Brazil Set to Redefine Broadcasting with TV 3.0

Brazil adopts IP-based over-the-air TV, becoming the biggest country to do so.

RIO DE JANEIRO & WASHINGTON, D.C. — Brazil is not the first country to adopt internet-protocol over-the-air television. It’s just the biggest, and the most likely to have an impact felt across the Western Hemisphere. The form that over-the-air (OTA) broadcast television will take in Brazil —known as ATSC 3.0 — represents a full departure from the early 2000s digital phase that resembled analog TV, but with more resolution.

Back then, the potential of IP-based digital media was not clear. YouTube was cat videos. Netflix mailed out DVDs. Twenty years later, they are streaming juggernauts while broadcast TV has become passé, at least in the United States. Still, it remains the sole nationwide platform that supports 100 million-plus people watching the same thing live.

With its decision to adopt ATSC 3.0, Brazil could bring about a broadcasting renaissance. While Brazil is not the perfect analogue of the U.S. or vice versa, the parallels are enough to make it a significant model.

With this in mind, a small group of U.S. observers and stakeholders recently spoke with Raymundo Barros, director of Strategy and Technology at Globo, Brazil’s largest media company as well as its largest broadcaster; and president of Brazil’s broadcast standards body, the Fórum do Sistema Brasileiro de TV Digital Terrestre (Fórum SBTVD).

Barros is at the forefront of Brazil’s historic conversion to IP-based over-the-air television — in time for the 2026 World Cup, no less. Via emails and Zoom, he shared Brazil’s vision, its motivation and its strategy for rolling out nationwide, non-backward-compatible, broadcast TV for more than 70 million over-the-air households. We spoke about how Brazil and the U.S. compare, the timing of their decision, the consumer-facing platform, rollout logistics, North American implications and what’s to come.

HOW BRAZIL AND THE U.S. COMPARE

Marketshare

US: Brazil is such a compelling model for the United States. We’re comparable in area and population, but broadcasting has far more marketshare in Brazil than it does in the U.S.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Raymundo Barros: Yes, broadcasting holds a strong market share in Brazil largely because it remains the primary source of television for many regions, especially in remote and rural areas. While urban centers have broader access to broadband and subscription-based services, large parts of Brazil rely exclusively on over-the-air OTA broadcasting.

This is due in part to the country’s expansive geography and socioeconomic factors that make it challenging to deploy infrastructure in less populated areas. Broadcasting’s reach ensures equitable access to information, education, and entertainment nationwide, reinforcing its importance.

Receivers

US: U.S. broadcasters cover about 75% of the United States with ATSC 3.0 signals, but receivers aren’t nearly as widespread. Brazil tied the transmission and receiver standards-development process together. How did that work?

R.B.: We launched the Fórum 18 years ago when we started standardizing TV 2.0, digital terrestrial broadcasting. The government is part of the Fórum — the Ministry of Communications and Anatel [Brazil’s version of the Federal Communications Commission]. They don’t vote, but they orchestrate how the Fórum operates. At that time, they decided the Fórum would be a private entity with the participation of broadcasters and the receiver industry, each with four votes; the transmitter industry and universities, each with two votes; and the software industry with one. It’s the same today.

Everybody normally agrees with the same decision. We are in alignment, but it took a lot more work this time. The stakes were broadcaster prominence; the “out-of-the-box” experience of the broadcast channels. As the chairman, I had to go to each commissioner on the Fórum to convince them of our vision, so we finalized all the technical standards for TV 3.0 receivers.

[The resulting 900-page standards document, which covers everything from transmission to reception, was sent to the government and the Brazilian Association of Technical Standards (ABNT), in late November, with publication expected next March and the final stroke of the president’s pen at the beginning of 2025.]

R.B.: This means that, in order to get the tax waivers and incentives the government gives TV set makers for their operations in the rainforest, they need to comply with these standards. In Brazil, TV manufacturers have their facilities in the rainforest area.

The government decided 30 years ago it would improve the economics and somehow preserve the rainforest. The cost to operate in the rainforest is high because of logistics, so the government gives them enough of a tax incentive to make a 32-inch TV in Brazil cost as much as a Google TV dongle [about US$40]. They also need to use a certain number of memory chips manufactured in Brazil, and to comply with TV standards. We expect the same policy will apply to TV 3.0.

Antennas

Our goal was to have the antenna built into the TV set, pretty much like the cellphone. You know how many antennas we have in a device like that? WiFi, Bluetooth, 600 MHz, 700 MHz, 900 MHz, 12.5, 3.5 — more than six antennas. If they can put six antennas in a cellphone, can’t they get the antenna in a huge TV set?

However, in the process of trying to get to alignment on the standard, we also allowed the antenna to come inside the box [with the TV and not within the TV as initially proposed].

Public Awareness

US: As we mentioned above, ATSC 3.0-based TV is available in around 75% of the United States, but there is little public awareness of it.

R.B.: Consumer awareness is a top priority, which is why Brazil has introduced a brand and logo for TV 3.0, known as DTV+. This branding will make it easy for the public to recognize compatible services and devices, helping to drive awareness and adoption.

The DTV+ brand emphasizes the benefits of next-generation broadcasting and solidifies the identity of TV 3.0 as the future of over-the-air television in Brazil, signaling advanced features and an enhanced viewer experience.

Consumer Incentives

US: Given that legacy TVs will not receive TV 3.0, what will be the most compelling features to get people to buy a new TV set?

R.B.: Personalization. Our vision for TV 3.0 is to provide a deeply personalized experience that adapts to each viewer’s preferences, creating a viewing experience that is engaging and uniquely tailored, whether that means ultra-high-definition video, immersive audio, interactive social TV, or customized ads and content.

This level of experience management—where the entire viewing journey is managed and customized—represents a true evolution for Brazilian TV. TV 3.0 will bring together the ease of broadcast and the versatility of digital, creating a cohesive, personalized ecosystem that elevates television viewing beyond what traditional and streaming services offer today.

Regulatory

US: The U.S. government has taken an indirect approach to IP-based OTA TV via ATSC 3.0. Brazil’s has been more proactive.

R.B.: I think the government here supports broadcasters and this process because everywhere in the world, the media is dominated by big tech. The only relevant media platform that is truly Brazilian, is broadcast — radios and TV. Those companies, by law, need to be controlled by Brazilians; native Brazilians. Which means, if broadcasters vanish from this ecosystem, those local governments will have to deal with big tech, and you have heard what happened with X in Brazil.

In Brazil, free television is considered a public service. We have access to the spectrum, but on the other hand, we have a lot of obligations in order to operate.

US: As of the end of November, there remains one more presidential decree necessary for deployment, correct?

R.B.: Yes. This is expected by the end of this year or by the beginning of 2025, and is a fundamental milestone in this developing process. This decree is anticipated to cover crucial aspects such as the prominence of over-the-air television in receiver interfaces, ensuring that broadcast content is easily accessible and prioritized on devices, as well as the rules for simulcast periods.

"We need to build a digital relationship with consumers while we still have the majority of viewership. Free-to-air is the mainstream media platform in Brazil."

Raymundo Barros

While we await these guidelines, it is important to note that the regulatory framework will define the conditions broadcasters must meet, though the exact requirements are not yet confirmed. The ruling is expected soon, which will allow broadcasters like Globo to adjust their deployment strategies accordingly and ensure compliance.

TIMING

Motivation

US: What’s driving your timeline?

R.B.: We need to build a digital relationship with consumers while we still have the majority of viewership. Free-to-air is the mainstream media platform in Brazil. Almost 60% of media consumption time in the home is free-to-air television.

When you look at traditional DTV, it was only the physical layer we made digital. The relationship we’ve had with each customer is pretty much the same as it was in the ’50s. TV 3.0 is digitizing the relationship with customers and the advertising market — and of course we’re going to provide 4K, HDR, immersive sound and interactive applications.

It is a bold decision with great opportunities to move into the TV 3.0 ecosystem, but it is also a defensive move. Money is already moving from traditional advertising products to digital ones. Eventually, we won’t have enough revenue to keep sports rights, high-end quality production, etc., and then broadcast will decline in Brazil.

Target

US: A transition to a non-backward-compatible system will be disruptive. Brazilian broadcasters have nonetheless elected to adopt ATSC 3.0 and deploy it in time for the 2026 World Cup in 18 months.

R.B.: Adopting ATSC 3.0 as our physical layer represents a strategic choice to unlock the full potential of next-generation broadcasting. While this transition is indeed non-backward-compatible, we see it as a necessary step to achieve significant, long-term benefits for viewers.

(Read also: Three Reasons Why Brazil’s TV 3.0 Decision Matters Here)

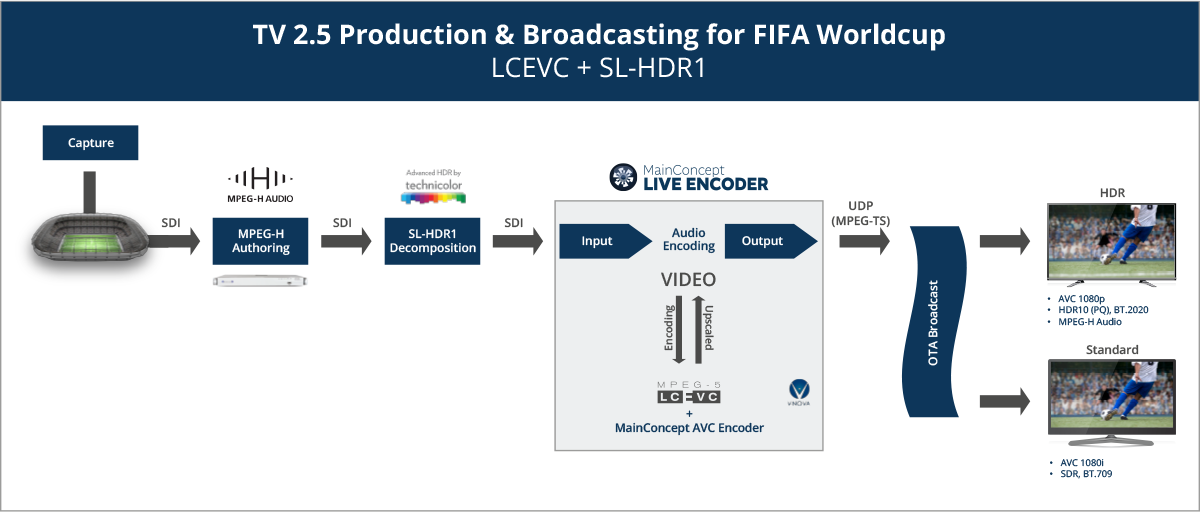

In recent years, Brazil has explored incremental improvements through TV 2.5, which added enhanced interactivity and functionality while building on our existing infrastructure. However, with TV 3.0, we are targeting a more transformative approach that will bring viewers substantial gains in quality, interactivity, and service flexibility.

The timing aligns with the 2026 World Cup, a high-profile event that allows us to showcase this technology on the world stage. Deploying ATSC 3.0 in time for the event positions Brazil as a leader in broadcast innovation, offering a world-class viewing experience that combines cutting-edge technology with the rich interactivity our audiences expect.

This shift demonstrates our commitment to future-proofing Brazil’s broadcasting infrastructure and elevating the experience for viewers nationwide.

CONSUMER-FACING PLATFORM

World Cup

US:. Globo TV demonstrated some of the capabilities of ATSC 3.0 in a live broadcast from the 2022 World Cup in Qatar using its ISDB-T-based TV 2.5 architecture, including real-time multistandard compression, simultaneous 1080i and 1080p, and a live social channel. What did you learn and what’s new for 2026?

R.B.: The 2022 World Cup experimental broadcast taught us valuable lessons in delivering seamless, high-quality content while managing real-time data and interactivity. These experiments underscored the potential of ATSC 3.0 to enhance the viewer experience by providing multiple resolutions and integrating interactive social channels.

For 2026, we plan to build on these capabilities, potentially introducing features like targeted advertising, expanded data services, and further options for audience interaction that align with Brazil’s interactive DTV Play ecosystem.

US: The 2026 World cup, the first in North America since 1994, will be hosted in 16 cities across Canada, the United States and Mexico. What has to be deployed on the production side to provide the enhanced features of TV 3.0?

R.B.: In terms of high-quality video production and the need to cover multiple venues, I don’t think we will have much additional complexity compared to the World Cup 2002 when Korea and Japan shared it. It’s going to be a huge one, but today, technology makes the production side of this process easy.

The point here is, what other experiences would we like to offer consumers based on 3.0 technology? Do you want to have a male or female narrator, or no narrator at all? Do you want to manage sound objects? Do you want more crowd noise or do you want to hear the ball kicked? Giving consumers the ability to play with sound objects is part of the standard.

It will present us with complexity in terms of production, because I won’t be able to just take the 5.1 mix coming from the host broadcaster. I need to take the sound groups, so I will be able to pass those sound objects to the consumer.

We are also going to integrate one-click sport betting, now approved in Brazil. We are going to provide T-commerce, so you can buy the jerseys of all the teams in partnership with the marketplace here in Brazil. There are many new features that will enhance the total experience of the World Cup.

Dynamic Ad Insertion

US: You mentioned the DTV Play ecosystem, the interactivity middleware developed by the Fórum and deployed by the government in 2020 with a goal of integration in 90% of LCDs produced in 2023. What is the penetration of DTV Play?

R.B: DTV Play is what we’ve called “TV 2.5,” which is our current standard with some enhancements. We have around 30 million TV sets with DTV Play middleware. That middleware is capable of supplying a fully interactive experience, which means we do have several shows every day that have interactivity, pretty much like the NBC Lounge during the Olympics.

We have applications on soccer games for choosing the most valuable player. You can vote on reality shows, or get statistics on the game or the player and, on top of that, we are also using DTV Play for dynamic ad insertion.

We have free-to-air dynamic ad insertion in Rio de Janeiro and São Paulo. So if a DTV set with DTV Play middleware is connected to an antenna and the internet; and if this set has what we call a “Globo ID,”— our identification manager, which almost every Brazilian connected to the internet already has — by identifying the viewer, it is possible to target content and advertising according to their profile and preferences.

During the regular broadcast break, we have the traditional advertising and then I have one slot in each break that I can replace with targeted advertising that comes from the internet, to that specific household. Next year, we are scaling up in other major cities. Free-to-air dynamic ad insertion will be available almost on a nationwide basis with the new DTV Play.

US: How is the market responding?

R.B.: Quite well. Dynamic ad insertion is growing by two digits, year after year. We launched two years ago on the streaming product, Globoplay, and then launched it last year over-the-air as well. It’s available for each of our 120 stations as well. So now, when the advertiser signs a contract with Globo for addressable advertising, we reach their objectives, but they really don’t care if it’s on Globoplay or TV Globo over-the-air. The programming is the same.

Content Delivery

US: You talked about this sort of platform fluidity with regard to the way Globo thinks about content delivery.

R.B.: We have to stop thinking about TV Globo going through the broadcast channel. We have to think about the content consumers are demanding most at that time, and that content will be distributed over the broadcast CDN.

Globo has two content delivery networks (CDNs). One is the broadcasting CDN and the other is the UDP CDN. Our content will be distributed over the CDN that is more suitable, depending on consumer behavior. That’s the vision we are incorporating into TV 3.0 here.

Think about the middle of the night in Brazil, during sports gaming happening in Asia at three in the afternoon. Our free-to-air TV doesn’t have rights for that, but our streaming service does. I’m going to have maybe millions of people watching that, so why not have that game at 3 a.m. going through the broadcast CDN?

It’s going to be more cost-effective to have this content distributed over the broadcast CDN, and from a consumer point of view, it doesn’t matter. The TV set’s going to be connected to both CDNs at the same time, and the underlying middleware will take care of where it comes from. The consumer doesn’t have to take any action.

US: The broadcast CDN concept hasn’t taken hold in the U.S. Meanwhile, the Mike Tyson - Jake Paul boxing match streamed on Netflix in November fell apart for millions of people.

R.B.: In Brazil, the maximum number of devices connected to the internet to simultaneously watch a live event was 5 million during the pandemic. I have the third largest UDP CDN in Brazil, after YouTube and Netflix. Globoplay is our streaming platform. We have around 25 million unique users. If I take the full capacity of my UDP CDN, which is 15 Tbps, and, given the 3 mbps picture quality, I can’t go out to 5 million people watching at the same time, and 5 million people is nothing compared to the free-to-air ratings in Brazil.

Datacasting

US: Is there a pure data market in Brazil? There’s interest in automotive software downloading in the U.S. market. Is this an opportunity in Brazil?

R.B.: The business model is still under evaluation. Brazilian broadcasters are keen to explore datacasting as a new potential revenue stream, enabling the delivery of various types of content and services—such as software updates, educational content, and emergency alerts—over the existing broadcast network.

Within Globo, the potential for datacasting is being carefully studied to ensure that it aligns with market demand and operational feasibility. This model is expected to evolve as testing and validation continue, with broadcasters focused on maximizing the benefits of data transmission.

Ancillary Services

US: What ancillary services does Globo envision with ATSC 3.0?

R.B.: Brazilian public and commercial broadcasters plan to leverage TV 3.0 to offer a range of ancillary services that go beyond traditional broadcasting. These services include advanced emergency alert systems that provide real-time, geo-targeted information with rich media content during critical situations.

Public broadcasters, in particular, aim to deliver public service information, such as health advisories and community updates, fostering stronger community engagement.

And, as already mentioned, similar to the U.S., Brazilian broadcasters are also analyzing the business case for automotive applications, such as real-time traffic updates, weather information, and infotainment options that enrich in-car experiences.

Software Development

US: TV 3.0 opens a green field for software developers. How is Globo engaging and leveraging this community?

R.B.: Drawing from past experience, we recognize the importance of broadcasting applications and enabling interactivity from day one.

The Brazilian government’s pilot station will support this ecosystem by providing a live testing environment where developers and broadcasters can experiment with applications and refine interactive features. To ensure consistency and compatibility across a horizontal market for consumer products, Globo and other industry stakeholders are collaborating with regulatory bodies and development communities to establish operational guidelines and testing suites. These efforts aim to create a seamless consumer experience and minimize compatibility issues across devices.

This approach not only fosters innovation but also guarantees a smooth, reliable user experience as new services are launched. By engaging developers early and providing a stable, standardized platform, Brazilian broadcasters are laying the foundation for a robust ecosystem that will drive the growth of ATSC 3.0 applications throughout Brazil.

ROLLOUT

Deployment

US: Globo has five owned-and-operated stations plus 115 affiliates. Is the intent to have them all broadcasting TV 3.0 by 2026?

R.B.: The deployment plan for TV 3.0 is currently in development. During the previous [2007] digital transition, the process took around seven years to complete nationwide. This time, however, we anticipate a more accelerated rollout. Initial deployments are planned for key cities, with either governmental or commercial stations launching in São Paulo, [pop. 22,806,700] Rio de Janeiro, [pop. 13,824,300] and Brasília [pop. 4,935,270]. Once these primary sites are operational, other major cities are expected to follow shortly after, creating a faster and more efficient transition compared to the previous one.

By starting in Brazil’s largest urban centers [covering half or more of Brazil’s TV households] we aim to establish a strong foundation and demonstrate the capabilities of TV 3.0 early on, encouraging adoption across the country and the rapid availability of receivers.

Early deployment in key cities will send a clear signal to manufacturers, thus enabling viewers nationwide to access the benefits of the new standard within a much shorter timeline than previous rollouts.

Spectrum

US: Anatel has until Dec. 31, 2024, to prepare a frequency plan. How many stations are likely to have to change channel assignments? How disruptive will 3.0 deployment be to the TV frequency band?

R.B.: The transition and frequency allocation plan for TV 3.0 in Brazil presents an intricate challenge, given the country’s size and diverse broadcast landscape. Anatel’s immediate task is to assess the available frequency range and determine technical parameters, such as the required field strength, to support the rollout of ATSC 3.0.

A comprehensive national allotment plan will take several more years to develop, gradually addressing regions from larger to smaller cities and enabling a phased rollout of the new standard. Initially, however, many retransmission [translator] stations will adopt a spectrum-sharing approach similar to the “lighthouse” model used by American broadcasters, as promoted by Pearl TV. In this model, broadcasters share transmission resources on a single channel, allowing both TV 3.0 and current broadcasts to coexist temporarily within the same spectrum.

While channel reassignment will be necessary for some stations, Anatel’s spectrum-sharing framework is expected to help streamline the process, reducing disruptions and maintaining service continuity for viewers.

Following the standard publication, Anatel will start the spectrum allotment plan. We have talked with Anatel about starting with the same process done in the analog-to-digital transition, considering there is now an even greater spectrum dispute in the UHF band. When we launched digital television, every broadcaster got a second channel to start simulcasting, but this will be more challenging since we don’t have enough channels on traditional VHF and UHF bands to accommodate one-to-one simulcast in the transition period.

Repacking

Anatel is considering granting additional spectrum at the 250 MHz to 350 MHz to broadcast TV 3.0. This frequency range is heavily used and needs further interference evaluation and repacking. It is anticipated that up to 14 channels might be released in the near term.

Naturally, this is not enough to allow for simulcast of all the available DTV channels, therefore we expect full-power TV stations to get a second channel; but the retransmitters may need to be in a spectrum-sharing arrangement.

Backchannel

US: A so-called “backchannel” — a signal return path — is necessary for interactivity. ATSC 3.0 relies on other carriers for its return path. What will TV 3.0 use for a backchannel?

R.B.: Brazil has about 100 million TV sets with about 66 million of those connected to the internet. By capitalizing on existing broadband networks, broadcasters can implement return-path functionalities efficiently, offering services like on-demand content, targeted advertising, and enhanced interactivity. This integration strategy aligns with Brazil’s goal of maximizing accessibility and simplicity while delivering the full potential of interactive applications.

This approach makes interactive and personalized features accessible to a broader audience without requiring additional equipment or complicated setups.

US: We’ve learned from you that Brazil has 8,000 ISPs, so how does this work?

R.B.: We don’t need a lot of bandwidth for those applications. There is no high bit rate going through the backchannel.

Broadcasters in Brazil are working closely with government agencies and consumer electronics companies to ensure a smooth shift to TV 3.0 and a strong transition plan that sets an example for the region.

Raymundo Barros

For many years, ISPs were a business only for the big telcos, but they weren’t going to lay fiber in medium and small cities, so those cities started ISP businesses—that’s why broadband access in Brazil exploded. Those guys can have a very lean business, so they don’t charge much to consumers. They typically offer broadband with pay TV as a bundle, and also pay TV only with streaming. Globo TV has many agreements with those small ISPs. They bundle Globoplay with broadband and data, which is good for us and good for them as well.

FUTURE

North America

US: At the 2024 Set Expo in São Paulo, you said that ATSC 3.0 has the potential to be a standard for all of the Americas from “Alaska to Patagonia.” What other advantages do you see in this besides cheaper and more ubiquitous devices?

R.B.: By aligning the entire region under a single standard, we would create consistency in technology, reduce fragmentation, and enhance the overall consumer experience, which is extremely valuable in the current media environment.

Beyond cost efficiencies, a unified standard would foster regional content exchange, simplify regulatory processes, and open up cross-border opportunities. It would also facilitate regional partnerships in content and technology development, creating a collaborative ecosystem for the Americas.

Broadcasters in Brazil are working closely with government agencies and consumer electronics companies to ensure a smooth shift to TV 3.0 and a strong transition plan that sets an example for the region.

US: Are there any discussions with the TV technology standards community in Mexico?

R.B.: We have not yet engaged in official discussions with Mexico or other countries in the region about ATSC 3.0, due to the fact that Brazil has not yet issued its final decree. However, Brazil has been actively sharing updates and test results with regional organizations such as CITEL, ensuring that countries in the region are aware of our progress.

This ongoing exchange of information helps lay the groundwork for regional cooperation, which will be crucial if ATSC 3.0 is widely adopted across the Americas. Establishing this collaborative spirit is essential for ensuring a smooth transition and maximizing the benefits for all countries involved.

5G & ISDB-T

US: Why did ATSC 3.0 ultimately win out over alternative formats such as Brazil’s legacy digital broadcast standard, ISDB-T, developed with Japan and adopted there and across South America; and 5G?

R.B.: ATSC 3.0 was selected due to a combination of technical strengths, flexibility, and proven readiness. Its high data throughput allows for ultra-high-definition video and immersive audio, while its robust transmission capabilities ensure consistent performance in varied geographic and environmental conditions—a vital consideration for Brazil’s diverse terrain. ATSC 3.0 also stood out for its strong performance in lab and field tests conducted under the SBTVD Forum’s guidance, which confirmed its readiness and suitability for deployment.

Emissions

US: Globo takes environmental, social, and governance (ESG) reporting seriously. In Globo’s 2023 ESG report, there’s no reference to energy consumed by TV/data transmission. Was there a component of efficiency in selecting ATSC 3.0?

R.B.: We have invested a lot in clean energy in Rio de Janeiro. We received an award last year from IBC for the best ESG in media.

However, in the beginning of discussions about ATSC 3.0, we didn’t talk about it being more green. After I got a report from Europe where they compare the carbon footprint of 10 million people watching content over the internet versus over terrestrial broadcast [which is 10x more energy efficient and 10x less CO2 emissive], we started making part of our argument that broadcasting’s relevance in the media ecosystem is that it’s greener than streaming. Anytime you have millions of people watching the same content, it doesn’t make sense to distribute it over traditional UDP CDN.

Five Years Out

US: What does broadcast television in Brazil look like in five years?

R.B.: In five years, Brazilian broadcast will be highly interactive, with a mix of live broadcasts, on-demand content, and personalized services. Viewers will enjoy higher-quality audio and video, while broadcasters leverage data services for targeted advertising and new forms of engagement.

The viewer will no longer need to think about whether content is delivered through over-the-air broadcast or internet streaming, as both will be integrated into a single, fluid experience. TV 3.0 will also leverage real-time data and census-based measurement, offering broadcasters deep insights into audience preferences and viewing patterns. This data will empower them to serve localized content, enhancing engagement by delivering programs that resonate with specific regions and communities.

Overall, Brazilian broadcast television will evolve into a high-quality media and a highly interactive and personalized ecosystem that rivals the capabilities of current streaming platforms while maintaining the key attribute of a free-to-air distribution. The holistic, data-driven, and flexible nature of TV 3.0 will ensure that broadcast television remains relevant, competitive, and compelling in the digital media landscape.

Article sponsored by One Media, dedicated to deploying NextGen Broadcasting across the U.S.