WGA Strike or Not, New TV Programming Faces Shortfall in 2024

Ampere says slowdown in new TV commissioning began in 2022

Depending on how long the WGA strike lasts and how much the work stoppage will affect TV and film production, one researcher says the signs of a slowdown in TV commissioning has already impacted the availability of new programming.

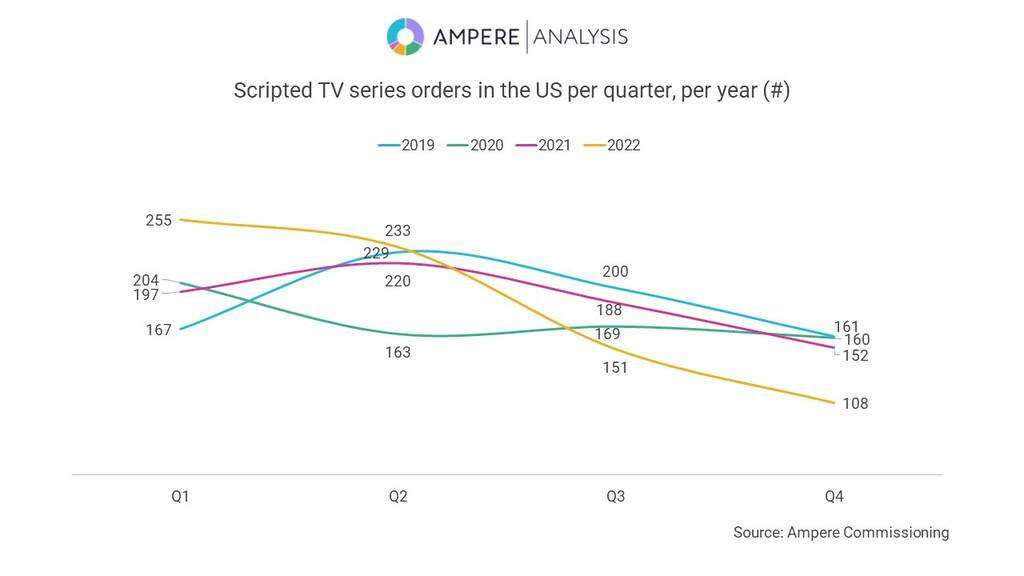

According to Ampere Analysis, the rate of TV commissioning in the U.S. dropped significantly in the second half of last year, and continues to remain low in 2023. The downturn is most profound for scripted content, with scripted TV commissions in the last three quarters down by 24% year-on-year— with overall volumes even lower than during the Covid pandemic, Ampere says. However, the researcher also believes that the resulting content deficit has created opportunities for those in a position to invest.

To-date, the time lag between commission and release times means that although commissions have been lower, audiences have yet to see the full effect on TV schedules. But low commissioning now will create a future content deficit, with the slowdown likely to start to bite in Q3 2023 and beyond.

Ampere outlines two possible scenarios: In the first, if commissioning rates recover soon, audiences will see between 5% and 7% fewer scripted releases each quarter between now and Q2 2024, when the effects will ease.

In the second scenario, if commissioning continues at current levels, audiences will start to feel a much greater impact towards the end of this year, with 16% fewer releases expected in Q4 2023, and 20% fewer from Q2 2024 onwards.

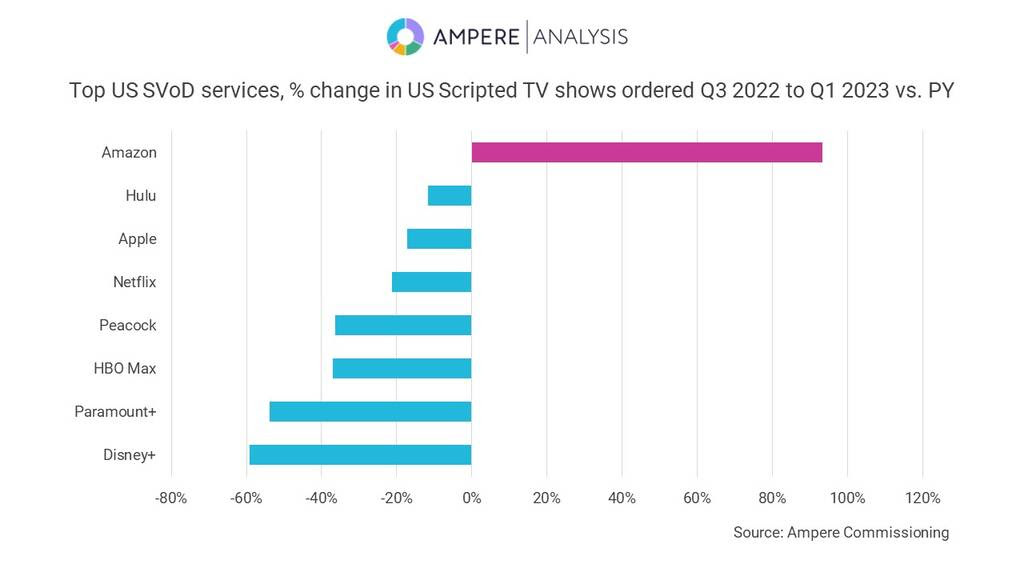

One streamer—Amazon—has bucked this trend, according to Fred Black, Research Manager at Ampere Analysis.

“Scripted commissions at flagship subscription video on demand (SVoD) services are definitely feeling the impact of budget cuts—and the studios aren’t only cutting back at their streaming platforms, with pay TV networks like TBS, FX, OWN, Freeform, Nickelodeon, Comedy Central, BET and AMC all reducing scripted commissions by over 50% when comparing the past nine months with the previous period.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“There’s one big exception however—Amazon—which is capitalizing on cutbacks made by rivals by increasing commissions of comedy and sci-fi and fantasy shows,” Black added. “Investing in scripted commissions now can pay off doubly for those willing to gamble, as the extra commissions will hit the market just as the output of original content from rivals drops to its lowest levels early next year.”

Although the decline of unscripted commissions was severe across SVoD and pay TV, SVoD services have been the biggest loser, with commissions down 33% over the last nine months versus the same period in the previous year, with 151 fewer titles commissioned.

Conversely, advertising supported video on demand (AVoD) and free ad-supported streaming TV (FAST) commissioners have provided a bright spot in the gloom with 83 Unscripted commissions over the period, 6% of all Unscripted activity in the US in that time.

The biggest decline in unscripted commissioning has been at Warner Bros. Discovery, according to Ampere. The WBD merger has created an “unscripted behemoth”—but one that the company is looking to slim down.

The drop in unscripted commissions overall can be largely attributed to WBD. Between July 2022 and March 23, there were 241 fewer unscripted TV commissions in the U.S.: WBD unscripted commissions accounted for 172 of them, a 32% drop for the company’s unscripted commissions overall, with cuts occurring at both its pay TV and particularly SVoD platforms. The drop across the market outside WBD is only 6%. Unscripted content was trimmed at Paramount and Comcast too by 16% and 13% respectively, while at Disney unscripted output actually increased, primarily via Hulu.

“While the commissioning cutbacks in Unscripted content at the dominant pay TV and SVoD platforms have been severe, there is a sense of balance being restored after a significant pandemic peak,” Black said. COVID-19 saw unscripted commissions soar out of necessity due to production complications, and then continue at a high level due to a surprisingly enthusiastic audience. What we’re seeing now is a course correction. Unscripted commissions in the US were down 16% over the last three quarters compared to the previous year, but compare it to the same period in 2019 and early 2020, and the drop is only 1%. There’s also optimism in the growing number of commissions from AVoD and FAST platforms, showing that while some SVoD services may have over-leveraged on Unscripted content, there are plenty of nascent players still investing.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.