HBO, CBS Raise OTT Profile

Gary Arlen The announcement last month from Home Box Office that it plans to launch an à la carte streaming video service “sometime” in 2015—followed a day later by CBS’s launch of its “CBS All Access” OTT service—illustrate the speed with which media companies are addressing the integration of online video delivery with traditional linear programming.

While the details—especially financial arrangements to appease cable and satellite operators—are still being hammered out for the HBO migration, plenty of other projects are either underway or in the early planning stages. Collectively they indicate the urgent search to find a new route to monetizing the collaboration of “old” and “new” media.

At the 23rd annual Goldman Sachs’ Communicopia Conference in September, the CEOs/chairmen of companies that own Home Box Office and Showtime both openly confessed that they are considering making over-the-top services available that would allow viewers to bypass a cable or satellite TV operator. In particular, Time Warner CEO Jeff Bewkes’ remarks at Communicopia were a stunning reversal of his comments there last year, when he strongly shied away from any such OTT possibility.

Exactly one month later, HBO CEO/Chairman Richard Plepler, citing America’s 10 million broadband-only homes, characterized the online video audience as “a large and growing opportunity that should no longer be left untapped.”

“It is time to remove all barriers to those who want HBO,” Plepler told an investors meeting. “So, in 2015, we will launch a standalone, over-the-top HBO service in the United States. We will work with our current partners. And, we will explore models with new partners.”

Observing that 80 million U.S. homes that do not buy HBO now, Plepler vowed, “We will use all means at our disposal to go after them.”

HBO is already offering its HBO GO content in Scandinavia (and soon elsewhere in Europe) as an OTT broadband channel available without a cable subscription. In fact, coinciding with IBC in Amsterdam in September, HBO revealed it will use cloud virtualization technology from ActiveVideo to allow viewers to see HBO GO via legacy set-top boxes.

Also at the Goldman Sachs event, CBS Inc. CEO Les Moonves indicated that Showtime Networks, the premium channels that CBS owns, are ripe for OTT delivery.

“I don’t know when the timing is right,” Moonves said, but he called the opportunity “very exciting” and a way to deliver “a Showtime channel in the future... all over the world.”

The terse acknowledgements by Bewkes and Moonves—followed by the announcements from HBO and CBS—underscore the march toward Internet-delivered, on-demand video. Like all other top media executives, they must be evaluating alternative distribution options all the time.

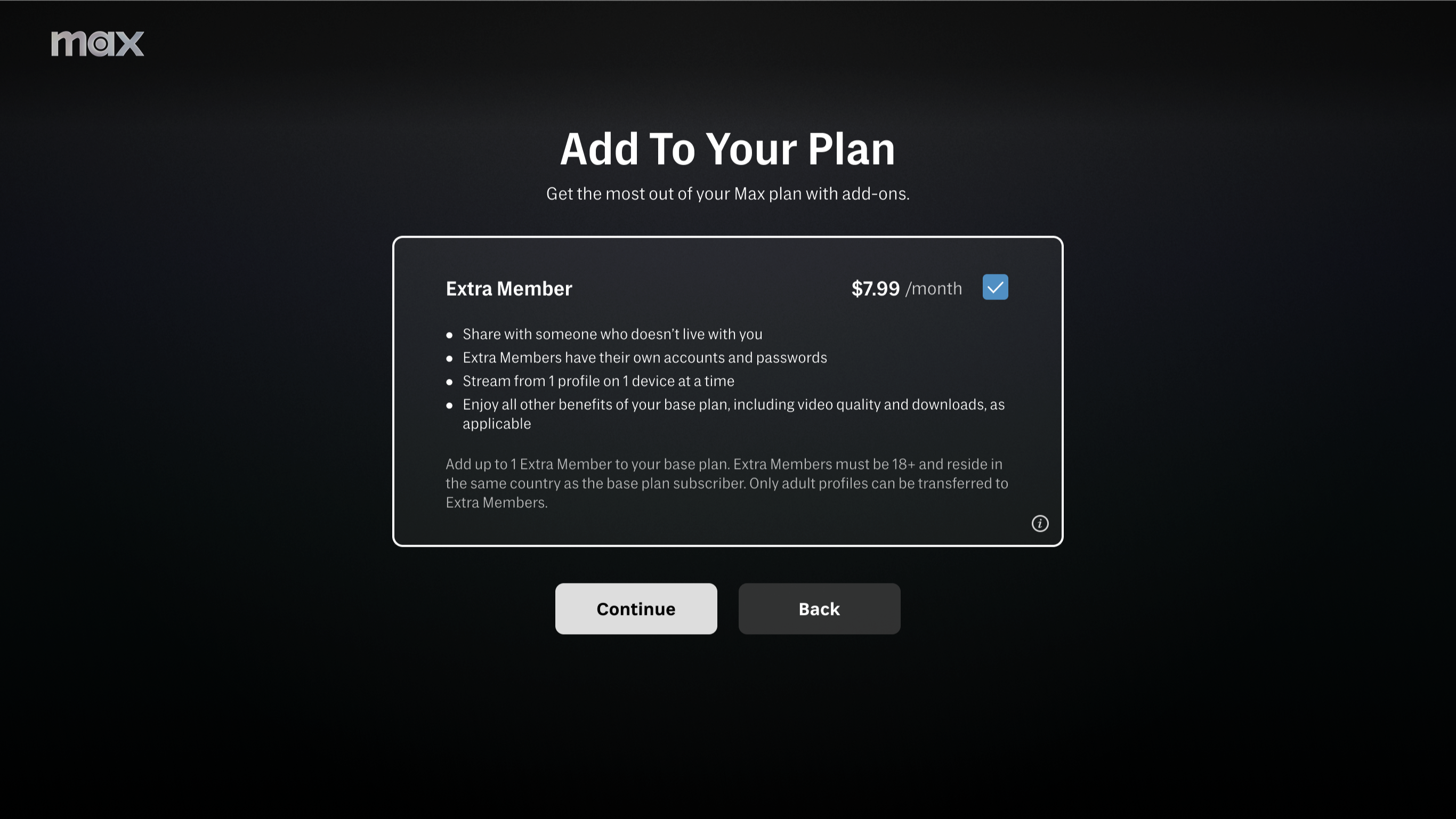

CBS will charge $5.99 a month for its “CBS All Access” OTT service. The HBO announcement, in particular, raises the stakes—will it spur other cable programmers to speed up their OTT plans?

Separately, a week earlier in New York, at the re/Code Media conference, ESPN President John Skipper, (who is also co-chairman of Disney Media Networks) hinted at his willingness to sell sports programming to OTT delivery. Skipper (like Bewkes, Moonves and others) was coy about details, for fear of aggravating current cable affiliates. But he acknowledged that ESPN content will be available via the Internet TV service that DISH plans to launch this year. He also indicated he is mulling other OTT distribution.

Although Skipper avoided specifics, analysts believe the mostly likely major upcoming alliance is with Verizon, which just confirmed plans to start its broadband video service by mid-2015. Verizon will use the Intel OnCue technology it acquired last year.

BUZZFEED, VH1 SHOW CROSSOVER OPTIONS

Meanwhile, other cable programmers are jumping into the online video world through a variety of platforms. For example, BuzzFeed’s agreement to cross-promote the VH1 series “Couples Therapy with Dr. Jenn” underscores the growing symbiosis—some may say “co-dependency”—between linear TV networks and Web video. The relatively small alliance emerged as BuzzFeed is stepping up its own media juggernaut. The company recently unveiled plans for “BuzzFeed Motion Pictures,” which will create videos for its website and for TV and theatrical release.

Under the VH1 deal, BuzzFeed will create video segments for its website, pointing users to the “Couples Therapy” TV series. In exchange, VH1 will run promos for BuzzFeed’s social media content, which focuses (for now) on gossip, quizzes and entertainment news.

BuzzFeed has similar “social tune-in” arrangements with Bravo (an NBCUniversal network) and the Independent Film Channel (owned by AMC Networks). The value of these relationships takes on increased meaning in the context of BuzzFeed’s recently unveiled media production agenda.

CEO Jonah Peretti says the company will set up three units: BuzzFeed Video for shortform content; BuzzFeed Live Development for mid-length serialized projects; and “Future of Fiction” to develop long-form film, television and “transmedia” efforts.

The growing relationships with cable networks give BuzzFeed a foot in the door when it is ready to transmit those “transmedia” products. Its expansion is fueled by a recent $50 million investment from Andreessen Horowitz, the $4 billion Silicon Valley venture capital firm.

Whatever happens to the BuzzFeed agenda—or whenever it happens—will be one more adventure in the evolving relationship between “big media” and Internet television.

At the Goldman Sachs event, Verizon Chairman/CEO Lowell McAdam said that ABC, CBS, Fox and NBC will be part of the Verizon à la carte lineup, but he stopped short of identifying any other big programming deals.

“Over-the-top video is right around the corner,” McAdam said, echoing phrases used by the programming CEOs. “We’ve got the assets in place, and I don’t feel we need an awful lot more.” He did acknowledge some initial limitations about delivering a full OTT program lineup via wireless systems.

“No one wants to have 300 channels on your wireless device,” McAdam said. “And I think everyone understands. It will go to à la carte.”

One more “horn of plenty” pronouncement emerged from the Communicopia discussions, this one involving Sony’s plan to deliver OTT content via its widely used PlayStation game consoles and its less-universal smart TV sets. Viacom CEO Philippe Dauman revealed that all 22 Viacom networks would be available through the Sony package, which is expected to debut within a few months (it was announced at the International CES last January).

Viacom’s popular networks, including Comedy Central, MTV, VH1, SpikeTV and Nickelodeon, match the demographics of PlayStation users.

Collectively, this spree of OTT deals and promises offer dramatic evidence of the fuzzy lines between conventional TV and Internet-centric delivery. Among the big hurdles is wireless bandwidth for viewers who expect full access to OTT content via mobile devices.

Nonetheless, the teasing hints—some of them obviously trial balloons—from media executives are harbingers of deals to come.

Gary Arlen is president of Arlen Communications LLC, a research and consulting firm. He can be reached atwww.ArlenCom.com.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.