Social TV: Hot or Not? Still a Work in Progress

GARY ARLEN

It’s not so much that “Videocracy’s” producers can make a TV series “ripped from social media,” as they say, but rather that an entire network can be built as “the first TV home for the social media generation.”

When HLN rebranded itself early this year, the network formerly known as Headline News proclaimed that its focus on “millennials and the millennial-minded” would seek to “debunk the myth that the world of social media is only about videos of cats riding skateboards,” as executive vice president and general manager, Albie Hecht, described it.

He insisted that the revamped network’s approach “will mirror what consumers are really doing digitally.”

“Videocracy,” one of a half-dozen new series that HLN is launching, was created by “My Damn Channel” which has produced online short videos since 2007. The new HLN series will feature a panel—presumably glib millennials plus a few wizened media veterans—discussing the “shared content we’re all talking about,” according to the companies’ joint announcement.

JUMPED THE SHARK?

Whatever the underlying significance of HLN abandoning newscasts (some would say that happened long ago) to focus on social media (some would call it the new kind of news), the move is another signal of the increasing importance of social TV in the viewing pantheon.

It also may mark a “jump-the-shark” effort, coming too late in the social media evolution. The show arrives at a moment of growing—and conflicting—research about how viewers are embracing social media.

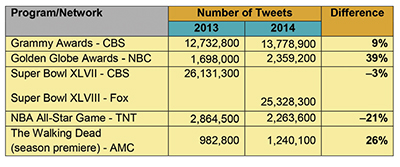

Fig.1: Comparing tweets: selected shows Since many TV companies are exulting and/or fretting about their commitments— and their viewers’ on-going relationships— with social media, the contradictory information makes it even more difficult to develop plans that incorporate a social component.

For example, AMC’s “The Walking Dead” has consistently been a top-tweeted show, according to Nielsen’s SocialGuide, which tracks the connection between TV viewing and social media usage. February’s mid-season series premiere drew 26 percent more tweets than did the comparable 2013 show. Yet the comparative viewership was up 28 percent, which suggests that some of the new viewers were not tweeters. (There could be many reasons for that.)

During the same week, the NBA All-Star game saw a drop of 21 percent in tweets. A couple weeks earlier, tweets during Super Bowl XLVIII telecast were down 3 percent even though the audience was up 3.5 percent (nearly four million more viewers) compared to the 2013 game, which (to be fair) was a more exciting and “tweetable” event with its Beyoncé halftime show and its stadium power blackout.

While SocialGuide’s ambivalent report raises warning flags, other research continues to indicate popularity for TV-related social media. For example, Shareablee found that the January 2014 TV premiere season generated 49 million social media interactions. The company, which characterizes itself as “powering the social data arms race (in a good way),” called the aggressive social media agenda an “effort to... keep devoted audiences tuning in.”

Shareablee’s evaluation of the top 10 returning and new TV shows identified that Facebook is the overall dominant social media platform, “driving 95 percent of all audience interactions,” according to the company’s report. “Pretty Little Liars consistently a top-tweeted show on the ABC Family cable network, had the highest level of “actions” via all social media, nearly five million engagements for its January premiere episode, according to Shareablee.

THE BIG PICTURE

As these data points bubble up, analysts are looking at the bigger picture for social media. A Pew Research survey of Facebook, released to coincide with the social network’s 10th anniversary last month, found that barely 10 percent of users update their status daily, a figure that would translate to a tiny portion who engage in social TV experiences. Pew did not specifically analyze social TV behaviors on Facebook, so analyses are speculative in this realm. Nonetheless, the impact can be significant, given the current scale of Facebook’s U.S. usage. The Pew study also found that about 44 percent of Facebook users click on “Like” to respond to friends’ postings, suggesting that comments about TV shows or other media experiences may have a far-reaching role.

And the research keeps rolling out.

A Facebook study, conducted by the research firm SecondSync, identified many behaviors for second screen usage, including ongoing conversations about what people are watching and the content of the shows themselves. Among the findings: up to 25 percent of the TV audience is posting Facebook comments “related to the show they are watching.”

The SecondSync study takes several swipes at Facebook’s dominance over Twitter, so not surprisingly the Nielsen SocialGuide “TVxTwitter” report shoots back with data points demonstrating that, for example, “hashtags in TV ads drive positive brand conversations” and “Twitter makes TV ads more effective.” Among the Nielsen findings: viewers watching TV and using Twitter had a 53 percent ad recall compared to 40 percent who watched without a second screen.

Such discontinuity in the social TV realm escalates the challenge of predicting a sustainable social media landscape. A Carnegie Mellon University computer model unveiled last month claims it can predict which social media are here to stay (at least for the next five years). It says Facebook will be around, boldly contradicting another academic study that predicts an 80 percent drop in Facebook membership by 2017. However, CMU researcher Bruno Ribeiro acknowledges that “even sustainable sites are vulnerable to upstarts that steal the attention of their members.”

Further complicating the outlook are studies such as the recent “TV Network Report” from a Tennessee research firm called SmartyPants, which indicates difficult times ahead for conventional media. The study focused on streaming, rather than second-screen applications, and its findings showed young audiences are very comfortable with, and looking toward, alternative platforms.

According to SmartyPants, networks such as Nickelodeon, Disney Channel and Cartoon Network fell below YouTube and Netflix on the “cool” scale. More significantly, the online services beat the kids-oriented cable channel on the “Offers Variety” question. Kids also said the online services were easy to use, convenient and portable. The study acknowledges that every network has a website and apps, but that streaming services are more appealing in what the researchers call “Kidfinity.”

Collectively, the research projects are a reminder that new media is still new and that viewers, as always, are fickle.

Gary Arlen is president of Arlen Communications LLC, a research and consulting firm. He can be reached atwww.ArlenCom.com

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.