Programmatic Ad Technology Proliferates

GARY ARLEN

Reports that Comcast might acquire Visible World, a programmatic TV ad platform provider, put a spotlight recently on the overhaul taking place in the video advertising world. Shortly after that announcement, the beam intensified when Nielsen bought eXelate, a data firm focused on digital advertising.

These deals—and a slew of similar alliances—are reshaping the TV advertising landscape, integrating commercial delivery, targeting and measurement, including ad effectiveness. The timing is impeccable too, paving the way for the advanced marketing options that ATSC 3.0 will enable.

Coinciding with these structural deals are developments that underscore viewers’ and advertisers’ changing expectations in the on-demand media era. For example, HUB Research LLC’s February “Study on Time-Shifted vs. Live TV Viewing” repeatedly showed that viewers want to use technology to control commercials that they see. Although HUB’s study focused on video-on-demand and digital video recording use, extensive parts of its report looked at “ad avoidance as a driver of time shifting.”

DVR VS. VOD AD AVOIDANCE

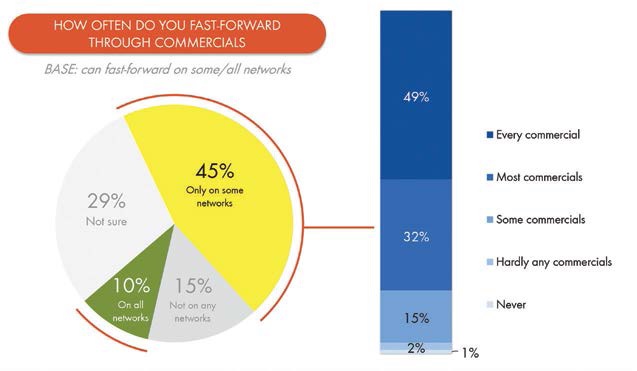

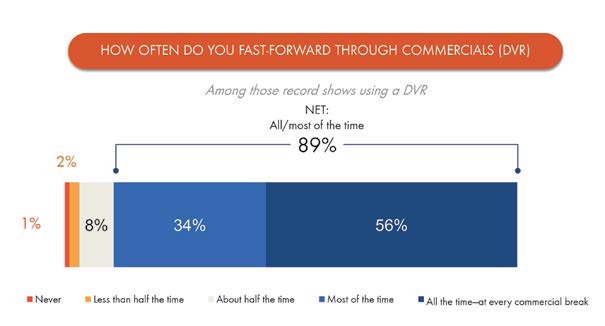

According to HUB Research LLC’s February “Study on Time-Shifted vs. Live TV Viewing,” viewers who do use fast-forward during VOD use it a lot, with half fast-forwarding through every commercial. “It’s not a revelation, but it confirms what everyone expected,” said Jon Giegengack, a co-founder/principal of HUB. “It shows that while DVR and VOD are really good for the traditional TV industry, the longer we go down this road the more pressure there is on the traditional model of making money through advertising.”

HUB’s study found significant differences between DVR and VOD ad avoidance procedures, some of which are artifacts of the platforms. Nearly 90 percent of DVR users fast-forward through most or all commercials in their recordings—56 percent of them do it “all the time at every commercial break.” On VOD, where some channels restrict the ability to skip commercials, about 49 percent of viewers who can skip commercials do it all the time and 32 percent jump over most commercials, according to HUB’s research.

“VOD has a different set of values,” said Peter Fondulas, HUB’s co-founder/principal. “More than 40 percent of VOD customers consider it a major restriction” if they cannot skip commercials, he said. He characterized it as a problem exacerbated because the same commercials are often repeated in every break during the VOD presentation—both via online sources such as Hulu and through cable set-top box catch-up features.

Such restrictions not only take away viewers’ ability to skip commercials, but also “rub it in their faces that such control has been eliminated,” Fondulas said.

Beyond the VOD and DVR experiences, viewers are increasingly sensitive to the ads— often short videos—they can see on websites and streaming media platforms, according to HUB’s co-founders. They said that viewers are more willing to tolerate, if not outright like, commercials when they believe that they have some part in the process, according to Fondulas.

“Even small things like a countdown clock”—which shows how much longer the commercial will run—or the ability to “skip an ad after the first 15 seconds gives viewers the impression that they have some control,” he said.

These insights are what make the Comcast, Nielsen and other ad technology deals so significant. Steve Hasker, global president of Nielsen, in describing the purchase of eXelate—which currently focuses on the online video market—made his intentions clear.

“While we are starting in digital video, we think it will—if and when the market is ready—go to a broader television ecosystem,” Hasker told the Wall Street Journal. He emphasized that the “synergy” between Nielsen and eXelate “will allow us to better serve the programmatic buying and selling space, in and around particularly video, but all forms of media.”

That’s not a commitment, but it’s a strong indication that Nielsen, like other advertising and measurement firms, foresees the expansion of programmatic ad-buying in the TV business. That means more real-time buying—through automated systems—and more specific targeting.

BEYOND THE ZIP CODE

HUB’s study found that DVR users are no different—almost 90 percent fast-forward through most or all of the ads in their DVR recordings. Comcast’s interest in 15-year old Visible World is even more complicated. Neither firm will discuss details; Comcast, which is notoriously zip-lipped about deals, has strengthened its protective curtain as it goes through the final steps of its Time Warner Cable merger process.

Although Visible World’s primary market so far has been online and cable advertising, its opportunities for use at NBCUniversal properties—starting with its cable networks such as CNBC, SyFy, Bravo, E!, USA Network, NBC Sports and Oxygen—is immense. Visible World works with advertisers to customize ads for specific viewers, going far beyond ZIP code information to use data from cable set-top boxes. Its programmatic ad buying software, AudienceXpress, brings cable ad buyers the ability to target specific viewers, much as online services can do.

One challenge of a Comcast/Visible World alliance—be it a merger or some sort of joint venture—is whether other broadcasters and media companies would be comfortable using a system owned by a rival. Analysts expressed concern that competitors would fret that Comcast or its NBCU networks would have access to proprietary data.

Others dismissed such concerns, noting that in 2014 Comcast bought FreeWheel Inc., which provides services for managing advertising across digital services and apps. Among FreeWheel’s customers are Walt Disney Co. and Viacom. Visible World already works with Cox Media—the ad division of Cox Communications—and Magna Global, a large ad-buying agency, to sell programmatic TV ads through a Webbased interface.

Visible World has a relationship with Suddenlink Communications (another large cable operator), which uses its “Schedule Optimizer” platform for programmatic scheduling of its cross-channel inventory and evaluation of how well certain programs reach specific audiences. Visible World also works with Sintec Media’s “OnAir” automated broadcast management solution to offer broadcasters a way to optimize program promotion schedules.

CONSUMERS LIKE TARGETED ADS

New advertising tools—and these examples barely scratch the surface—provide aggressive ways to meet the expectations that were identified in the research of HUB and other analysts. Developers hope that today’s business deals and continuing experiments will manifest themselves into features that can be delivered via the ATSC 3.0 platform now in development.

Most significantly, the integration of new research and measurement tools with realtime ad buying will lead to more efficient broadcast commercial targeting. The planning also takes into account the need to stay on the “safe side” of consumer privacy concerns.

At the Mobile World Congress last month, where the focus was on wireless systems, many of the lessons about digital advertising could be extended to the new vision of broadcasting commercial operations. Speakers described solutions such as “deterministic” and “probabilistic” modeling to handle multiscreen campaign management.

Proponents of programmatic advertising insist that the advanced systems will catch on quickly after the current testing period. Jeff Green, founder and CEO of The Trade Desk, a real-time ad bidding platform, contends that, “consumers are clamoring for on-demand, addressable content.”

“More relevant ads are worth more to advertisers,” Green said in AdWeek recently. “Consumers welcome them, too.”

Gary Arlen analyzes cross-platform media technology and content at Arlen Communications LLC. He can be reached via TV Technology.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.