Global reach buoys vendors’ bottom lines

At this year’s IBC Show in Amsterdam, the general consensus among broadcast equipment suppliers was that while sales have been modestly increasing, the majority of that growth is coming from regions outside Western Europe and North America. This is the result of U.S. broadcasters’ continued struggle with how to generate new revenue by distributing content across multiple screens, and Europe’s current economic uncertainty. Broadcasters in the UK and surrounding countries, in particular, have spent the past year producing two major television events (the Queen’s Coronation and the Summer Olympic games), not shopping for equipment, so spending was put on hold.

This muddled scenario is being felt across all equipment categories, relegating newer technologies on display at the IBC Show — like advanced compression (HEVC), 3-D TV and Ultra High-definition television (UHDTV) — to mere curiosity. Clearly, international broadcasters have more pressing issues to address.

“It’s tough out there right now,” said Roger Thornton, head of publicity for Quantel. The company demonstrated its latest software-only version of its Pablo Rio color correction and image compositing system, complete with features that address 3-D TV and UHDTV. “We seem to be doing well in China and Latin America, but the rest of the world appears marred in a funk when it comes to buying new equipment and deploying it quickly.”

Indeed, many companies exhibiting in Amsterdam this week were equally apprehensive about what the market would bring in the coming months.

“This is an industry with six or seven competitors in every equipment category,” said Harris Morris, President of Harris Broadcast. “It’s not easy to sustain a high profit margin in this type of environment. We anticipate a lot more consolidation among suppliers, even as we sit here looking to be acquired ourselves.”

In April, Harris announced it would divest its broadcast division, and, according to Morris, several parties (venture capital firms and other vendors) are looking at buying the business. The company expects a deal to be done by the end of the year.

At the show, it was also announced that Belden had completed its purchase of Miranda Technologies, which is based in Montreal, Quebec, Canada. One reason for the purchase, given by Denis Suggs, executive vice president for the Belden Americas Group, is the potential for increased business in the emerging regions of Brazil, China and Russia, countries where the transition to HD is not yet complete.

Patrick Harshman, president and CEO of Harmonic, said the company is currently operating at $550 million in revenue globally, but admits most of that is coming from previously underserved markets.

“We have to go where the business is and be ready to support those markets with the right solutions,” he said. “Customers are trying to solve difficult technical and business model challenges. It’s not just about the technology.”

Other business news from the show included audio equipment suppliers TSL Professional Products buying Soundfield microphones and T-VIPS merging operations with Nevion — both IP distribution technology developers and both located in Norway. Again, for all parties involved, the goal is to grow bigger in order to gain entry into markets they perhaps didn’t address before.

“We share a similar vision for the future, so this merger makes complete sense and is right for both companies financially,” said Geir Bryn-Jensen, CEO of Nevion. He added that many of the orders they are now seeing are for larger systems installation, not single product sales, so a company with larger resources is better equipped to handle this. “We’re building a larger company that can do more things and bring products to market faster."

Equipment vendors must reach into a variety of markets to find sales success.

“We’re fortunate that 60 percent of our business is outside the U.S. because currently that’s clearly where the growth for most companies in this industry is,” said Alain Andreoli, president and CEO of Grass Valley. The company has spent the last year reorganizing (and reducing) its staff in order to make it more competitive.

“You have to establish local resources in the various emerging countries in order to serve them correctly, and that’s what we are doing now,” he said. “Sometimes you have to buy a company in order to do that, and sometimes, like with Grass Valley, you can expand into new markets organically. The more markets your organization supports, the better off your financial results will be. I would say it’s a very complicated selling environment right now, but Grass Valley and its competitors will figure it out. We all have to do this in order to stay in business, right?”

Many expect more industry consolidation and the continued building of new strategic relationships between previously fierce competitors to occur in the coming months.

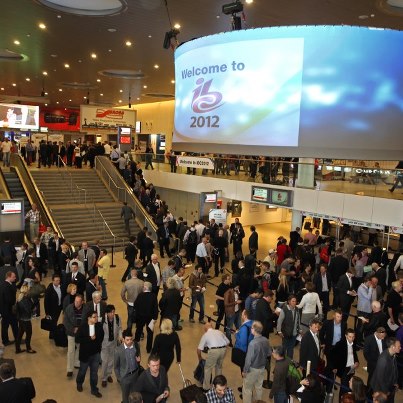

Of Note: Attendance at this year’s IBC Show was stated to be 49,433, or “slightly higher” than last year. However, the various exhibit halls appeared less than crowded most of the time.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.