Tablets Tap Into TV Territory

Gary Arlen

Anyone seeking a clear vision and valid roadmap for the role of tablets and other companion TV devices in the multiscreen landscape should stock up on headache pain relievers and “alternative” routing software.

Last month’s The Cable Show (the National Cable & Telecommunications Association’s annual convention) was laden with a predictable variety of possibilities, much as vendors at April’s NAB Show posited their visions of how viewers will want to interact with programs and commercials.

As previously interpreted in this space, some envision the smart TV set itself as supplying both the traditional video and interactive add-on features on a single screen, while others believe that viewers will prefer second-screen services to be delivered and customized via a mobile handheld device to supplement the primary big-screen TV set.

Add “the cloud” to this conversation about how best to deliver multiscreen experiences. At The Cable Show, Comcast CEO Brian Roberts focused on cloud-delivered services as he unveiled X2, an upgrade to his company’s year-old X1 user interface, which enables subscribers to obtain a personalized guide, navigation and interactivity (including on-demand ordering) via cloud systems. The approach fully integrates access via any device, especially mobile handsets such as tablets.

ABC has recently expanded availability of its Watch ABC OTTP app in new markets. Roberts’ presentation came just days after the Pew Internet project released its latest report, which underscored the boom in tablet usage. About 34 percent of American adults now own a tablet, says Pew, with the significant finding that the highest penetration is among 35 to 44 year-old adults, the prime advertising target audience.

Pew noted that there is “no statistically significant difference in tablet ownership between men and women or between members of different racial or ethnic groups.”

The only age category in which tablet penetration drops below 30 percent is among people older than 55 years, with another drop-off (to 18 percent) in the 65+ year-old seniors audience.

Although the Pew research didn’t correlate tablet usage with TV viewing, plenty of other studies have shown that at least 80 percent of viewers have a handset of some sort close at hand while watching TV.

TABLET FOR ONE-SCREEN SERVICES

With that in mind, one multiscreen advertising company is focusing on the tablet as a TV replacement on many occasions.

“I’m selling the tablet as the first screen… not just the companion screen,” says Long Ellis, general manager and vice president of direct media at Flurry Inc. Ellis, a long-time network TV sales executive, cites three sectors that are driving acceptance of the tablet as the primary platform for both video delivery and wireless/ online interactivity.

“Advertisers are looking for addressable advertising and will pay a premium for it. Publishers [e .g. website producers] want to reach target audiences and charge a higher price. Consumers want to get more relevant ads,” said Ellis, emphasizing that the tablet delivers on one screen what all three groups want.

Long Ellis A major evolving factor is measurement and analytics—services that Flurry offers with “a few lines of code,” he said, adding that the company can see behavior “in more than a billion devices,” that generates insights about usage experiences. That’s the kind of data for which advertisers clamor.

“Ad agencies are dying to buy the tablet,” says Ellis, especially as TV networks— both broadcast and cable—are putting more shows into their apps for mobile devices. He stresses that availability of viewing/usage data will trigger agencies to make tablet ad purchases.

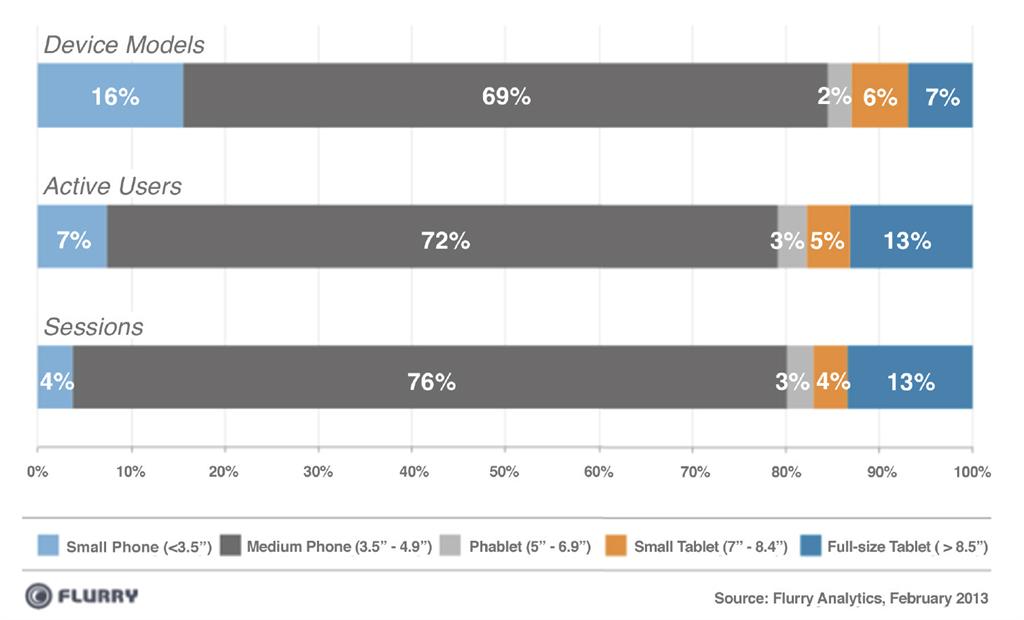

In its recent analysis, San Francisco-based Flurry observed that the time spent with mobile apps is challenging the time spent watching TV. The company’s report indicated that advertisers may be able to reach “a TV-sized audience” on mobile more effectively, including more quickly, during evening primetime viewing hours (Fig. 1). Flurry’s research found that in those hours, usage of the top 250 iOS and Android apps spikes at up to 52 million viewers, a level that rivals TV viewership.

WHAT THE FUTURE MIGHT HOLD

With the familiar enthusiasm of a seasoned sales executive, Ellis predicts that in the next 18 months, more people will be watching tablets, especially in the home—“a tidal wave” as more content “moves to mobile.”

At last month’s Cable Show, Comcast CEO Brian Roberts unveiled the company’s new X2 user interface, which enables subscribers to obtain a personalized guide, navigation and interactivity via cloud systems. The approach fully integrates access via any device, especially mobile handsets such as tablets. While Flurry provides app development and ad support services for the online community, one of its core offerings is “Flurry Analytics,” which understands consumer interaction with mobile applications. The company, which debuted in 2005, says that more than 100,000 firms use its Analytics system to measure audience reach, engagement, retention and revenue on the full array of mobile devices. The software can measure all activity, gathering demographic as well as psychographic info from actual usage.

Ellis’s belief in the tablet’s dominance offers a striking alternative to other approaches on display at The Cable Show— and there’s no way to know yet whose focus is accurate. Certainly the tablet is seen as an integrated component of the new TV experience.

Qualcomm, which updated its AllJoyn service—an integrated wireless home networking service it is testing with cable operators—relies on tablets and other mobile devices as the control unit for many of its services. In that regard, its vision reflects Comcast’s Roberts’ expectation that the tablet will play a central role in the emerging multiscreen ecosystem through the cloud.

At a social TV apps session, SocialGuide CEO Sean Casey predicted that more twoscreen packagers will enter the market, a concept that, if true, will continue to muddy the multiscreen outlook as system operators, advertisers and viewers evaluate the fragmented arena. Yet Casey’s comment takes on greater significance since Comcast is a major investor and user of SocialGuide.

Fig. 1: Distribution of device models, active users and sessions by form factor

(Click to Enlarge) The debut of Samsung at The Cable Show, demonstrating its smart TVs and other devices, and LG (which was focused on its multi-platform set-top boxes) underscored the complexity of the secondscreen environment.

As Cable Show attendees and vendors tried to soak in the opportunities and options, the only thing that became crystal clear is that tablets have quickly become a key contender in the video delivery business. But no one is yet able to guarantee the ultimate role they will play vis-à-vis the TV industry itself.

Gary Arlen is president of Arlen Communications LLC, a media/telcom research firm. He can be reached atGaryArlen@columnist.com.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.