Bypassing the Broadcasters: TV in the Social Age

Click on the Image to Enlarge

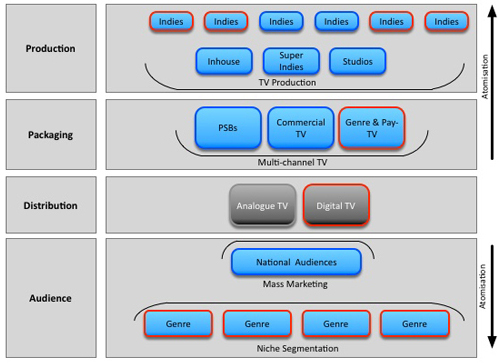

New broadcast ecosystem

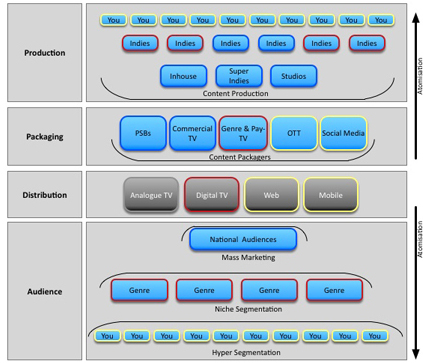

Click on the Image to Enlarge

We are witnessing demographic shifts in the age of linear TV viewers, with millennials and younger consuming more content online, and increasingly mobile; social media outstripping TV as the primary news source; Youtube showing the Champions League and Europa Cup Finals, Twitter streaming the NFL, and Facebook Live. The broadcast industry has gone from seeing social media in particular as having only marginal impact to something far more threatening. This potential threat was neatly encapsulated in a recent Royal Television Society (RTS) event ‘Social media muscles in on TV’ which had Facebook, Twitter and YouTube on the panel. However, the panel members emphasized that they:

- operated distribution platforms, that enabled content makers to publish their content, and were not content makers themselves; and

- already had established partnerships with existing broadcasters, rights and content owners

The implication is that social media may offer more opportunities for content owners or producers rather than threatening their existence.

ERA OF COMPETITION

Traditional linear broadcast

This is not the first time that disruption has caused concerns for linear TV broadcasters. The deregulation of TV in the 1980s and 90s focused on increasing competition through program quotas and licensing more channel capacity.

The most significant impact came from digital thematic channels at the time more TV capacity was seen as heralding an era of competition, greater consumer choice and where Public Service Broadcasters would no longer be relevant. Of course, this did not happen in that way. These new channels needed content—but high-quality, and well produced high-quality content costs money—which most thematic channels operators did not have . The winners from that deregulation were actually the people who were predicted to be the biggest losers —the producer-broadcasters. They were the only ones with the talent, resources and budgets to produce high-quality content. It is only many years later that the successful thematic channels could afford to commission originated content.

The intent was to broaden the market (as shown in the diagram in red) and deliver niche segmentation rather than diminish the existing players.

With hundreds of channels, the thematic genre-based broadcasting model was an effective means of providing more choice. The impact on production was more mixed. Program quotas opened the market for independents and there was a demand for more content but there was not the same increase in budgets, which were stretched further. The ‘atomization’ of production—the ability for smaller new entrants to compete—did increase. This was enabled by lower cost file-based HD cameras, but it did not radically alter the cost or process for making content.

SOCIALISM

So what will be the impact of social media?

The first impact of social media has been to massively increase ‘atomization’ of viewers to the point of ‘hyper-segmentation,’ where it is now affordable to serve segments that are very small. So the first effect may be to generate even more revenue for existing content producers, just as the multi-channel model generated a new wave of revenue in the 80s and 90s. This reinforces the conclusion that the producer-broadcasters are content owners rather than just broadcasters.

But there are threats. This time social media coincides with the dramatic fall in the cost of production of technically high quality content. Whilst smartphones and consumer video cameras may not meet the UHD (or even HD) standards of traditional broadcasters, this is not an issue for social media.

New formats, such as AR, VR and 360 may bypass broadcasters altogether. This enables far greater democratization of the production market and the minimum equipment investment for a production company making high quality content has never been lower, and importantly the route to viewers is no longer bound to broadcasters. But is this good news for production companies? The growth in demand for content on social media may well fuel demand for their services, but the pressure on cost is also likely to increase, and so yet again they face a world of “more for less, please”.

STAYING RELEVANT

For broadcast technology vendors, the market for specialist hardware is only going one way—down. Whilst not yet a ‘meteorite’ moment, it will be essential for traditional broadcast technology vendors to embrace cloud technologies if they want to stay relevant.

We are moving inexorably towards a binary market in ‘broadcasting’—we will have the known high-end world of premium content commissioned by big broadcasters and global OTT providers, where production values remain high and technology innovation will be expected to drive operational and infrastructure costs down.

At the other end, we will have the chaotic and brave new world of atomized markets and production processes—where it’s all about personalization, mobile, on-demand, produced by commoditized tools and systems. For those willing to adapt and embrace the change this is a compelling opportunity.

This story originally appeared on TVT's sister publication TV Technology Global.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.