Amazon’s Agenda Fits Streaming Expectations From Researchers

Gary Arlen

BETHESDA, MD. —Woody Allen. Philip K. Dick. Ridley Scott. The New Yorker. Starting with that “A” list of creators and content, Amazon is pushing aggressively into original video programming and theatrical movies. The high-profile juggernaut is bringing added credibility to the streaming video marketplace, joining Netflix’s growing inventory of original content plus stepped-up productions from digital and conventional production sources.

On the technology size, YouTube’s shift to HTML5 as its default video player technology is expected to presage the next ramping up of the Google subsidiary’s video agenda. Last month, YouTube also announced support for 360-degree videos, clearing the way for more original content, including sports and outdoor adventure videos.

YouTube’s adoption of HTML5 as the default player technology (rather than Adobe Flash) will let viewers see video faster, with less buffering. In addition to quicker video load times, the new technology offers higher-quality video resolution in less bandwidth, which makes possible 4K video at 60 frames per second.

These streaming technology advances, especially when delivered to the growing array of big flat-panel screens, enhance the accessibility for the high-profile content coming their way.

Netflix has lured Tina Fey to bring her news series to its streaming platform.

Amazon’s creative juggernaut and the You- Tube technology upgrades (plus similar developments at other OTT providers) coincide with a new sheaf of market studies confirming that audiences—especially coveted millennials (ages 13–35)—avidly consume OTT/online video. A half-dozen recent reports underscore the shift toward on-demand viewing and alternative program content.

Amazon’s double-edged approach, unveiled last month, demonstrates several important trends. Top-notch talent is increasingly migrating to online distribution, reflecting the greater creative flexibility on OTT than broadcast or even cable networks allow them. The program selection process and distribution timeframes are being reinvented. In addition, new digital platforms are enabling “old media” (such as The New Yorker magazine) to re-imagine and expand their digital offshoots.

Moreover, the new digital ecosystems, with virtually unlimited real estate, are encouraging writers and producers to mine historical content for literary gems they can bring to the screen. In Amazon’s case, this includes an updated series based on the 1962 cult classic “The Man in the High Castle.”

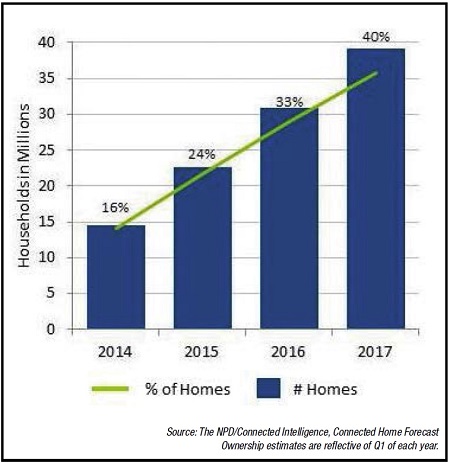

Fig. 1: Forecast of streaming media player devices in households with Internet access

Amazon stepped up its streaming video assault last month by releasing 15 potential series pilots, seeking crowd-sourcing approval before decisions are made to expand some of those pilots into a full first season of shows. Viewers were asked to sample and rate potential new shows to determine which will be developed as full series.

Amazon hopes to repeat the success of its first such effort, which launched “Transparent,” the series for which won Amazon its first Golden Globe award in January. (Ironically, “Transparent” was not highly ranked in the viewer polling last year, but Amazon went ahead with the series anyway.)

Among the most enthusiastically supported series in Amazon’s arsenal is “The Man in the High Castle.” The video series is based on the award-winning alternative history masterpiece by Philip K. Dick about life in the United States if Japan and Germany had won World War II and then started bickering about their North American territory.

Its pedigree includes venerated producer- director Ridley Scott (who directed “Blade Runner,” the 1982 movie also based on a Dick novel) and Frank Spotnitz as executive producers of the Amazon series. Spotnitz, who also wrote the screenplay, was a writer and producer for the popular Fox series “The X-Files.” David W. Zucker, who is producing “The Man in the High Castle,” has credits as a writer and producer for TV series including “The Good Wife” and “Numb3rs.”

Also treading along Amazon’s star-studded streaming video path are filmmakers such as Woody Allen, who will create “straight-to-series” productions. While cynics have noted Allen’s historic denigration of television (despite his start as a TV writer for Sid Caesar and Garry Moore), his late-life return to video recognizes that his quirky, iconoclastic ideas fit well with the specialized appeal of streaming channels.

Separately, Amazon Studios, the production subsidiary of the e-commerce behemoth, plans to produce and acquire up to a dozen movies per year, which will be released to theaters and then on Amazon Prime Instant Video four to six weeks laterz. The theatrical plan itself is significant, but the short window for home-viewing dangles an attractive option to theater owners who hate simultaneous “day-and-date” release, but might tolerate a month or two of exclusivity. The sequence would leverage theatrical promotional costs by bringing the content home quickly, rather than the typical three to six months later.

Collectively, the arrival of such celebrated “behind-the-camera” talent is an important indicator of old Hollywood’s embrace of new digital platforms. Amazon’s Original Movies will be in the low-budget range: $5 million to $25 million each. As “Variety” pointed out, Ted Hope, another successful veteran producer who has been brought in to head the movies venture, is “a vocal advocate for changing the way independent films are produced and distributed.”

Amazon is hardly alone in its theatrical aspirations. Netflix is also pushing a similar agenda, including a four-picture deal with Jay and Mark Duplas, brothers with creative and on-screen credits for movies and TV shows such as “Zero Dark Thirty” and “The League.” Netflix also has lured Tina Fey to bring her new series “Unbreakable Kimmy Schmidt” to its streaming platform. Fey made the move after problems with putting the series on NBC, her long-time outlet.

AUDIENCES ARE READY

The aggressive original production plans of Amazon, Netflix, YouTube and other streaming video stalwarts come amidst a slew of upbeat reports about audiences thirsty for viewing alternatives.

comScore found that not only are millennials avid viewers of streaming content (87 percent look at it), but that 45 percent of young viewers “exclusively” watch shows via Internet sources. About 45 percent of viewers under the age of 25 watch via the Internet, including 13 percent who only watch shows online. comScore, which has announced viewership ratings studies to compete with Nielsen, also says that four out of 10 U.S. households now subscribe to a digital video service, with 32 percent using Netflix and 19 percent using Amazon Prime Immediate Video.

Research by NATPE||Content First (a TV programming association) and the Consumer Electronics Association showed that just 55 percent of millennials use TVs as their primary viewing platform, while streaming devices—laptops, tablets and smartphones—are poised to dominate their viewing preferences.

The NATPE/CEA study, conducted by E-Poll Market Research, “confirms that the paradigm for TV content discovery has changed dramatically with increased availability and use of TV content streaming options,” NATPE President and CEO Rod Perth said. Among the study’s key findings is that millennials are comfortable using many different sources of TV program content, and consequently are significantly more likely to consume full-length TV programs from a streaming source than live “real-time” TV programming.

This age cohort has especially embraced portability, with a quarter to half of millennials watching TV programs on smartphones, tablets or laptops. Older viewers (Generation X, ages 35–50) “love video-on-demand and DVRs,” according to E-Poll’s research.

Deloitte, in its 2015 “Technology, Media and Telecommunications Predictions,” cited the growing expenditures for streaming media services. Deloitte’s report, also issued in January, expects that millennials will “spend about $3,000 per year on technology hardware and connectivity,” including game consoles and portable devices on which they can receive and watch streamed video.

ABI Research, in its study of over-the-top and multiscreen services, predicted that the online video market— fueled by Netflix, Amazon, Hulu and similar providers— will grow to $56 billion by 2019, with a six-year compound annual growth rate of 23.1 percent.

And NPD’s “Connected Home” forecast, issued in late January, envisions that 40 percent of U.S. Internet homes will have a streaming media player by 2017, up from about 16 percent now. John Buffone, NPD’s executive director- Connected Intelligence, sees the growing OTT content mix (including Amazon, Netflix, Hulu and YouTube initiatives, plus the recently unveiled streaming video services such as CBS All Access and HBO Go’s standalone feed) as fully integrated with the hardware deployment.

“Over the coming years we will continue to see a growing audience of TV viewers for streaming video services, authenticated network apps, and offerings such as CBS All Access that no longer require a pay-TV subscription from a cable or satellite provider,” Buffone said.

In other words, OTT content, hardware and viewer appetites are falling into place. Just as broadcast TV struggles to find its bandwidth.

Gary Arlen analyzes cross-platform media technology and content at Arlen Communications LLC (www.ArlenCom.com).

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.