Demand and Supply Revamping OTT Outlook

Hub Entertainment Research’s report last month, which found that 52 percent of pay-TV viewers prefer to watch their favorite shows online rather than via traditional broadcast or cable channels, surfaced amid a flurry of high-profile developments in the fast-evolving, over-the-top and subscription video-on-demand market.

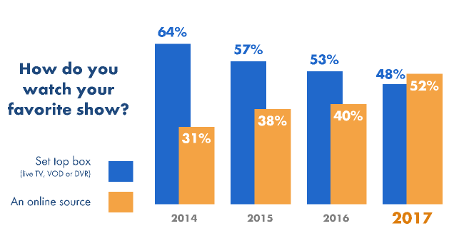

Hub Research chart STB vs online viewing

The Hub study reinforced a Parks Associates report, issued just a few days earlier, that declared SVOD services—many of them offshoots from traditional linear TV networks—now dominate the paid OTT landscape.

Almost simultaneously, several new streaming services materialized. Most prominently, “Philo,” a $16 per month “skinny bundle” of 37 channels largely culled from non-sports cable networks; and a new Disney streaming network, due to debut in 2019, will further bolster the appeal of non-traditional TV viewing.

Disney’s go-it-alone plan, which was announced quickly after the company said it will take its content off Netflix, generated extraordinary interest because of suggestions that Disney will create new shows for its streaming channels, featuring original video based on company franchises such as “Star Wars,” its Marvel properties and Pixar’s “Monsters, Inc.”

Plus, the past month had the usual parade of OTT announcements, such as:

· A fee-based “Sports Illustrated” SVOD channel on Amazon Prime; for $4.99/month, there’s a lineup of sports material, although no live coverage;

· Fee-based “Curiosity Stream” (the SVOD service created by Discovery Channel founder John Hendricks) on Comcast’s OTT platform; the $5.99/month lineup is available on Comcast’s set-top box VOD platform and via its Xfinity Stream app/portal;

· A no-fee, ad-free video streaming service from Hoopla, a company that collaborates with local participating public libraries. Hoopla’s service offers “classic” titles (oldies) from Paramount Pictures, Viacom, Disney and other distributors for delivery to Apple TV and Amazon’s Fire TV at no charge for limited periods of time.

Separately, AT&T filed a trademark application for a “Watch TV” logo, with an intricate design highlighting the letters “A”, “T” & “T”. Although the paperwork at the U.S. Patent and Trademark Office offers no hints about how the logo might be used, analysts speculated that it could eventually be a unified mark for all AT&T video services, including (pending current legal challenges) those offered via AT&T’s u-Verse IPTV systems and DirecTV, including DirecTV Now apps plus the Time Warner content.

For deep thinkers seeking to find a unifying context in these developments, there is the question of how (or if) these platforms and applications will fit into the emerging ATSC 3.0 environment. Some concepts—but probably no deals—may emerge during next month’s CES (see cover story) where the streaming producers and platform providers will be scouting for collaborative and competitive delivery systems.

Philo, which started as an internet TV service for college campuses, has programs from A+E, AMC Networks, Discovery, Scripps and Viacom—along with investments from most of those networks. Nostalgically named after Philo Farnsworth (considered by some to be the father of television), the new streaming service will seek to position itself with cord-cutters who want to access major OTT options, according to Philo CEO Andrew McCollum, an alumnus of Facebook. He expects customers to use an over-the-air antenna to receive local TV and to continue their subscriptions to SVOD services such as Netflix.

“We wanted to build the first social TV experience,” he said, indicating that Philo will eventually add social functionality, which was not available at launch. The vision is to establish a synch-watch feature that lets multiple friends chatter online about shows they are jointly watching, such as programs on Comedy Central or Discovery.

“We share a lot more about much more personal things on social media all the time,” McCollum said.

HOW ADVERTISERS PERCEIVE THE CHALLENGE

Inevitably, these research reports, launch promises and business visions were accompanied by deep thinking about the impact on advertising and the financial structure of broadcast economics, especially as it affects sports telecasts.

In a report last month, Rob Norman, chief digital officer of GroupM Global, examined “the challenge of getting younger viewers into the TV habit” with special attention to the problems for “ad-funded sports programming.” GroupM characterizes itself as the “world’s largest media investment group with more than $108 billion in billings.”

Norman warned that if OTT purveyors “emerge as aggressive bidders” for online sports rights, the legacy “television establishment will lose impacts or be forced to pay more.”

“This is important as it will lead to inevitable advertising price inflation at a time when advertising itself is under considerable pressure to prove return on investment,” said Norman.

At about the same time, the Consumer Technology Association’s research department issued its analysis of the streaming video advertising landscape. Its study “Exploring Preferences for Personalized Content Consumption Experiences” concluded that streaming viewers are more willing than expected to watch commercials on streaming platforms. About 71 percent watch video commercials to discover other streaming content, and 69 percent watch videos for a product or service, explained Steve Koenig, CTA’s senior director of market research, who conducted the survey.

Although about two-thirds of viewers watch streaming ads up to the point where they can skip out “most of the time,” Koenig found that “nearly four-in-10 viewers watch the entire ad without being required to do so.” CTA’s study also determined that viewers expect the length of an ad to conform to the length of the content they’re watching.

“For example, shorter spots for short-form video and longer ads with long-form content,” Koenig said. “To a lesser extent, the number and placement of ads tied to streaming video also influence ad tolerance.”

FORMULATING THE STREAMING FRAMEWORK

The restructuring of the SVOD ecosystem, along with the research findings, are typical of an emerging category, although it is complicated because of the relationships with—and the competition against—existing broadcast and cable operations.

For example, as the Park Associates study pointed out, about half of the general entertainment and premium-level SVOD services in its 2017 Top 10 have some connection to conventional TV brands. Parks pointed out that these top 10 paid OTT video services have “a massive lead over more expensive and relatively newer virtual MVPD services.” Here is Parks’ tally on the most-viewed SVOD services:

1. Netflix

2. Amazon Video

3. Hulu

4. MLB.TV

5. HBO Now

6. Starz

7. YouTube Red

8. Showtime

9. CBS All Access

10. Sling TV.

“While the top three are no surprise, the big story over the past year has been the rapid subscriber growth for OTT video services from HBO, Showtime and Starz,” said Brett Sappington, senior director of research at Parks Associates. “The combination of recognized brands and popular original content is driving demand for their offerings. Services such as Sling TV and Crunchyroll are still enjoying strong growth, but other services have simply grown at a faster rate over the past year.”

Sappington noted that online pay-TV services are also growing quickly, fueled by nationwide advertising campaigns. “YouTube TV’s advertising and sponsorship deal with MLB during the recent World Series is just one example of the marketing dollars behind these service offerings,” Sappington said. “While more online pay-TV services could enter the top 10 within the next year, those services that comprise the top 10 are recognized brands that are aggressively working to expand their subscriber bases. Displacing them will be a difficult task.”

Hub Entertainment Research’s annual “Conquering Content” report examined the role of conventional cable/satellite programming in a different context. Hub identified that set-top box use has “been steadily declining over the past several years.”

It noted that in 2014, 64 percent of viewers watched their favorite show through an STB (either live, on a DVR or through their MVPD’s on demand platform). At that time, just 31 percent said they watched their favorite show online (via an SVOD service such as Netflix, Hulu or Amazon, through a network or MVPD site/app or through other online sources such as iTunes). The past year saw a big jump (from 40 percent to 52 percent) in the online viewership preference.

“These findings suggest that the aggressive investment SVODs are making in original and exclusive content is paying big dividends,” said Peter Fondulas, co-author of the study and principal at Hub. “In this research and other recent studies, we see clear evidence that high-profile online exclusives generate buzz that draws consumers to these platforms, which not only helps attract brand new subscribers, but also builds loyalty among current customers.”

Hub’s Jon Giegengack, co-author of the study, characterized the SVOD companies as transforming themselves “from technology companies that distribute content, into entertainment companies that create it.” He also predicted that in the future, “the share of total TV time may turn out to be a more important way to evaluate platforms than looking at the number of subscribers.”

MEANWHILE, ON THE OBITUARY SIDE

While all these promising and upbeat OTT developments were underway, the video undertaker was also keeping busy. Many OTT services just quietly slip away, but some high-profile ventures get a farewell salute.

For example, “SeeSo,” a comedy SVOD service from NBCUniversal which debuted in January 2016, is running its final feeds this month. No one issued a body count on how many customers the $3.99 per month service ever attracted.

“Fullscreen Media” (backed in part by AT&T in its joint venture with The Chernin Group) will cut off its SVOD spigot in January. Again, there was no official tally of users, but sources suggest it had “hundreds of thousands” of viewers, although it was unclear if that included one-time tune-in audiences.

And Comic-Con HQ, a streaming VOD channel that began early last year as a partnership between San Diego Comic-Con and Lionsgate studio, was cut off last month. Its content—much of it from Lionsgate, has been licensed to other streaming services, including Roku, Amazon Prime and TubiTV.

In other words, the OTT/SVOD landscape continues to be dotted with promises, solid trends and a few corpses.

Gary Arlen is president of Arlen Communications LLC, a research and consulting firm. He can be reached atwww.ArlenCom.com.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.