Video Will Consume 76% Share of Mobile Capacity in 5 Years, Ericsson Predicts

Annual forecast ups outlook for 5G growth, despite current North American lethargy

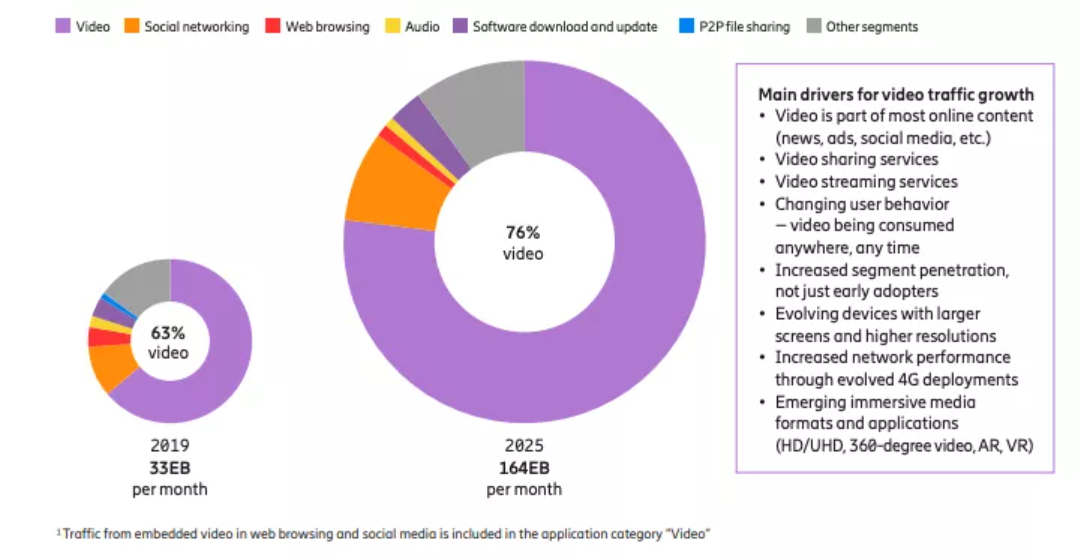

STOCKHOLM, Sweden—About 76% of global wireless bandwidth will be used for video delivery by 2025, according to the new annual Ericsson Mobility Report. The monthly use of 164 exabytes (equivalent to a billion gigabytes) compares to video's current level of 63% (33 EB) and reflects greater use of Fixed Wireless Access (FWA) and the continuing expansion of 5G technology, the report says. Ericsson's forecast expects 2.8 billion global 5G subscriptions by the end of 2025, compared to 190 million at the end of this year.

Ericsson's report acknowledges that it has "slightly decreased our 5G subscriptions forecast for 2020 and 2021 in North America," compared to previous estimates, although it offers no reasons other than "LTE will remain the dominant mobile access technology" for the next few years and "is projected to peak in 2022." Ericsson predicts that "5G subscription uptake is expected to be significantly faster than that of LTE" after its 2009 debut.

Video traffic in mobile networks will grow by around 30% annually during the next five years, Ericsson says, driven "by the increase of embedded video in many online applications, growth of video-on-demand (VOD) streaming services ... and viewing time per subscriber." It also cites "the evolution towards higher screen resolutions on smart devices" and "the increasing penetration of video-capable smart devices."

The growing impact of wireless video becomes even more significant when compared to the forecasts of exactly 10 years ago this month, when Cisco's Video Network Index for the year 2020 predicted that video would consume 79% of internet traffic—almost entirely using wireline facilities.

The primary drivers for video traffic growth include the growing role of video in online content such as news, advertising and social media as well as video streaming and sharing services, according to Ericsson's analysis. It also cites:

- Changing user behavior

- Increased segment penetration, not just early adopters

- Evolving devices with larger screens and higher resolutions

- Increased network performance through evolved 4G deployments

- Emerging immersive media formats and applications, such as high definition and ultra HD, 360-degree video, augmented and virtual reality

The report also cites that decades-old visionary goal: "video being consumed anywhere, any time" (although it overlooked the "any device" trope).

Ericsson expects that video streaming via wireless networks will rely on higher resolution quality than the current 480p format.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

"With smartphones and networks improving constantly, streaming in HD (720p) and Full HD (1080p) is becoming more common," the report says. "More immersive media formats and applications are expected to become a significant factor contributing to mobile data traffic growth, as 5G networks will provide the performance needed for a good user experience. For example, watching a streamed e-sports event in multi-view would consume about 7GB per hour, while a high-quality AR/VR stream with a media (bit) rate of 25Mbps would consume as much as 12GB per hour."

This year's forecast slightly ups the outlook that Ericsson predicted a year ago, when it expected 5G to account for 55% of North American mobile subscriptions by 2024.

COVID-19 IMPACT

Ericsson's report begins with an examination of the role of networks and digital infrastructure during the COVID-19 pandemic, described by Fredrik Jejdling, Ericsson's executive VP and head of business area networks. He cites the impact of novel coronavirus starting early this year, including lockdown restrictions and new work-from-home "digital behaviors."

The report explains that, "in markets with limited penetration of fixed residential networks, the mobile data demand increase was especially high" and that in some markets "service providers made temporary changes to data plans [such as]... unlimited data for a certain period of time." The report also cites, "up to 90% increase in Voice over Wi-Fi (VoWiFi) calls for some service providers" and an "increase of 20% to 70% in voice due to more and longer calls. Data traffic increased due to more bidirectional and streaming services."

EXPANDEDED ROLE FOR FIXED WIRELESS ACCESS

FWA connections are forecast to reach nearly 160 million by end of 2025 – totaling about 25% percent of global mobile network data traffic. At the end of 2019, global FWA data traffic was estimated to have been around 15% of the global total. It is now projected to grow nearly 8 fold to reach 53 exabytes in 2025, representing 25% of the global total mobile network data traffic.

"FWA delivered over 4G or 5G is an increasingly cost-efficient alternative for providing broadband," says the report, citing factors that are driving the FWA market, including growing demand for digital services and government-sponsored programs and subsidies in some countries.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.