Have Viewers Really Opted-In to the CTV Economy?

Low awareness of viewing tracking may be a ticking bomb for CTV

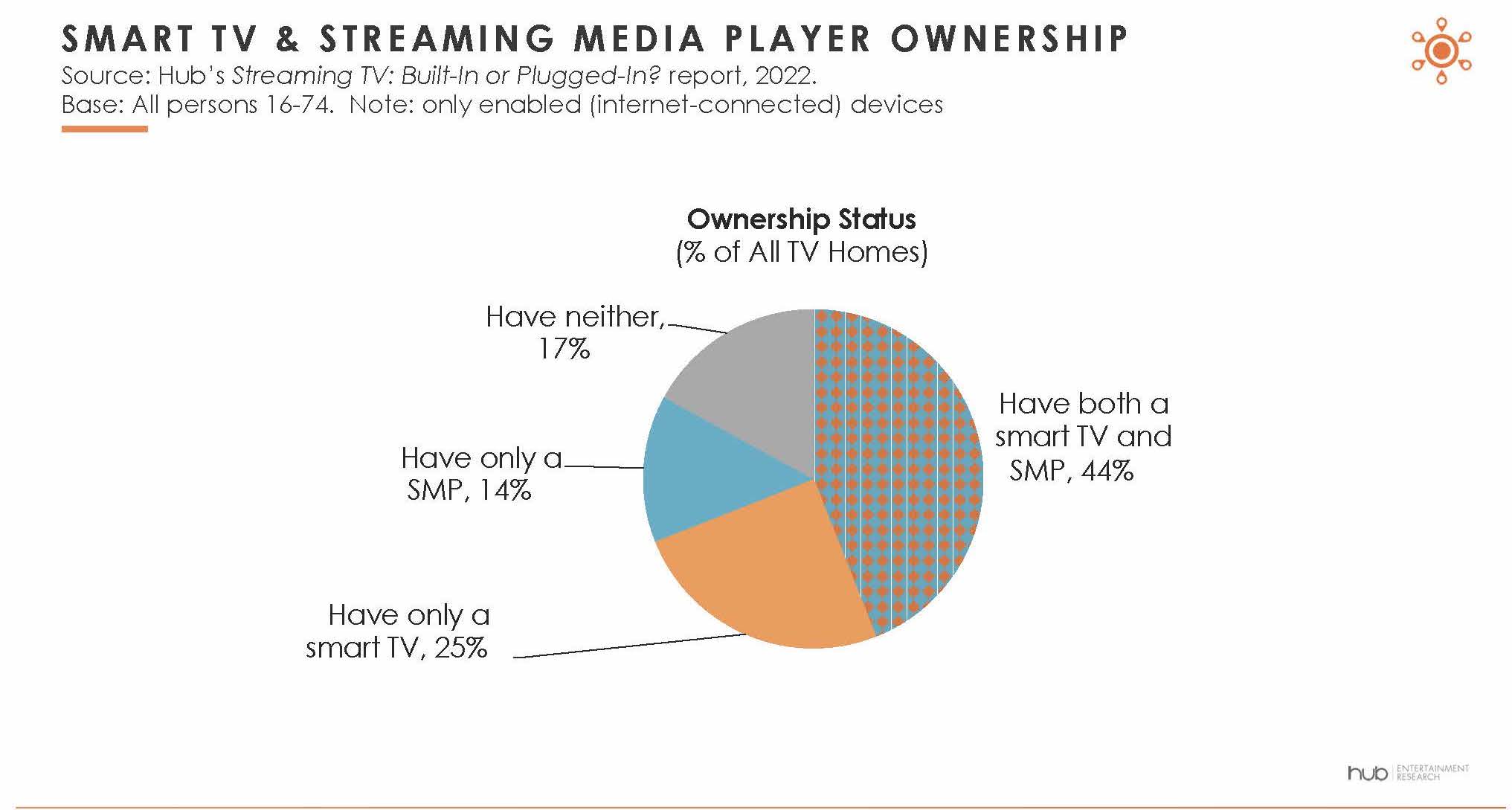

Smart TVs and streaming media players (SMPs) are the backbone of the CTV ecosystem. A large majority of homes in the United States (83%) have either an “enabled” (internet-connected) smart TV or an SMP. A plurality of homes (44%) own both types of devices.

Asked about the equipment attached to their smart TV sets, respondents tell us that over half (57%) of enabled smart TVs have at least one streaming media player attached – with a notable share of those having two attached!

Viewing Data are More Valuable Than Ever to the New CTV Gatekeepers

In today’s connected TV (CTV) world, the smart TV and the SMP are the primary ways viewers stream to their TV screens (putting aside the much smaller user bases of other CTV devices like game consoles or Blu-ray players). As a result, the evolution of the CTV space has seen the manufacturers (OEMs) of smart TVs and SMPs take on increasingly important positions as middlemen in the marketplace, impacting the 4D’s of CTV (Discovery, Decision, Delivery, and Data).

They act as an intermediary to the viewer by impacting discovery and viewing decisions – such as providing recommendations or pseudo-curating viewers’ decision sets by virtue of what their device shows on its home screen. They affect delivery of content through their agreements with content providers, and of advertising through their platform’s ad functions. As for data, the entireCTV ecosystem is reliant on viewing data collected by the smart TV and SMP OEMs – these data points are used for viewer recommendations, program promotion, advertising sales, or the provision of viewer data to third parties such as marketers, agencies, and audience measurement firms.

Viewers Are Unfamiliar with Their Opt-In Status

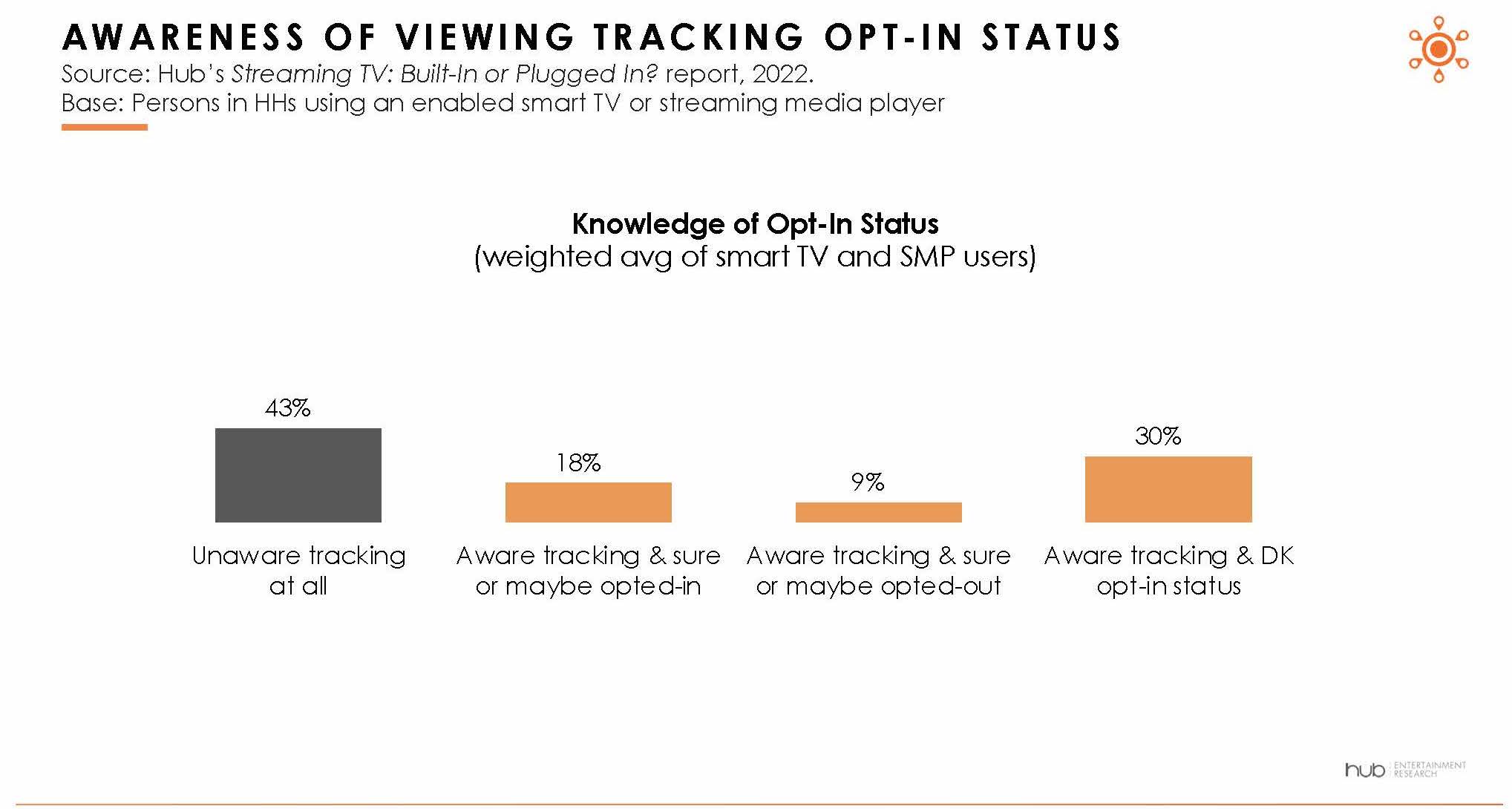

People in homes with enabled smart TVs and SMPs report low levels of awareness of their opt-in status for OEMs to track their viewing—and of tracking at all. This is a potentially serious issue for those working in the CTV space.

Overall, almost half—43% of those who are in a home with a smart TV or an SMP—say they are unaware at all of OEMs potentially tracking the viewing on their respective device.

Another 30% are aware of tracking but have no idea whether their device(s) are opted-in or opted-out of tracking.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Let’s take a pause. This ultimately means that 73% of people in smart TV or SMP homes don’t know about tracking, or don’t know their opt-in status.

In fact, only about 1 in 6 (18%) people in smart TV or SMP homes are sure – or think “maybe” – their device(s) are opted-in.

Tick… Tick… Boom!

These results indicate there may be a couple of ticking privacy time bombs waiting to disrupt the CTV world. The first could be a consumer revolt once the true scope of tracking and its business applications become well known. In the 1980s, concerns about the privacy of personal videotape rentals caused enough consternation that a federal law was passed providing protections against rental lists being shared or becoming public. It may be that we’re in a different age and no one cares anymore about privacy, but what if we’re not?

The other potential time bomb is the validity of OEM viewing data if it’s true that just 1 in 6 have opted-into tracking. There have always been issues with the representativeness of individual OEM datasets, simply by virtue of who is the target market for the brand in question (and no, millions of installed sets don’t make a dataset representative—it just makes it a very large unrepresentative dataset). If only a small proportion of installed devices are opted-in, those viewing data just got even more skewed.

By way of argument, some readers may be quick to blame our survey or our respondents. But the point is, even if one discounts these results for some invented reason, the levels would still be alarming—if “only” 35% were unaware of their opt-in status instead of 73%, would that be “good”? It still shows a lack of communication, understanding, and education.

Others may argue this is just standard operating procedure in the digital space, ranging from in-the-bubble excuses like “everyone knows they are tracked,” or “what do they expect?” to dressing up opt-in language in a way that doesn’t really reveal everything (“we collect data to improve recommendations and personalize advertising” rather than “we collect every piece of content that hits your TV’s screen, streaming or not, and we monetize your viewing in every way we can, including selling the data to whoever will pay for it”).

Burst the Bubble

As I’ve seen over almost 30 years in this business, consumer education greatly lags media technology.

Why did VCRs always flash “12:00”? Why did TiVo lose out to comparatively poorly designed cable box DVRs? Why did cable VOD and TV everywhere fall flat and let Netflix emerge? A big reason is many of these services or technology were ahead of consumers, and there was little effort to help consumers catch up.

Maybe, as some argue, privacy is dead. But maybe—as evidenced by Europe’s GDPR and its equivalents in several US states—it is not. The CTV industry, whether individually or as a group, should be out educating consumers in simple, transparent terms of what is being done with viewing data and their options to participate. This would hopefully help increase awareness and willingness to opt-in; at the least it may help defend against any future blowback.

David C. Tice is a senior consultant to Hub Entertainment Research and Principal of TiceVision LLC, a media research consultancy. For over 25 years, he has overseen syndicated and custom research projects for many media companies, media industry associations, and pro sports leagues.