One Hub to Rule Them All

Roku is the newest entrant in a converging smart home and entertainment market

Leading smart TV operating system provider Roku is betting that its next growth opportunity will come from the smart home sector. In mid-October, the company announced an entire suite of smart home products in partnership with Wyze Labs, a well-known brand in the smart home market, which can be purchased directly through Roku’s website or at Walmart. The smart devices include indoor and outdoor cameras, smart light bulbs, smart plugs, a smart light strip, a floodlight camera, wired and wireless video doorbells, smart light bulbs, and smart plugs.

Roku’s streaming business, which has made affordable hardware a priority for consumers, should align well with the new smart home offerings, which range in price from around $7 to $100. Wyze itself, is known for catering to budget-minded consumers, as is Walmart, making both suitable partners for Roku as it endeavors to tackle this new business category. It’s also a sign of Roku’s budding relationship with the nation’s biggest retailer—it partnered with Walmart in June to offer shopping via streaming on Roku devices.

Toe to Toe

Mustafa Ozgen, Roku's president of devices, labeled the leap into smart home a “natural extension” of the firm’s business. Streaming is expected to remain Roku’s bread-and-butter sales driver, but the company is also clearly seeing where the winds are blowing and wants to ensure it catches a ride. Merging home entertainment with home control has already been attempted by a number of prominent brands including Apple, Comcast, Creston, Control4, Logitech, Samsung, LG, and others, but consumers have mostly kept the functions separated. Roku sees an opportunity to become the hub for a consumer’s entire home, not just the living room.

Entering this space, however, also means going toe-to-toe with tech juggernauts Amazon and Google, who both have sought to gain widespread OS adoption through a combination of smart home services and streaming offerings. Google acquired Nest back in 2014 for $3 billion and forged a partnership with security expert ADT. At the same time, Google’s Chromecast streaming hardware has become ubiquitous and its Google TV OS is beginning to see greater adoption among smart TV manufacturers (Sony, TCL, Hisense, etc.). The Google Home app unifies smart home and entertainment control.

Similarly, Amazon bought video doorbell firm Ring in 2018 for $1 billion and smart camera company Blink for $90 million, followed by Wi-Fi mesh operator Eero in 2019 for $97 million. These offerings, combined with Echo smart speakers, Alexa voice control, and a Fire TV hardware/software empire have made Amazon a formidable contender for the convergence crown. While Roku has 63 million active accounts, Amazon has sold more than 150 million Fire TV devices, and there are hundreds of millions of Alexa-connected products on the market as well.

To a lesser extent, Roku will also be competing with companies like Samsung—the leading smart TV manufacturer and provider of SmartThings smart home control—and cable/internet behemoth Comcast, which also offers smart home security solutions through Xfinity.

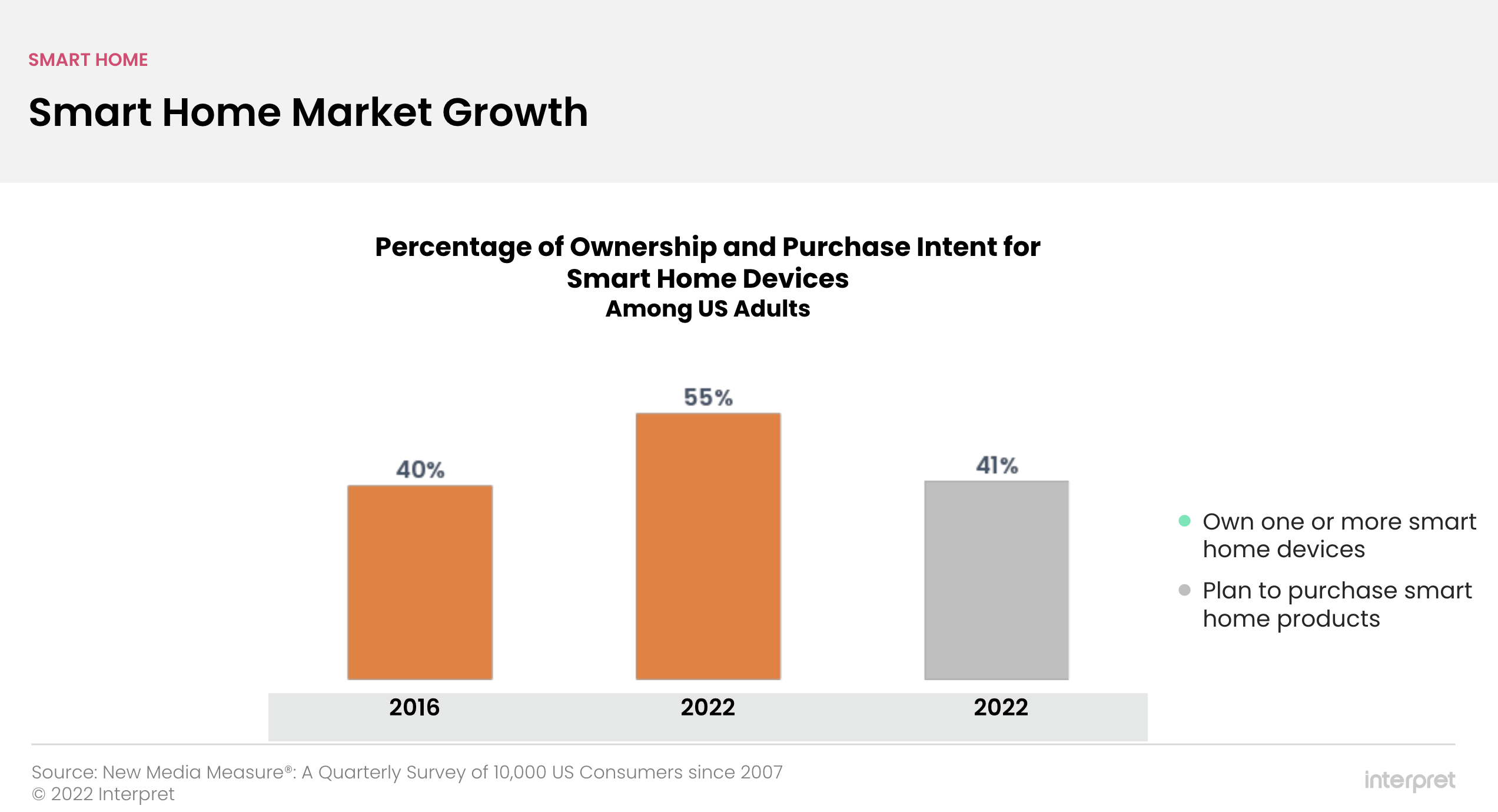

That said, the smart home market is not a zero-sum game. Interpret data finds that 55% of US adults own one or more smart home device, which represents 15% growth since 2016. Moreover, 41% of adults express desire in having smart home products in their next home. The appetite for smart home control continues to grow, and when factoring in the continued shift from linear TV to SVOD and FAST channels, there’s never been a better time for Roku to dive headfirst into smart home waters.

New Opportunities

Roku is wise to spread its bets to further diversify its business, as streaming has become crowded and fiercely competitive. The company’s 63 million active accounts are flat when compared to the prior quarter, indicating that growth in streaming alone could be an uphill battle—shares in Roku closed at their lowest level since February 2019 on October 14.

Smart home, on the other hand, offers new opportunities to expand revenue generation through advertising and subscriptions. For example, Roku is selling monthly and annual subscription options to consumers who pick up its new smart home products. The company offers a $3.99 per month per camera plan ($39.99 per year per camera but on sale for $29.99 for the first year), that comes with detection/monitoring features and cloud storage of video for 14 days.

Consumer privacy will be another challenge for Roku to tackle. It’s worth noting that Wyze suffered a significant data breach in 2019, which exposed the personal data of about 2.4 million customers. According to Interpret data, 27% of US consumers are concerned about the privacy of their online data, and among those looking to add more smart home products to their home, nearly 30% state that they are influenced by products that offer strong data privacy and security protection.

Roku understands that data privacy has become an important consideration for many consumers. The company will be strengthening the security around its Wyze-built products, including offering consumers the ability to set up two-factor authentication. In addition, Roku has been certified by ioXt Alliance, meaning that it’s met the appropriate level of security needed for each product, as outlined by the consortium of IoT companies.

Smart home may not be a panacea for Roku’s recent market woes, but with the right approach and marketing, the newest products could be the key to unlocking future growth, cementing a foundation for Roku to build upon for years to come.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

James Brightman brings 20 years of media experience to Interpret, with a focus on games, esports, streaming, digital media, and consumer electronics. He now serves as the lead editor of Interpret’s blog and newsletter covering global trends in gaming and technology. He also contributes to Interpret’s syndicated research as a lead analyst.