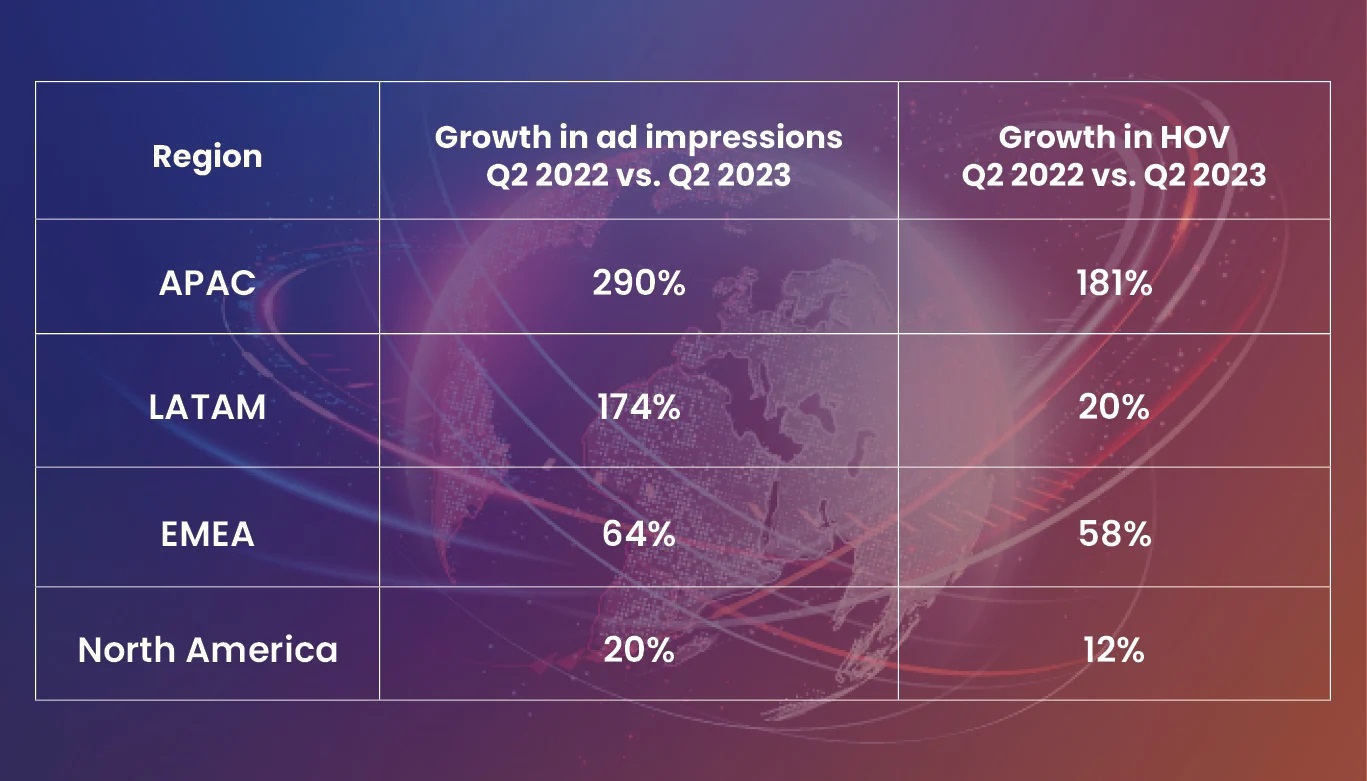

In the U.S. Ad impressions increased by 20% from Q2 2022 to Q2 2023 and hours of viewing (HOV) increased by 12% over the same period according to Amagi’s ninth Quarterly Global FAST Report.

In contrast, APAC took a major lead with 290% growth in ad impressions and 181% in HOV, with LATAM in second place and EMEA in third, underscoring the importance of expanding FAST offerings globally.

By 2027 the Amagi report cites data from Omida projecting the FAST business will grow to $12 billion in revenue and Statista expects it will reach 1.1 billion users.

"As we delve into the insights and data presented in this report's latest edition, it's clear that FAST has not just arrived; it's thriving, expanding, and reshaping how viewers consume content," said Srinivasan KA, co-founder, and Chief Revenue Officer of Amagi. "The remarkable growth of FAST on a global scale is both an opportunity and a testament to the evolving preferences of the modern viewer. With FAST 2.0 on the horizon, we're entering an era where personalization, interactivity, and innovative ad formats will be key to creating a truly dynamic and engaging linear television experience. We invite broadcasters, content owners, and advertisers to join us in this exciting journey, where we're redefining the future of television."

While the industry continues to see rapid growth, the report also raises a number of serious concerns, particularly in the area of content discovery and advertising. About 70% of the respondents experience confusion about what to watch next and 81% of viewers said they prefer ignoring ads.

The report examines viewer data across 50-plus FAST platforms and a sample of 1,500 channel deliveries that use Amagi THUNDERSTORM, the company's proprietary server-side ad insertion (SSAI) platform. It also provides insights into audience preferences and viewing habits based on the 2023 Amagi Consumer Survey of over 500 US households, which represents participants of diverse socio-economic backgrounds.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Key findings include:

- News Ranks Highest in Global, APAC, and U.S. FAST Viewership: Compared to other genres, news content contributed the most in global ad impressions (40%) and HOV (37%). These numbers are roughly on par with APAC (47% in ad impressions, 36% in HOV) and the US (44% in ad impressions, 46% in HOV), demonstrating a general preference for FAST viewers to stay connected to current events.

- FAST Thrives in EMEA and LATAM, Especially With Movies: From Q2 2022 to Q2 2023, LATAM saw a 174% growth in ad impressions and a 20% growth in HOV, while EMEA experienced a 64% increase in ad impressions and a 58% hike in HOV. Interestingly, movies contributed the most in ad impressions and HOV for both regions, indicating a clear preference for this genre.

- Content Recommendations Present Challenges and Opportunities: Approximately 70% of respondents to Amagi's Consumer Survey reported experiencing confusion about what to watch next on CTV platforms. However, only half of respondents who receive recommendations from their CTVs said suggestions were helpful, suggesting that more needs to be done in FAST and CTV to improve content discovery.

- Personalized Advertising Is a Dire Need: Only about 19% of respondents found ads pertinent to their interests, 24% reported they prefer interactive ads, and 22% made a purchase from an ad with an interactive or shoppable feature. These statistics demonstrate that improved personalization, interactivity, and sophistication in CTV advertising should be a top priority in the industry.

Amagi provides a complete suite of solutions for channel creation, distribution, and monetization. Amagi's global clients include ABS-CBN, AccuWeather, A+E Networks UK, beIN Sports, Cinedigm, Cox Media Group, Crackle Plus, Fremantle, Gannett, Gusto TV, NBCUniversal, PAC-12, Tastemade, and The Roku Channel among others.

The latest edition of the Amagi Quarterly Global FAST Report is available here.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.