Will Tech Advances Attract More Baseball Fans?

Amid a resurgence in popularity, streamers roll out new features

As Major League Baseball enters a new season on a wave of resurgent popularity, live game streaming could soon play a bigger role than ever in drawing fans to the game.

Looking back, the biggest changes in 2023 were the new rules created to shorten the average length of an MLB regular season game, which had grown to a record 3 hours, 11 minutes in 2021. The new rule changes in 2023 reduced the average length of a MLB game down to only 2 hours and 42 minutes.

The shorter games, however, have not changed the fact that the upheaval in regional sports network coverage in particular, has drawn attention to team owners’ efforts to maintain TV exposure, with some streaming services rolling out new technologies that could soon be impacting fan engagement on a much broader scale.

How fast that impact will spread depends in part on what happens next in the unfolding saga that is consuming regional sports networks, but new demonstrations of what can be done to attract online viewers are not likely to be ignored no matter who ends up with individual teams’ broadcast and streaming rights.

The RSN Mess

For the most part, it looks like traditional TV coverage, primarily through team affiliations with RSNs and national TV network broadcasts from MLB Network, ESPN, TBS and others, will continue. But where things go with many teams after 2024—especially the 12 clubs broadcasting through Diamond Sports Group’s RSNs—remains to be seen.

Diamond, rescued from bankruptcy by $450 million in debt financing, $495 million in a suit settlement with owner Sinclair Broadcast, and $115 million from sale of a minority equity stake to Amazon, will cover 12 teams in 2024. Presumably, with its commitment to ongoing operations, it will seek to stay the course with at least some of those teams in the years ahead.

Elsewhere, the defending Texas Rangers, along with the Pittsburgh Pirates and Seattle Mariners, have set up pay TV broadcasting deals in the wake of Warner Bros. Discovery’s termination of AT&T Sportsnet last year, leaving the Colorado Rockies without a TV deal after working out support for a streaming service supported by the MLB.TV platform. The 14 other MLB teams’ RSN affiliations remain intact.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

An important factor in what comes next for baseball on TV will be the approach to securing rights taken by broadcast station groups, which, as reported in our cover story this month, have capitalized on sports team owners’ preference for free TV’s reach over the diminishing viewership registered by RSNs. Several NBA teams have taken this route, and it’s likely broadcasters will want to bid competitively for MLB team rights as well in light of the sport’s renewed popularity.

The improvement was confirmed in recent consumer surveys by the polling company Ipsos and sports marketer Playfly Sports, both of which ranked baseball second only to football among pro sports in the U.S. in terms of popularity. Baseball stadium attendance surged 9.5% in 2023, the largest spike in 30 years, according to ESPN, which attributes some of that increase to the shorter games.

On the streaming side, Diamond RSN games will be available at a premium to Amazon Prime subscribers, and the other RSNs will continue their streaming services, most of which, like Diamond, use the MLB.TV platform. With streaming now the default source for 73% of American adults, according to Adtaxi, the experience of viewing baseball is about to become much more engaging.

MLB.TV Innovations

The most pervasive availability of new enhancements to baseball streaming is coming by way of the MLB.TV platform. The MLB.TV streaming service supports access to all teams at $149.99 annually while the regional RSN’ streaming services focus on single teams at much lower costs.

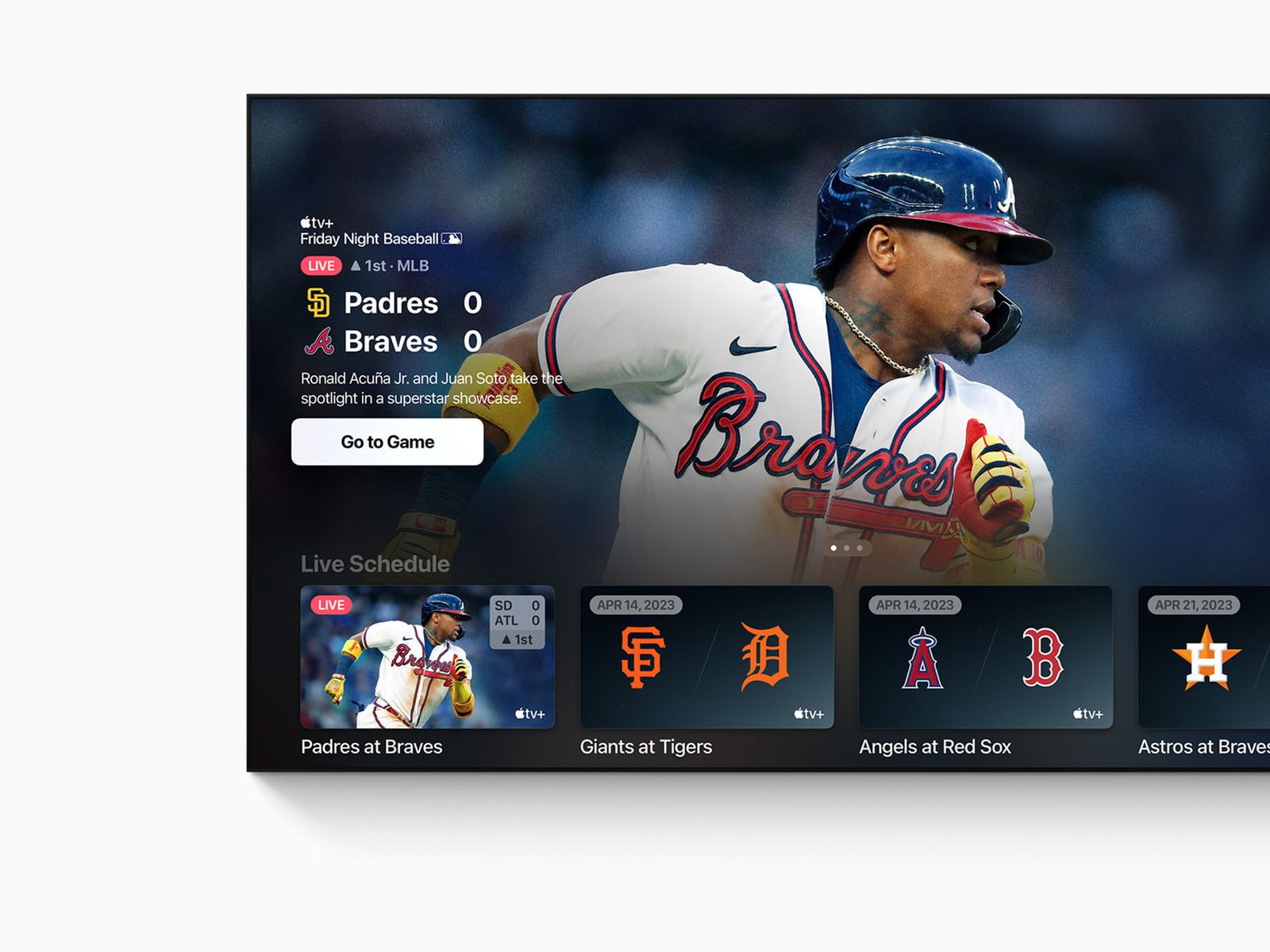

MLB has long been at the forefront of streaming innovation. And Apple TV+ with the streaming component of its $9.99-per-month Friday Night Baseball package built on the MLB.TV platform is adding some bells and whistles related to other options available through its app store.

Much of what’s new this year is related to enhancements of popular features from last year, including expanded availability of Catch-up viewing of live game highlights to Xbox and Roku and simultaneous viewing of up to four games on supported Apple TV, Fire TV and Google TV devices.

Also, MLB tells us, “We continue to add tailored VOD to the MLB.TV home screen based on the user’s favorite team, going beyond the top highlights and into home runs, minor league highlights, defensive highlights, data visualizations, longer-form features, and vault and archive content.”

Mirroring the MLB Network’s TV programming, streaming subscribers will again be able to access the live “lookins” to games around the league and other highlights. And, once again, they’ll have access to 7,000 streamed minor league games from affiliates of all MLB clubs.

MLB broadcasts and streaming will also make more use of dynamically inserted digital ads appearing virtually behind home plate. “EVI [electronic visual insertions] technology dynamically overlays those ads without changing any of the physical signs in stadiums,” MLB says.

YES and MSG are GAME

Unrelated to any reliance on the MLB.TV platform, an even more cutting-edge perspective on what’s doable in the streaming domain is coming from YES Network, broadcast home to the New York Yankees. Now in its third year, the YES App—with its support for an impressive range of features and interactivity—is setting a new benchmark in baseball streaming.

It’s one that other providers may soon find is easier to reach, if things go as planned with a new business created by YES Network and another regional sports broadcaster, MSG Network. They say they’re putting their streaming expertise to work through a joint venture they’re calling Gotham Advanced Media & Entertainment (GAME).

Along with collaborating to further enhance their own streaming services, the partners will be developing a turnkey platform service designed to provide customizable support for other parties’ locally branded streaming services.

The YES App, which also streams games from the NBA’s Brooklyn, plus the New York WNBA and MLS franchises, is better known for its enhancements to user experiences than MSG’s streaming service MSGSN, which covers the NBA’s New York Knicks as well as the New York City area and Buffalo Sabres NHL teams, and, on occasion, the NFL’s New York Giants and Buffalo Bills.

Last year the YES App was named “Best Fan Engagement Tool” in the Cynopsis Sports Media Awards competition and won two gold awards as D2C platform of the year and best in fan engagement at the global SportsPro OTT Summit Awards.

Parties to the Gotham JV declined to discuss their plans, but just judging from what’s already on offer from YES App, GAME-supported services could end up expanding user experiences with baseball and other streamed sports in multiple directions.

As described by Matt Duarte, vice president of strategy and business development at YES Network, the refinements YES has introduced on its streaming app going into this year’s Yankee season are incremental but significant improvements to major advancements the network has been implementing since the app launched in 2021.

Just Like Opening Day

One aspect to what YES is doing with Yankee streaming this year has to do with “revamping the look and feel” of the YES Watch Party feature “at or close to opening day,” Duarte says. The app allows any user to text an invitation to one or two other users to join in the video chat, where each user is given independent control over the volume balance between their comments and the game audio.

The YES iteration of watch parties with backend support from two U.K.-based suppliers—Evertz subsidiary Eaves Live and start-up Sceenic—is designed to bring the video chat element of shared viewing directly into the app as a tightly synchronized first-screen experience rather than running as a second-screen complement to the primary game feed. Synchronized reception of notoriously out-of-sync live unicast streams is an innovation that obviates reliance on alternative video conferencing infrastructures like those supported by the WebRTC protocol.

“No matter what platform, Android, iOS, or web, you’re on, we synchronize the video reception so there are no spoilers from other participants,” Duarte says. Synchronized stream reception also plays a role in other interactive aspects of the YES App, he adds.

Amid these advances in streaming experiences, it’s clear there’s much more to come. For example, last year MLB experimented with a virtual ballpark experience tied to its Gameday 3D application in conjunction with a September 20 Angels-Rays game at Tropicana Park.

It remains to be seen whether and when MLB will bring such experiences back into play, but they point to the types of features that can now be supported with virtual technology. Using any type of connected personal 2D display device, users appearing onscreen as avatars could navigate the 3D environment via hand swipes or cursors and audibly interact and play games with other visitors.

They could tap into a live game feed as would be seen from different locations in the stands or watch the game on virtual jumbotrons as they moved around the virtual stadium. These capabilities were enabled in part by technology supplied by U.K. based Improbable, which uses location coordinates and other data collected by each game camera to recreate a three-dimensional animated video rendition of the entire space.

Fred Dawson, principal of the consulting firm Dawson Communications, has headed ventures tracking the technologies and trends shaping the evolution of electronic media and communications for over three decades. Prior to moving to full-time pursuit of his consulting business, Dawson served as CEO and editor of ScreenPlays Magazine, the trade publication he founded and ran from 2005 until it ceased publishing in 2021. At various points in his career he also served as vice president of editorial at Virgo Publishing, editorial director at Cahners, editor of Cablevision Magazine, and publisher of premium executive newsletters, including the Cable-Telco Report, the DBS Report, and Broadband Commerce & Technology.