Cloud Adoption and IP Networks: Live Streaming in 2020 and Beyond

Building a highly profitable and scalable live media engagement ecosystem is a top business priority

It’s no secret that internet content delivery has been on the rise for some time, and although commodity internet has presented plenty of opportunities for broadcasters that need to deliver high-quality content reliably and with negligible delay, it has also led to some challenges.

For example, achieving the right balance between cost-effective streaming and the best-quality viewing experience is easier said than done. Margins are also coming under immense pressure as media enterprises adapt to changing content production workflows and audience acquisition processes.

This explains why building a highly profitable and scalable live media engagement ecosystem is the top business priority for more than two-fifths (41%) of media enterprises over the next 12-18 months, according to a recent Ovum industry survey and report in partnership with IBM Aspera—“Delivering Cost-Effective Premium Live QoS at Scale ‘Anywhere, Everywhere’”

READY FOR CHANGE

The current live streaming environment is in need of change. The world of TV and video services is fragmented and very competitive, so implementing differentiated content strategies is essential in order to achieve average revenue per user and per advertiser (ARPU and ARPA) targets.

This pressure is driving premium content owners to acquire niche media assets. The Ovum report found that 12% of enterprises expect their live content repositories to be worth more than $5 billion by 2023 (up from just 1% in 2018). In terms of specific industries, 19% of social networks, 16% of sports franchises and 14% of digital service providers are planning to hit the $5 billion milestone in three years’ time.

Furthermore, live content is continuing to become a core tool in engaging today’s digital users. This is forcing enterprises to focus on key performance indicators related to economies of scale, such as cutting costs and increasing efficiencies. Reducing the total cost of ownership (TCO) of premium content delivery via remote production is a leading business objective for 71% of enterprises.

Nearly 80% of enterprises are dissatisfied with their existing live media transport solution deployments. This is primarily because the increasing fragmentation of media consumption between traditional and non-linear models is increasing the cost and inefficiency of traditional content delivery routes. Many current live media transport solutions have poor public network interoperability and lack unified collaboration, testing and visualization capabilities.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Therefore, it’s not surprising to see that IP is currently the fastest emerging delivery route—a trend that will become more prominent in the years to come.

LOOKING FORWARD

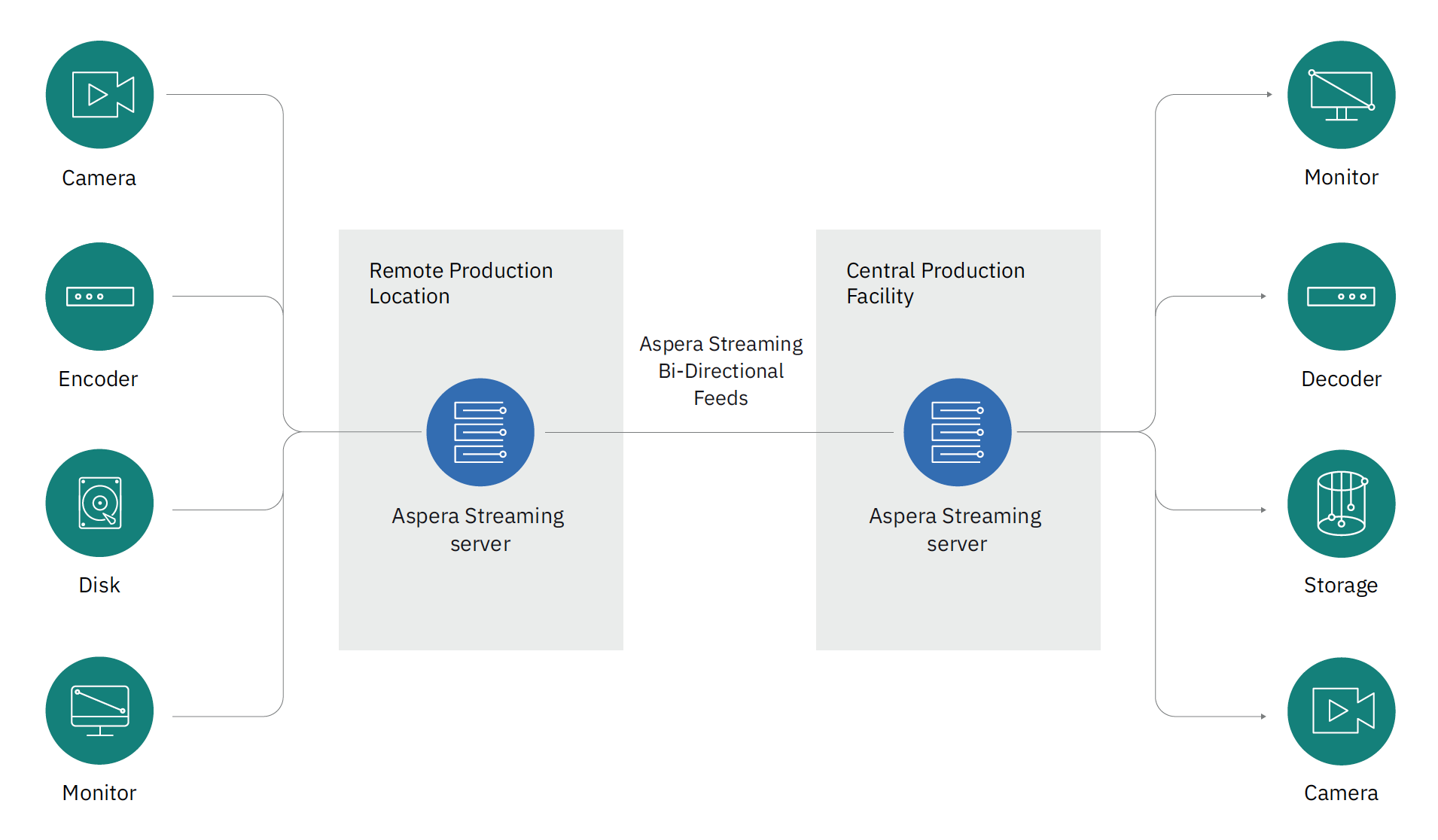

Two key trends are converging to shape the future of live content streaming: increasing cloud adoption and the growing role of agile live media transport over IP networks.

According to the survey, cloud will emerge as the leading deployment mode by 2023, driven by the need to control costs, streamline media contribution workflows and ensure multigeographical back-ups.

Exclusively cloud live media transport solutions will be the preference for more than a third (34%) of enterprises in three years’ time, in contrast to 2018 when 69% of enterprises preferred an exclusively on-premises deployment model. Additionally, public and private clouds will be the most prominent deployment modes, as highlighted by 82% of enterprises.

However, the cloud adoption curve will vary across premium content-owners. While sports franchises and film studios will be the fastest-emerging segments for cloud offerings, more than half of broadcast TV and video enterprises and digital service providers will maintain their legacy on-premise deployment modes.

Next is the growth of IP networks. Embracing this technology will enable businesses to safeguard profitability and extend the reach of their content by building horizontally and vertically diversified content repositories. Given the level of investment required when acquiring premium live content for tier-1 sports (e.g. the English Premier League, NFL and IPL), this will be vital to maintaining market competitiveness and increasing ROI.

IP networks can also play a key role in enabling premium content owners to improve their long-term operating margins by exponentially increasing the reach of their repositories at the lowest possible TCO. 56% of enterprises believe that single media asset reach can be enhanced by 1-5% using an IP-based cloud live media transport solution, while 37% say it can also reduce workflow TCO by up to 5%. This can equate to a significant long-term cost saving for enterprises.

FULL STEAM AHEAD

So, what tangible steps can media companies take to cut costs, increase audience engagement rates and lead from the front in today’s marketplace?

First, they must address their live media transport workflows by looking beyond traditional delivery routes. Legacy technologies will simply be unable to support highly scalable TV and video streaming ecosystems, while also failing to cost-efficiently deliver a robust, premium quality of experience to live audiences across multiple screens.

This is where embracing IP networks will make a big difference. For example, it will help provide the cost savings that many enterprises are currently struggling to achieve by reducing their reliance on traditional delivery modes.

Media companies should also look to streamline media contribution by leveraging a unified live media transport workflow. As well as reducing production to distribution TCO (which is currently standing at 32%), this will guarantee premium QoS/QoE with negligible pre buffering, packet loss and round-trip delays.

The final piece of the puzzle involves the adoption of diverse media production workflows (e.g. remote), which will help premium content owners improve both their audience engagement rates and ARPU. When combined with cloud-based live media transport over IP, it will also enhance real-time collaboration, reduce time to market and ensure more efficient media asset management.

With the market more competitive than ever before, following these steps will empower broadcasters and media companies to transform their workflows and spearhead the future of TV and video streaming.

Mike Flathers is CTO of IBM Aspera.