White paper: Feds to reap $33 billion from auction of TV spectrum; NAB: Consider the source

A new white paper from two trade associations that favor clearing 120MHz of TV spectrum as proposed in the FCC’s National Broadband Plan finds the U.S. Treasury stands to profit by $33 billion from the auction of TV spectrum.

The document, “Broadcast Spectrum Incentive Auctions White Paper,” made public Feb. 15 is the work of the CTIA – The Wireless Association and the Consumer Electronics Association (CEA). Both groups are strong proponents of the FCC’s National Broadband Plan, which calls for clearing 120MHz of TV spectrum.

The document, submitted this week to the FCC, builds the case for the net auction proceeds the government would realize based on several data points, including: a spectrum valuation model based upon past auctions; the degree to which channel repacking will be necessary; the cost of RF technology to repack the band; and two different estimates of the enterprise value of TV licenses, one based on gross revenue and the other on cash flow.

According to the paper, a conservative estimate of the gross proceeds of the auction amount to more than $36 billion. After compensating broadcasters that would need to surrender their licenses and paying for the technology to repack the DTV band, a conservative estimate of the net to the government is $33 billion.

At the foundation of the paper is a value assigned to the spectrum licenses that could be auctioned in the TV. The paper asserts this to be $0.978 per MHz-POP. (A MHz-POP is the product of multiplying the number of megahertz associated with a license by the population of the license’s service area, according to the FCC.)

However, if more generous MHz-POP calculations — those based upon the average value for 700MHz spectrum licenses in Auction 73 or a value consistent with the auction of the D Block in Auction 73 — are employed, revenue resulting from the auction of TV spectrum would range between $48 billion and $99 billion, the paper says.

As laid out in the paper, the government would deduct two expenses — the cost of repacking TV broadcasters from today’s channels 2-51 to channels 2-30 and the cost of compensating broadcasters choosing to surrender their licenses — from the gross auction proceeds.

The paper relies on data from the Commerce Department’s National Telecommunications and Information Administration showing the average cost for a TV transmitter, antenna and installation to be $898,000 and need for a maximum of 629 existing TV stations to relocate to arrive $565 million as the cost of repacking TV spectrum.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The cost of compensating broadcasters for surrendering their license will range between $1.214 billion and $2.299 billion depending upon the valuation model used, the paper says. While the paper does not explicitly say how many stations would surrender their licenses, the license valuation total excludes “big four” broadcasters, ABC, CBS, NBC and Fox affiliates.

According to paper, there will be little need for spectrum reclamation outside the largest U.S. TV markets. “Indeed, an analysis of TV channel usage in the Continental United States shows that outside the Top-30 markets, sufficient spectrum should exist such that, in general, no stations will need to surrender their over-the-air channels,” the paper says. “In the Top 30 markets, in all but a small number of markets, only a handful of stations will need to (sic) addressed, and that could possibly be accomplished through channel sharing or other mechanisms.”

In making its case, the paper makes several assumptions that likely will raise red flags among broadcasters, including the whole concept of incentive auctions, which currently is beyond the Congressional authorization of the FCC, as well as several technology-related hurdles, such as DTV VHF reception issues and the ability to secure sufficient transmission sites to adopt of a cellular (distributed transmission) approach to TV broadcasting. Another is the source of the paper.

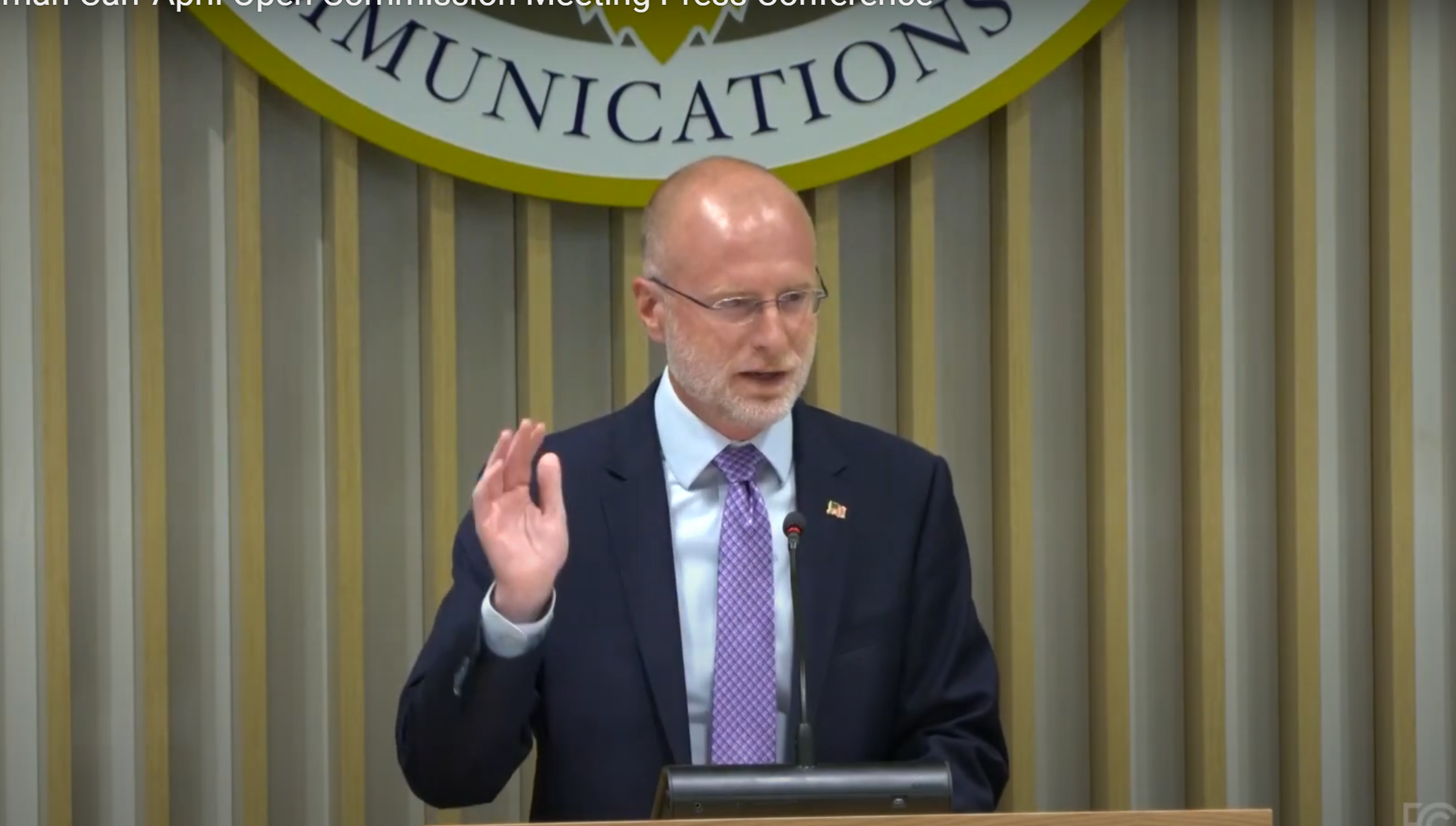

Dennis Wharton, NAB executive VP of communications, released a statement to the press regarding the white paper Feb. 15. It says: "It's hard to take seriously an analysis of broadcast spectrum values done by parties with a vested interest in forcing scores of broadcasters out of business. It's noteworthy that CTIA and CEA cavalierly suggest eliminating 'smaller stations in larger markets,' which translates into fewer niche broadcast stations that serve important immigrant communities and religious audiences. NAB does not oppose spectrum auctions that are truly voluntary, and we look forward to an informed dialogue in coming months on the enduring value of free and local television for all Americans."

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.