U.S. Virtual Pay TV Users Are Big Consumers of Video Services

The average vMVPD user who subscribed to services like YouTube TV used nearly twice as many video services a month according to Omdia

LONDON—New research from Omdia has found that virtual pay TV subscribers are some of the best customers for video services, with the average virtual pay TV user in the U.S. utilizing 13.5 video services per month compared to 7.4 services in the average video household during 2021.

The new data from Omdia’s TV & Online Video Intelligence Service, which provides subscription video on demand (SVOD), advertisement-based video (AVOD), and pay TV revenue forecasts across 100 territories worldwide, also found that in the U.S., traditional pay-TV subscriptions saw a 7% decline in 2021, ending the year with 69.7 million households with a traditional pay-TV subscription.

Of the 125.1 million TV households in the U.S., 55.4 million did not have a traditional linear experience. At the end of 2021, there were 13.6 million virtual pay-TV subscriptions in the U.S. representing approximately 11% of TV households.

In consumer surveys, virtual multiprogramming video distributors (vMVPD) customers rated the user experience higher for virtual pay TV than SVOD, AVOD, or traditional pay TV, Omdia said.

“Because virtual pay-TV services are internet-based and have no long-term contracts like traditional pay TV, user interfaces and experiences are received well and can adapt to changing customer needs,” said Sarah Henschel, principal analyst at Omdia.

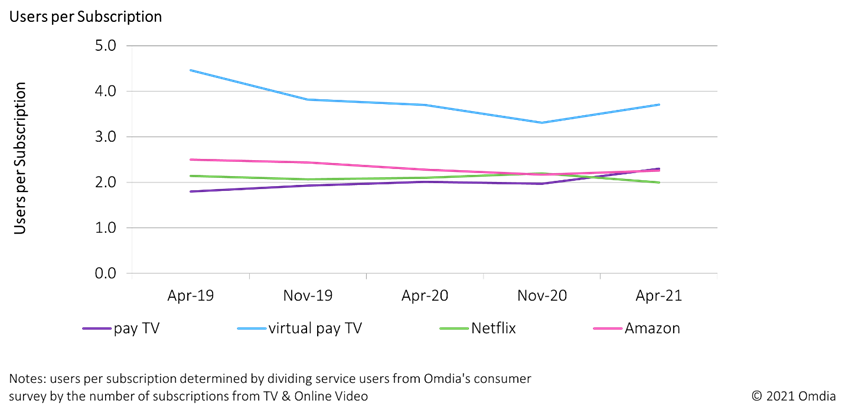

Omdia’s analysis also showed that virtual pay TV in the U.S. continue to have more users per subscription than traditional pay TV, Netflix, and Amazon services. In April 2021, virtual pay TV had 3.7 users per subscription on average while traditional pay TV had 2.3.

The Omdia data showed that in April 2021, YouTube TV accounted for 26% of total virtual pay-TV subscriptions but 39% of total virtual pay-TV users.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

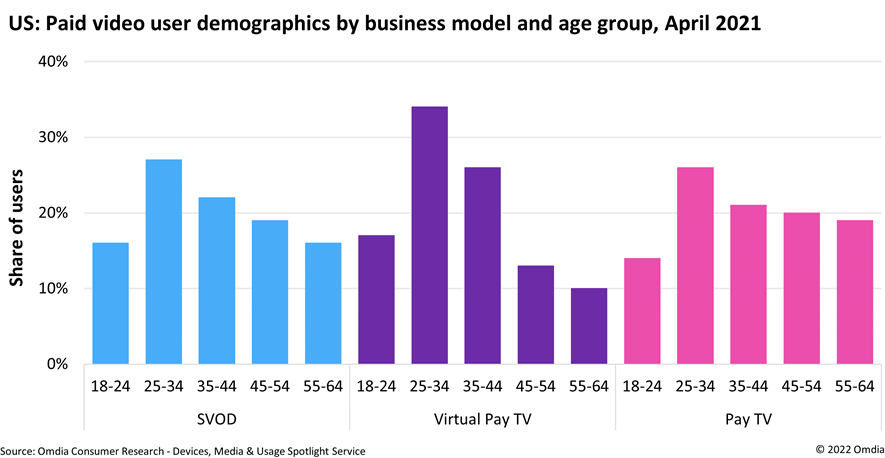

Virtual pay-TV users typically skew younger than the average pay-TV and SVOD users, meaning they may be more tech-savvy and more likely to seek content post-cord-cutting, the researchers said. While password sharing and subscription sharing may initially seem like a bad trend for service growth, it has proven to be quite the opposite for YouTube TV. As a service, it has the most users per subscription, but that growth has allowed it to become the number one service in the U.S.

“These users are more than twice as likely to use transactional video services (both retail and rental), with this growing to 3x as likely for premium video on demand (PVOD) and more than 5x for sport pay-per-view (PPV),” Henschel said. “Virtual pay-TV users are also almost 3x as likely to have pirated video content. This over-indexing highlights that these consumers are content-hungry and are able to find the content they need—through paid means or otherwise.”

Although virtual pay TV users are highly engaged, price hikes continue to push consumers to fully cut the cord and just rely on SVOD or AVOD services, the Omdia researchers said. Average monthly pricing for a vMVPD service in the U.S. in 2021 was $58.89 per month compared to $99.44 for traditional pay TV and $8.75 for SVOD.

While virtual pay TV has attracted a customer base of avid video consumers, the business models for these services remain difficult, researchers explained. Virtual pay-TV services still pay carriage fees to channel owners to license content and channel groups often bundle multiple channels together during negotiations to require carriers to take all or nothing. This forces virtual pay-TV services to pay high margin prices for licensing with little margin left over for in-house profits.

This also explains why companies in the U.S. that have done well have larger conglomerates backing them (Google and Disney) to offset operational costs and why the virtual pay-TV business has struggled to find profitability with small margins causing U.S. average pricing to double from 2017 to 2021, Omdia reported.

“U.S. virtual pay-TV users skew toward high income 25 to 44-year-old males with interest in TV shows and sports,” said Max Signorelli, senior analyst at Omdia. “Live sports is one of the driving growth factors behind virtual pay TV, but it is still niche in size compared to pay TV or SVOD.”

U.S. virtual pay TV accounted for 7% of subscription revenue but only 3% of total subscriptions, the researchers also reported.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.